Nell Sloane of Capital Trading Group summarizes a dozen developments in cryptocurrency: the Basis project, Tim Draper’s prediction, Bittrex, Monero, blockchain, One Pay FX, Neo, Ripple and more.

Finally, the crypto space exhibited some much-needed life after spending weeks in this downward to sideways trend. We’ve read all sorts of ideas as to the reason for the bounce and as we touched upon last week with some legendary names getting into the fray. This doesn’t surprise us the least bit.

We figured perhaps some tax selling was going through as crypto investors decided to fulfill some tax liabilities in anticipation of paying tax on prior gains.

Then CNBC reported that none other than legendary trader Stanley Druckenmiller alongside Federal Reserve-ite Kevin Warsh are teaming up on a cryptocurrency project called “Basis.”

Early info depicts the projects endeavors toward creating a coin that exhibits a stable value.

If by stable they mean void of extreme fluctuation, we can’t wait to see their product and exactly the tools intend to use in order to reduce volatility within the confines of a decentralized cryptocurrency.

As with every passing week, someone of fame is out prognosticating the epic fall or rise of bitcoin (BTCUSD) and this last week was no different. Last week Silicon Valley's Tim Draper, who successfully bid on 30k bitcoin that the U.S. government “assumed” from Silk Road in 2014, said he believed, “Bitcoin could reach $250k by 2022.”

Now we can’t say we don’t like his thought process, but like John McAfee's call of $1m, we tend to think a lot needs to happen for those lofty expectations to come to fruition.

**

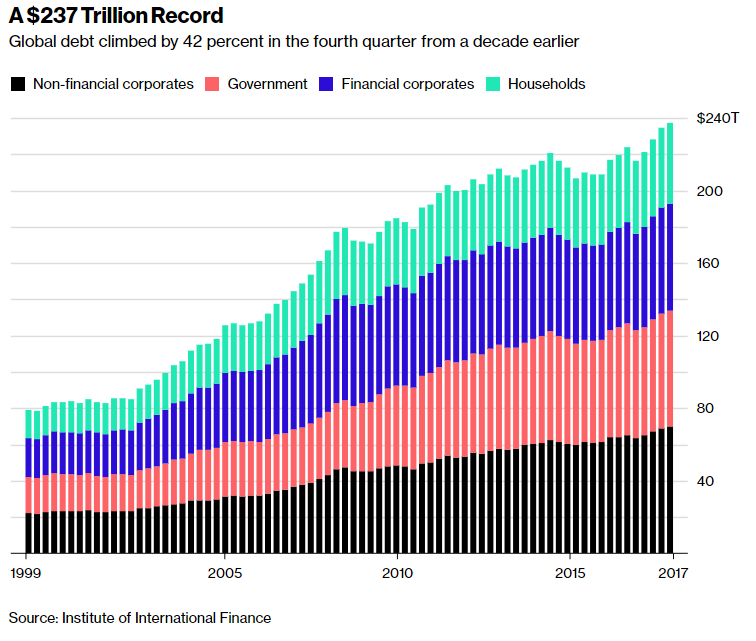

One thing people aren’t thinking of is the fact that the global fiat currency system could be called into question. What we mean is that the debt just keeps piling up and for those readers who may not know, our current monetary system is all just debt, money and debt are different sides of the same coin. One cannot exist without the other, not anymore at least, but bitcoin and cryptocurrencies could change that.

When we look at the global debt pile, the numbers are truly staggering, so perhaps these prognosticators, may eventually be proven correct, just not for the reasons they may be thinking.

Anyway, here is the global debt chart for your viewing pleasure, just to put into context how large this problem has become, its up a staggering 42% from just a decade ago. As fundamental economic Austrian followers, there is one word that incapsulates this situation rather succinctly it’s #UNSUSTAINABLE:

**

Pantera predicts BTC low: Also, out last week, was one of our favorite crypto companies, Pantera Capital Management, who stated last week that $6500 would mark the low of bitcoin for now. Dan Morehead the CEO stated that, “A wall of institutional money will drive the markets higher.”

Fundamentally he does make a valid claim and considering Pantera is a crypto fund, they are a bit biased, then again, why not!

**

What else did we hear over the past week?

Reuters reports that JP Morgan is part of a nationwide class action lawsuit regarding charges related to the purchase and sale of cryptocurrencies in regards to the high fees and charges, which were likened to a cash advance plaintiffs claim.

**

Coin Central reporting that Bittrex announced that it is accepting new clients now that their platform and website are optimized with new usability and security improvements to their API.

