Q1 earnings begin later this week. We think earnings reports will increase volatility until the Federal Reserve meeting on May 3rd. But companies that are able to generate reliable earnings growth will become more valuable in this environment and that is where we are focused within our equity strategies, advises Nancy Tengler, CIO at Laffer Tengler Investments.

One of the benefits of being in this business for almost 40 years is that, over time, you learn who to listen to at turning points. Brian Reynolds is one strategist I listen to. Brian published a commentary on April 11th revealing his proprietary analysis on Q1 corporate tax payments and what that means for the upcoming earnings season.

Reynolds expects earnings season to be “OK, but not great,” with most companies beating lowered expectations. He discerns this from quarterly corporate tax receipts. Novel. Insightful.

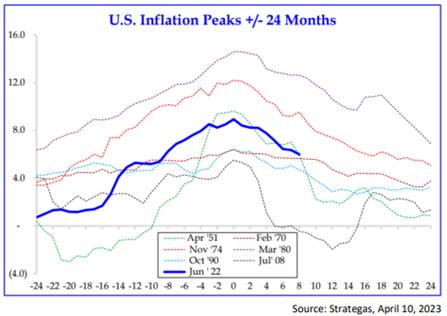

As for inflation, last fall we suggested it had peaked in June of 2022, and that inflation on the way up and down, was mostly symmetrical. It took 16 months to hit peak inflation and we expected (based on historical patterns) that it would take 16 months for inflation to decline to more reasonable levels.

Based on the chart you can see that CPI is following the historic patterns set during other high inflationary periods. Though not necessarily linear, inflation rises and falls symmetrically.

Further, history shows that at the end of the period (in this case 16 months from June 2022) inflation will settle—on average—around 0.5-1.0% above where inflation started.

We have also talked about sticky inflation which remains elevated. But we take comfort in knowing that shelter (which is a major component of CPI and sticky CPI) lags. Therefore, the rollover we’re seeing in rents won’t be reflected in the CPI number until later this year.

Why does this matter? Because we think the Fed’s mission is/should be complete. A pause to let the effects of one of the fastest and most dramatic hiking regimes take hold. The Leading Economic Indicators, Manufacturing PMIs, and the yield curve are all signaling a recession.

There is plenty of speculation around whether the U.S. economy will experience a hard landing, soft landing or no landing—we have been in the mild recession camp—but we don’t actually have to know the answer to that question. What we know is that the economy is slowing and focusing on solid companies with reliable earnings growth is the smart move here.