Since Wednesday was PI day (3.14), I thought I might update my PI trade article, says Dave Landry, founder and president of DaveLandry.com. More Trading Lessons every Friday.

If I laid out an exact game plan for you could you follow it? Well, for most of you, probably not. There is a statistical and emotional bias that’s stacked against you. The good news is that if you recognize and embrace this, then you’ll be well on your way to success. Let’s explore this further.

Okay, before we get started, I guess some assumptions are necessary. First, you have to have experience with trading and trading my methodology. You’ll also obviously have to have some faith in my abilities to execute it. Even with those givens, most still can't follow a plan.

Plan the PI trade

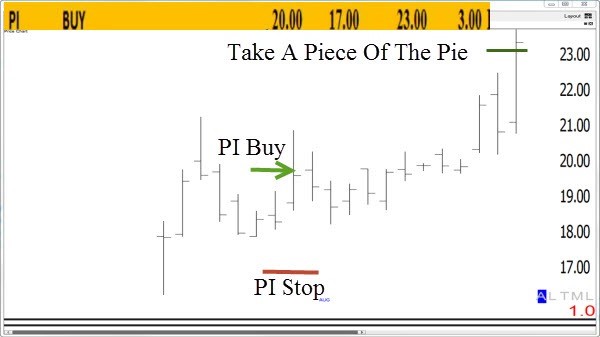

Back in July 17, 2016 I laid out the following plan: Buy PI at 20. If triggered, place a protective stop at 17. Take partial profits (half) at 23. And, at that point bump your stop to breakeven on the remainder. Below is a snapshot of the spreadsheet of my Core Trading Service model portfolio.

All you have to do is follow the plan

My bride Marcy has either zero grasp of construction knowledge or an unbelievable amount of confidence in my abilities. As I often mention, she prefaces each easy project with all you have to do is… I’m never completely sure if she's baiting me, playing to my ego.

So, my manly pride along with my happy wife, happy life mantra usually has me diving in head first. And, one way or the other I get the job done but not without losing my religion repeatedly, numerous trips to the hardware store, watching a few YouTubes/contemplating a stay at a Holiday Inn Express, and occasionally calling in some reinforcements.

The point is, like following a trading plan, it’s never as easy as it looks.

Above is how the trade unfolded. The day before the stock began to rally I received a call from a client. He notified me that he was exiting because the volume had dried up and there was obviously no more interest in the stock-implying that the position was now dead money.

The trade didn’t turn into the mother-of-all winners, but it did manage to hit the initial profit target for a 15% gain, 1% on the overall model portfolio.

It then stopped out at a scratch on the remainder for what I have dubbed a better-than-a-poke-in-the-eye trade (especially if anualized).

BTW, occasionally people complain because they had to give up some open gains. I tell them, send me the money but keep enough out so you can get a massage to relax. This will help you to forget about this whole ordeal. In 20-something years of saying that, I have yet to get a check.

I know that I’m being tongue-in-cheek, but I was that guy years ago.

I was complaining to a much more seasoned trader after getting a bad fill on an exit. He said, let me get this straight, you made a lot of money and you're complaining? It was like being hit over the head with a halibut. I’ve since learned to smile and shout next!

Deja vu all over again

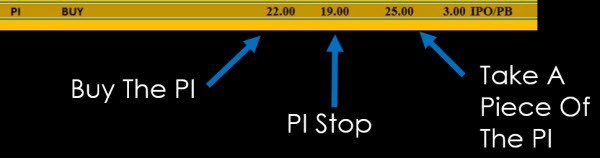

Something neat happened next. The stock set up again as a hot IPO pullback. The new parameters were to buy at 22, place a protective stop at 19 once triggered, take partial profits at 25 (half), and then bump the stop to breakeven.

Below is an actual snapshot of the spreadsheet.

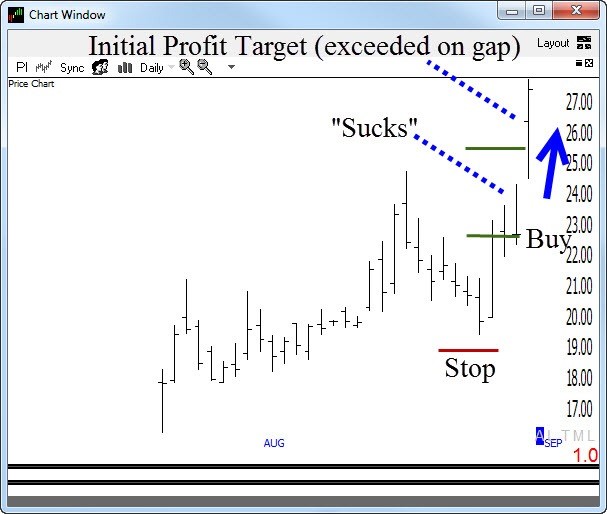

The stock triggers an entry and then begins to move modestly in our favor. The day before it takes off I receive the following email:

Hi Dave, Sucks watching our positions slowly drift lower except PI. When all positions drift lower (it) makes me want to take the position off of PI for fear it will also go lower. Am I the only one?

