Don’t let the fact that there is no well-defined career path to becoming a trader get in your way. Take your time and follow some suggestions and you’ll do just fine, asserts Dave Landry, He’s Founder and President of DaveLandry.com. More Trading Lessons every Friday.

Get Trading Insights, MoneyShow’s free trading newsletter »

There is no clearly defined career path to becoming a trader. This can result in years of searching, confusion, and frustration. The good news is that there are specific steps that you can take once you embrace the fact that it is a process, just like any other career. Let’s explore this further.

1. Give yourself time to become a trader, doctor, or a plumber

Advertisement

Let’s say that you want to become a doctor. Well, obviously, you have to get your bachelor's degree, take the MCAT, go to med school, complete your residency, and then get licensed. That’s it! What about a plumber? That's not so easy either. A friend of the family worked as a mortician. One day, on his ride home after embalming yet another child, he realized that he was spent emotionally. I’m not sure why but for some reason, he decided to become a plumber-maybe because it was the furthest thing away from being a mortician.

A couple of months later we called him for his services. He said, “Oh, no, you don’t understand. I have to apprentice as a journeyman, pass tests, and then get licensed.” Apparently, becoming a plumber is a process, and it’s a lengthy one.

Again, in trading, there is no clear career path. You get a computer, fund an account and, voila! You’re a trader. Well, technically, yes, but there's a lot more to it. My point is, just make sure that you give yourself adequate time. Treat it like any other profession. Last year, I was speaking at a conference and met a very successful entrepreneur who was depressed about his trading. I assumed that he’d been chipping away at it for years to have reached this level of frustration. When I asked him how long he has been trading, he replied “three weeks.” For some reason, successful people automatically assume that they can transfer success. They forget how long it took them to become successful in their current or prior career.

2. Get some help-no one becomes a trader on their own

I tend to view myself as a self-taught individual. I once wanted to learn how to sail, so I bought a boat and a book. Within days, I was leaving sight of land and overnighting at barrier islands. Within a few years, I was ocean racing to foreign countries.

The reality is that I wasn’t self-taught. I learned a lot from the crews that I joined and from the initial book for that matter.

In my educational business, I often feel that I am working myself out of a job because many clients quit as soon as they feel they get it. They desire to do it all on their own. They act in a manner that is the complete opposite of what an institutional client does. The satisfied institutional client keeps me on staff.

No one does it alone-even once they get it. Isaac Newton once said, “If I have seen further than others, it is by standing upon the shoulders of giants. Throughout history other sole achievers such as Einstein have been known to quote Newton. Edison, who improved the light bulb, is another great example.

“We see more and farther than our predecessors, not because we have keener vision or greater height, but because we are lifted up and borne aloft on their gigantic stature.”

3. Find your trading methodology

Find something simple that works and makes a lot of sense to you. If I had to do it all over again, I would start with something very simple until I mastered it and then Grail hunt--and not the other way around. My going-back-to-the-start thinking was the inspiration for my Trading Full Circle Course.

Make sure that it also fits your lifestyle. I knew a doctor once who would carry a laptop from exam room to exam room while day trading, or, at least attempting to! Obviously, you can't do both.

When you do think you have something, make sure you play devil’s advocate. Don’t just focus on the times when everything prints money. Pick it apart. As mentioned ad nauseam, many times I’ve been presented with systems that have horrendous drawdowns. When I point this out, the designers take great defense, explaining how their system subsequently recovered. The problem here is twofold: when implementing a system based on historical data, your biggest drawdown is always in front of you. I once literally got screamed at when I pointed that out to a system designer. There’s no guarantee that the past will equal the future--hence that line nearly verbatim in virtually all trading disclaimers.

As human beings, we tend to be positive. Heck, “I was going to be a pessimist but I figured it wouldn’t work out” (Wright). Unfortunately, when trading you must embrace and accept what can go wrong, because eventually, it will. Selective perception and perceptual distortion are going to be your two biggest enemies that you'll face when searching for your methodology. So-called permanent income hypothesis is another foe. “What you see is not all there is.” (Kahneman).

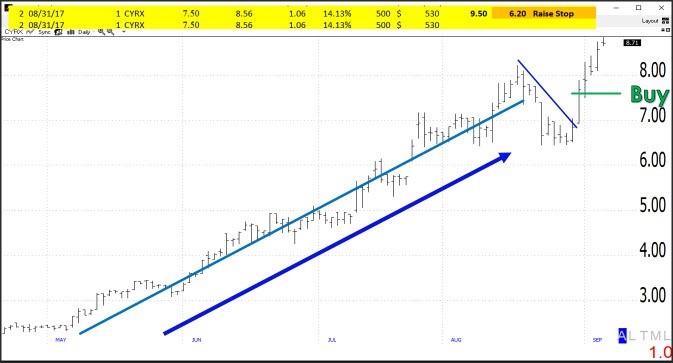

Again, keep it simple. Let’s look at two open trades. Here we have a simple pullback. Notice that the market was trending and noticed that the trend was a persistent one. The stock pulls back and we enter as the trend resumes. See references at the bottom of this article for more on this setup, money management, and trading psychology.