**

Monero did hard work to try and thwart ASIC mining. This is a first we have seen where a crypto hard fork resulted in not just one, but five new versions. The new coins are: Monero 0 (XMZ) Monero Original (XMO) Monero Classic (XMC) Monero-Classic (XMC) MoneroC (CXMR).

**

XMR fans must be very mindful now that the new forked coins don’t get confused for their XMR when sending and receiving. As CoinCentral pointed out the real risk for XMR users is if they do use these new forked coins, some deep data analysis may expose a wallets anonymity due to some relationship correlation mining.

South Korean Exchange OKEx, one of the largest exchanges by volume is expanding to Malta, as the government there is very receptive to expanding the ecosystem.

**

Bitcoin Magazine reported last week that Xiong’An Global Blockchain Innovation Fund launched with $1.6B to invest in Chinese blockchain startups. So much for banning it.

**

CNBC reports Santander launched a blockchain based foreign exchange service called One Pay FX, that uses Ripple technology, could be why the coin has found a little bounce.

**

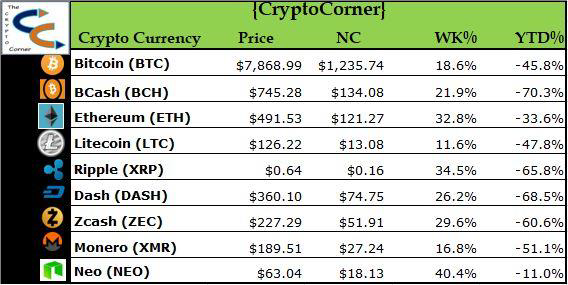

So, let’s look at the settlement prices for the week ending Friday, April 13:

Neo was the big winner on the week up 40%, followed closely Ripple and Ethereum (ETHUSD) up 34.5% and 32.8% respectively.

Bitcoin flirted with the formidable $8k area and as of this week is now above and hovering around $8100.

For the bulls this was a much-needed reprieve from what seemed to be constant and sustained week after week selling.

However, we felt technically bitcoin if it continued to reject pushes below the $6300/$6500 area, that upside pushes were possible. We aren’t in full bull mode, but further sideways consolidation may be leaning toward a greater chance for a push back up.

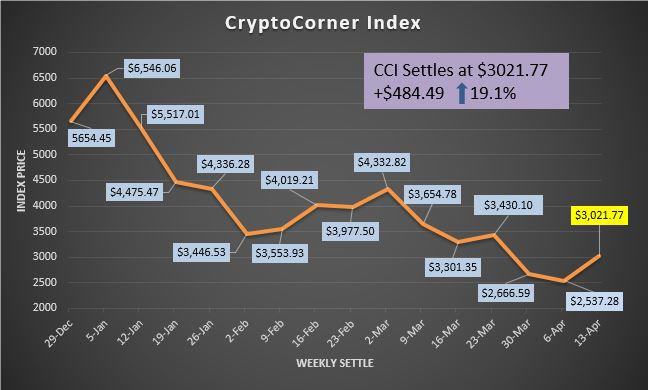

As for our CryptoCorner Index, it settled at $3021.77 up 484.49 or 19.1% on the week. This was a constructive settlement but we only expect a sideways to higher consolidation at this point. Fundamentals are improving alongside the technical picture.

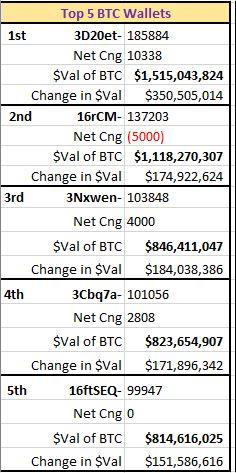

As for the top 5 BTC wallets, the chart shows that 4 wallets have now surpassed the 100k BTC mark.

The top 2 wallets continue to hold above the $1 Billion-mark dollar valuation, especially given this week’s move. It will be interesting to see if new wallets start to accumulate BTC and enter these lofty holding levels.

Thanks for reading and best of luck this coming week, cheers!

Subscribe to the Capital Trading Group newsletter here

More articles on cryptocurrencies on MoneyShow.com

The CFTC and virtual currencies

The risks and rewards of trading cryptocurrencies

Trading Lesson: Decrypting the cryptic cryptos

Trading Lesson: Decrypting the cryptic cryptos: Many questions, few answers

Trading Lesson: How I learned cryptos and became the Ethereum Whisperer

As regulators come for crypto criminals, invest in what is real