Thanks, Lance

Just follow it?

Here we have two successful trades, one of which is still open with the potential of unlimited gains. (Update: this one later stopped out for a 23% gain, much better than a poke-in-the-eye I suppose.)

Both trades worked out in a textbook fashion according to plan. Yet, two traders have likely micromanaged themselves out. Lance posed the question: Is it just me?

Oh, Lance, it’s not just you. You’re a microcosm of most traders. It’s normal. In fact, we have innate urges inside of us that make it all but impossible not to micromanage.

Another letter:

Hi Dave, Just a note to tell you that I appreciate the PI setup you put out. I was able to use the tools you provide us to stay in the trade using discretion despite the technical stop out; I had flipped it out twice to take swing profits. Now I am in long-term trend following mode. I know this trade will end badly at some time, but I just want to let you know that I appreciate your service, your methodology, and especially the psychology necessary to stay with your system. Despite the fact that several other setups in the portfolio aren’t profitable (yet), I do have faith in the methodology.

Sincerely, Bill

Pain and pleasure

The driving urge within us to avoid pain is a much stronger emotion than seeking a delayed gratification. This is because the emotional response of a negative is twice as intense as a positive. Many believe that it’s actually much more. Fight or flight is part of our makeup.

When profits are eroding/not accumulating or losses are mounting, we feel an irresistible urge to do something. If we don’t, we face serious regret. And, unfortunately, the smarter and more motivated you are, the more likely you will be tempted to take action outside of the plan.

There’s always a reason to ditch the plan and rarely a reason to stay the course. You might want to write that down. In fact, according to Robert Frey, statistically, you spend 75% of your time in a state of regret (drawdown).

So, when you trade, there’s a much-better-than-average chance that you’re experiencing some sort of pain at any given time. This pain will tempt you to take unnecessary action.

For me personally, this is an epiphany. Now I know why all these years I never feel great for long--constantly questioning myself (and, when I told Marcy my epiphany, she said, AHH, now I know why you're always so grumpy!).

How do we fix this?

Great Big Dave, yet again you’ve identified some problems. So, how do we fix them?

Well, in my best Marcy voice, all you have to do is follow the plan. It is that simple. Unfortunately, my empirical research has shown that you’re not going to do just that. You’re going to be tempted to do something, anything--other than just follow the plan.

Maybe this will help:

1. Avoid the siren call of micromanagement

Accept the fact that micromanagement often pays off shorter-term but never longer-term. Abandoning the plan by taking a small profit long before your target is hit or bailing out at a small loss even though the stock is nowhere near your stop will often prove prudent. And, if you don’t, you’ll feel regrets. Statistically, that’s nearly guaranteed. As I preach, the market can be a really bad teacher.

2. Forget about being right every time--strive to be right over time

With a trend following methodology-btw, the only way to profit from a trade is to capture a trend--your results are going to be skewed. Like in life, the 80/20 rule of the Pareto Principle rears its head. So, 80% of your profits will come from 20% of your trades. Taken one step further, the trades that make your year will be even fewer and farther in between, maybe even 20% of the 20%.

I’m often criticized for making it sound too elusive. Well, I’d love to tell you that it wasn’t. Yes, I'm proud of PI. However, PIs don’t come along every day. And when they do, you can’t micromanage yourself out of them.

3. Reduce your observations

I’m trying not to watch the screen as I compose this prose but I can’t help myself. A few minutes ago the aforementioned PI was up over 14% for the day. Now, it’s only up 11%. So, what's still a decent positive, +11%, something I’d be happy with any given day, can now be framed as a negative-off 3%.

The more you watch a screen, the more you will put yourself into a state of regret. Something, thanks to Mr. Frey, we now know is a fact. As I’ve said repeatedly, I’ve often looked at my screens, cussed and then left for a walk in frustration.

Not every time, but often I return to find that everything has turned back around. It makes me wonder why I wasted all that negative energy for absolutely nothing.

Make fewer observations. Don’t stare at a screen when there’s nothing to do. Use that time for research, to take care of business outside of trading, or spend some time with your loved ones.

4. Embrace and accept

Like in life, recognizing that the problem exists goes a long ways towards fixing it. Embrace that the retrace which will occur more often than not. Embrace the fact that if you signed up for this business, then a nearly constant state of regret is possible. Minimize the frustration of this by simply making fewer observations and just let things play out.

May the trend be with you!

Dave Landry’s Trading Full Circle course videos and newsletter here