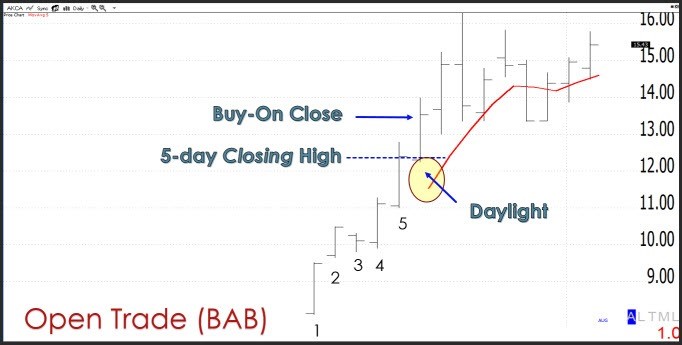

Here’s a simple IPO strategy that basically buys when an IPO closes at a new high and there is “daylight” above the five-day moving average. That’s pretty much it. I have an even simpler strategy--Buy At B (BAB)-that buys on a new closing high with a few caveats.

What's interesting is that my Grail hunting over the years has morphed into how simple can I make a system? The above and my "Buy At B" (BAB) are exhibits A and B, pun intended.

So, grail hunt and dabble in the arcane if you must, but only after mastering something simple first. Many, present company included, do just the opposite. That can lead you to a lot of frustration and dead ends.

Don’t reinvent the wheel. There’s plenty of existing research out there that, while not perfect (hint nothing is!), can do quite well longer-term and in actual markets. And, again, stand on the shoulders of giants. I'm not worthy enough to call myself a giant, but I do believe that you could be successful with something as simple as Trend Knockouts (TKO), Persistent Pullbacks, and Buy At B patterns. I’d start there. If you can’t make money with something as simple as that, then you certainly won’t have much luck with the complex and arcane. I just saved you years of searching.

You’re welcome!

Once you do think you have a plan in place you’ll need to be patient in your execution. Give me someone who is patient and has a good attitude and I’ll give you a great trader.

The great thing is that becoming a trader is that it is not (and should not be!) something that's mutually exclusive. The best traders that I know trade when the opportunity presents itself and then go on to save lives, build buildings, or do other great things like play with the grandkids.

When I decided to take my efforts full-time back in the mid- 90s, I thought that I would become much more successful since my focus would now be exclusively on the markets. What happened next was a rude awakening. I quickly found out that just the opposite occurred--my performance nosedived. I was trying to force things to happen versus letting the market come to me.

The tough thing about markets (and life?) is that sometimes you have to relearn a lesson.

Around five years later, I began writing my first book. And, my trading results started to deteriorate. I assumed that the problem was that I was too busy. In reality, it was the markets. I decided to stop digging my hole and turned my focus to my project.

What happened next was a great epiphany. I saw opportunities that I simply could not ignore. I took them and then went back to working on the book. I then found myself allowing the positions to work versus mentally monetizing and micromanaging myself out of perfectly good positions. I learned that the busier I stayed the better my trading became with both new and existing positions. Until this day I have kept myself extremely busy. And, if I don't walk away from my screens when I take a break, I know I'm going to fire off an unnecessary trade.

4. Find a simple money & position management strategy

Let’s be frank. It happens. I was once in line at a grocery store and, for whatever reason, said that under my breath. The rather large woman in front of me--about a biscuit shy of 400--turned around and exclaimed “sometimes twice!” Sooner or later you’ll get hit for far more than you initially intended to risk. Further, even if you’re keeping risk in check, a string of bad trades will have a significant drawdown on your account. One of the few things that I can guarantee is that it happens, sometimes twice!

Never forget that you must make back far more than you lose, so a solid money and position management strategy is crucial. Your plan must keep losses within check while still allowing for the potential for unlimited gains. Write that down.

You must be leery of anything that does just the opposite of the above. For instance, contra-trend reversion to the mean, naked option selling, or any other methodology marketed as highly accurate and “income producing” should be viewed with a high degree of skepticism.

The tough part is that a lot of these methods can work, quite well, until they don’t. It’s a great way to have a very brilliant but brief career on Wall Street.

