Extra Space Storage (EXR) owns, operates and manages almost 2,100 self-storage properties in 41 states, with over 160 million net rentable square feet of storage space, notes Jim Woods, editor of Bullseye Stock Trader.

Of these properties, the majority are wholly owned, while some facilities are owned through joint ventures and others are owned by third parties and managed by Extra Space Storage in exchange for a management fee. The company is structured as an umbrella partnership real estate investment trust, or UPREIT.

EXR is one of those stocks that is hitting the bullseye on all of my criteria. Earnings per share growth is in the top 10% of all companies on that metric. In addition, the stock has a gain over the past year of more than 50% which puts it in the top 8% of all public companies on a relative price strength basis.

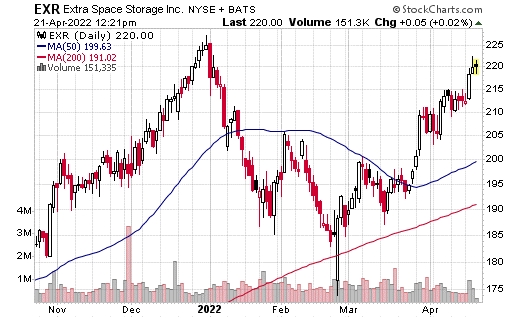

Conditions in the housing market have provided a safe haven for stocks in the storage space, as more and more customers flock to store goods in anticipation of an upcoming home sale or purchase. Looking at the technical pattern, the stock is in the “handle” portion of a bullish cup-with-handle pattern and is near its new highs.

EXR is slated to release earnings for its most recent quarter on May 3. As you can see from the chart above, the stock has run up nicely in anticipation of strong results. In the past month, shares are up some 13%, but I suspect the move higher has a lot further to go, especially if EXR handily beats earnings expectations of $1.86 per share.