Right now, the "Trump trade" is one in which cyclical sectors are likely to benefit, including Trump-specific sectors such as aerospace and defense, building materials, financials, etc., explains Jim Woods, editor of Weekly ETF Report.

However, there are two broader ways to play the Trump trade that are a bit less intuitive, but that could be sound ways to gain exposure that's not quite as far on the risk curve as sector-specific ETFs.

What both funds have in common is that they are value-oriented. As such, they offer a measure of protection from market pullbacks vs. the more cyclical sectors.

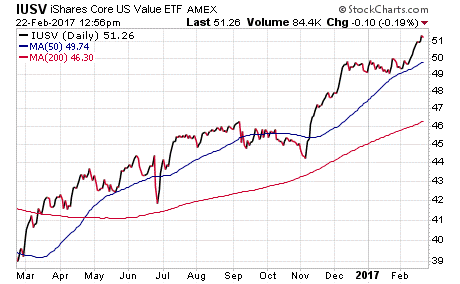

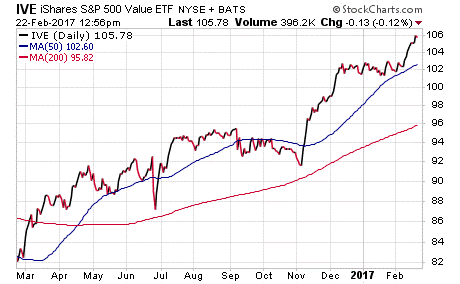

Two specific ETFs I like here are the iShares Core S&P U.S. Value ETF (IUSV) and the iShares S&P 500 Value ETF (IVE).

These funds offer us a good combination of reasonable valuation and favorable sector make up (sectors I suspect will outperform in 2017 are heavily weighted in these ETFs compared to the S&P 500). Both also have seen strong post-election outperformance.

With IUSV, we get a great mix of sectors likely to outperform in 2017, including financials (27%), healthcare (9.7%), energy (13%), consumer staples (7.6%) and industrials (10.2%).

Meanwhile, IVE has similar sector exposure, with the main difference being healthcare at an 11.5% allocation and industrials at an 8.7% allocation.

This difference won't be significant in terms of overall performance, but the over-allocation to health care in IVE gives you that little extra contrarian exposure if you think, as I do, health care has been unfairly battered over the past year.

Finally, both funds offer us exposure to a continued rotation out of defensive sectors and towards higher-beta, more cyclical stocks and sectors - while also not putting us too far out on the risk curve if the Trump pro-growth agenda breaks down.