5. Know that the map is not the territory when it comes to trading

You’re going to have to experience a variety of conditions. There will be times when you can’t hit the side of the barn no matter how hard you try. You’ll feel like you're snake bit. There will be times when you print money. Everything you touch seems to turn the gold. And, there will be times you just grind it out – win, lose, win, lose, lose, win, and so forth. Me telling you about this and not having to go to your head in good times and becoming distraught in bad times are two different things.

You might think, okay I get that bad times are tough, but good times can't be so bad? Well, I’ve seen people do a lot of stupid things like leaving a profitable business or telling the boss off. They over leverage and allow their godlike complex to interfere with their trading. Pride then goeth before the fall. This is because of their success, they fail to recognize when the trend has ended. As I preach, everything works better with trend. I’ve seen people do amazing things following arcane methodologies only to give it all up when the tide turns. They fail to realize that they are continuing to fight the last war.

Putting the plan into action

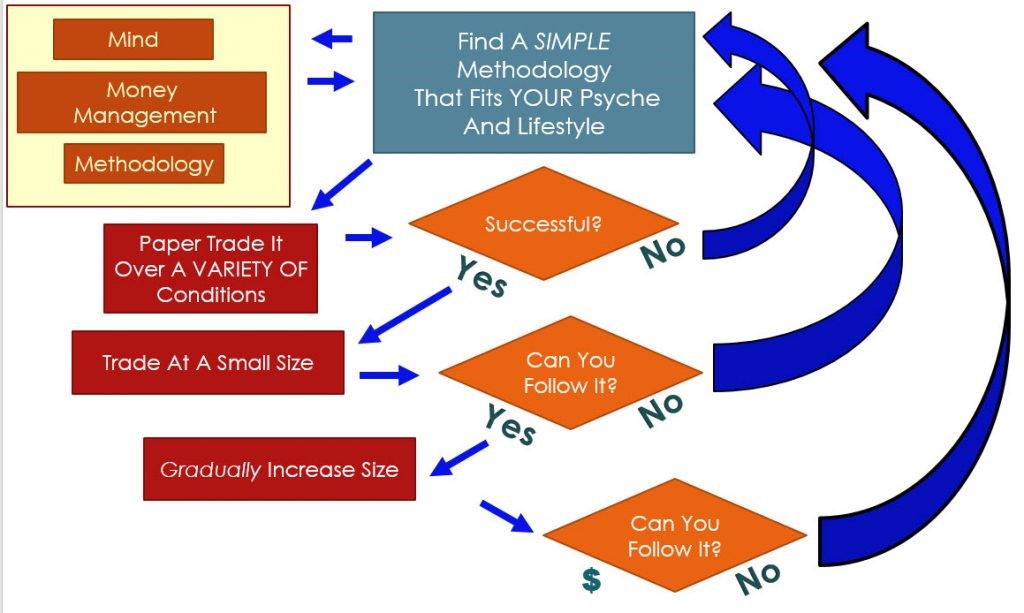

1. Find at least 100 examples of the setup that you are going to trade. Find ones it worked and more importantly find ones that did not. Again, be your own devil's advocate.

I once remember talking on the phone with a friend who had just put on a trade.

Me: When did you learn that pattern?

Him: 10-minutes ago.

Obviously, 10 minutes is not enough experience to begin trading a new pattern.

2. Begin paper trading the setup. Keep in mind that “I’ve never met an unsuccessful paper trader.” (Layman's) Nevertheless, it’s still a very worthwhile exercise. No capital is put into harm’s way while you see how it works in real time-both good and bad.

3. Once you are convinced that you have something viable, begin trading at a very small size. Trade at a size that’s almost meaningless. As I preach, it's much easier to follow the plan in a trade that only monetizes to a round of golf or a tank of gas for your boat--or, for your ladies, a new pair of shoes (well, maybe 1/2 of that amount!).

4. Slowly increase your size until you reach the maximum amount that your money management calls for. Suppose your max risk is 2% per trade, then start by trading ¼% and continue until you experience both a string of winners and a string of losers and then continue to bump that until you eventually reach the maximum. What amazes me is that people who aren't successful trading in a very small size somehow think they will be successful trading a larger size.

I’ve mapped the above out for you below:

So how do you know if you are successful?

Well, the obvious would be that you are making money. However, that doesn't mean you've achieved success, at least not longer-term. “Outcomes can be noisy.” (Odean) Measure your success by your ability to consistently follow the process. The money will eventually come as long as you do this longer-term. And, if it doesn't, only a minor tweak or two might be necessary. For instance, it could be something as simple as loosening your stops a bit to fully accommodate the volatility of the market or your stock selection could use a little improvement.

In summary, don’t let the fact that there is no well-defined career path to becoming a trader get in your way. Take your time and follow the above process and you'll do just fine.

May the trend be with you!

Dave Landry’s Trading Full Circle course videos and newsletter here