Featured Content

MARKET MINUTE

The MoneyShow Market Minute for April 16, 2024

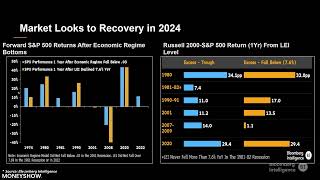

STOCKS

TOP PROS' TOP PICKS

BGRSX: A Long/Short Fund That's Attractive in this Uncertain Market

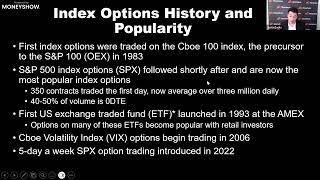

HEDGING

TOP PROS' TOP PICKS

KNTK: An Energy Midstream Play Profiting in the Texas Delaware Basin

ENERGY

TOP PROS' TOP PICKS

Inflation Roundup: What the Numbers Show and What They Mean for the Fed

ECONOMICS

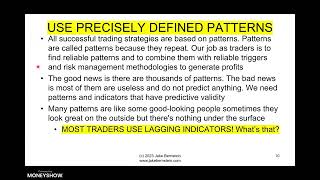

TRADING INSIGHTS

Technical Indicators Continue to Show Declining Momentum

TECHNICAL ANALYSIS

TRADING INSIGHTS

Teck Resources Looks Ready to Break Out

TRADING

Virtual Learning

Silver: The New Oil, the Next Uranium

PRECIOUS METALS

Virtual Learning

Building an All-in-One Portfolio in 2024

Conferences

Virtual Learning

Virtual Expos

Sponsored Content

A 40-Year Passion and History

MoneyShow has a long history of creating successful investors and traders through timely investing and trading education, delivered by powerful experts who are best-selling authors, market analysts, portfolio managers, award-winning financial journalists, and newsletter editors. With MoneyShow’s interactive environment, our audience of over one million passionate investors and traders are offered a unique format of live, interactive exchange, which generates unparalleled experience for both the expert and the investor and trader.

With constant network expansion, we continue to create broader distribution of our expert commentary through virtual events, face-to-face forums, social media, and in-depth courses that educate and guide qualified investors and traders to outperform the market. Each session energizes, empowers, and educates everyone who participates. The opportunity for learning and profit within this highly charged atmosphere draws hundreds of thousands of enthusiasts, year after year.

View Courses