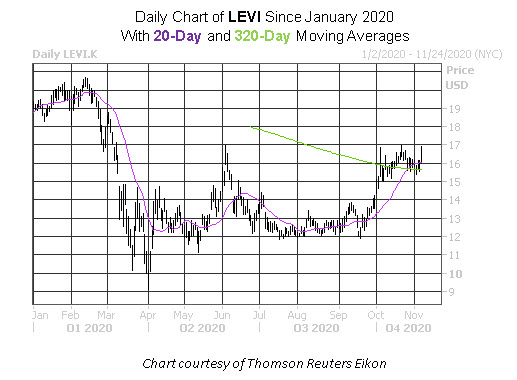

Jeans icon Levi Strauss (LEVI) has recently formed a cup and handle bottoming pattern on the charts, explains Matthew Timpane, a leading technical expert and analyst at Schaeffer's Investment Research.

With emerging short and long-term support from the shares' 20- and 320-day moving averages, plus vaccine optimism fueling a return to "normal" clothes, we are recommending a new long position on LEVI.

A short covering rally is certainly in play. Short interest increased by 21% in the last two reporting periods, and the 9.01 million shares sold short now account for 21.4% of LEVI's total available float. At the stock's average pace of trading, it would take shorts nearly a week to buy back their bearish bets.

There could also be an unwinding of pessimism among options traders. The stock's 10-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the elevated 75th percentile, indicating the preference for puts has been quite high in the last two months.

Further, LEVI's Schaeffer's Volatility Index (SVI) of 50% stands higher than only 18% of all other readings in its annual range, implying that options players are pricing in relatively low volatility expectations at the moment.

This means with options cheap; the stock could soon be on traders' radar. Traders should target a move up to $20.50, with a stop below $15.