Global X Millennials Thematic ETF (MILN) is the first exchange-traded fund to invest in millennial stocks, explains Jim Woods, fund expert and editor of The Deep Woods.

Now in its third year, MILN tracks “a broad range of categories, including: social media and entertainment, food and dining, clothing and apparel, health and fitness, travel and mobility, education and employment, housing and home goods, and financial services,” according to the fund’s management company, Global X.

The U.S. Census Bureau uses birth years for Millennials that span the early 1980s and early 2000s. In contrast, to keep the Millennial generation analytically meaningful, and to separate it from the next cohort, called Generation Z, Pew Research Center uses 1996 as the last birth year for this age group and begins it in 1981.

Nonetheless, data show the more than 90 million Millennials born between 1980 and 2000 recently became the largest demographic group in the United States, replacing Baby Boomers, who the Census Bureau designates as those born after World War II, starting in 1946 and extending through 1964.

Wall Street understandably is taking notice of the spending habits of Millennials. Many data points show Millennial-focused stocks and ETFs could become potentially potent investments.

Millennials are about 35% of the labor force today and are expected to compose 75% of the U.S. work force by 2030, according to Global X. Additionally, Millennials have been forecast to receive $30 trillion in wealth from Baby Boomers.

In 2019, the oldest Millennials are in their late 30s, which is an age when many people start families and form households. As people age and increase their earning power, their spending tends to rise until it tapers off when they reach their 50s, according to Census Bureau data.

The fund’s top 10 holdings, comprising 33.22% of its total assets, are in some of the biggest blue-chip stocks that Millennials love — Fiserv (FISV), Costco (COST), Starbucks (SBUX), Home Depot (HD), Equity Residential (EQR), Apple (AAPL), Walt Disney (DIS), 3.26%; Nike (NKE), 3.25%; Booking Holdings (BKNG) and Twitter (TWTR).

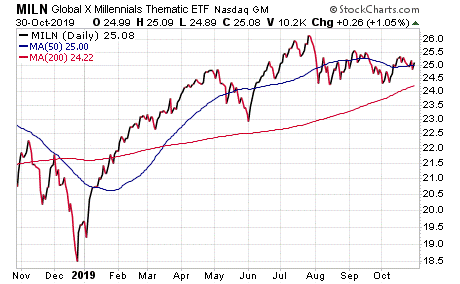

MILN is up more than 67% since it was formed in May 2016. As the chart above shows, MILN has beaten the market year to date, and is up more than 27%, making it one of the best-performing, consumer-related ETFs so far in 2019.

With a yield of 0.4%, MILN’s investors received dividend payments on December 28, 2018, and June 27, 2019, of $0.085 and $0.021, respectively. The yield is not much, but it beats what many banks pay. MILN also offers an opportunity for outstanding capital appreciation.