I’m almost certain that all is not well so I trade in small lots in stocks with positive charts and solid fundamentals, use options, and hedge my bets, writes Dr. Joe Duarte Sunday.

I may be standing alone in the wilderness, but at the moment I am nervously basing all my investment decisions on one simple and very contrarian theme: this time is different. Of course, anytime that phrase is uttered on Wall Street it can signal that a dramatic change in the long-term trend is on its way. But because that’s what history suggests should happen and it is not what’s I’m seeing, I’m more convinced–and nervous–every day that this time may be the one time which is different.

And here is why what once worked isn’t currently adding up. Analysts are caught in a time warp, essentially flying blind. That’s because after the 2008 subprime mortgage crash the game changed, perhaps irreversibly.

The Fed panicked and here we are.

Indeed, the central bank printed an unthinkable amount of money and then spread it around the world to so many places that it’s impossible to quantify or imagine the effect or extent of their actions. Furthermore, as other central banks joined the party they multiplied the cash hoard that’s still sloshing around the world. Thus, because there is so much money still out there, it’s practically impossible to use traditional monetary indicators as benchmarks from which to make decisions.

Yes, some of the excessive liquidity has been mopped up, especially the largesse deployed in the emerging markets which are now suffering in a major way. But even so, there is no way to measure the real amount of cash that’s still floating around in the U.S. and the developed world, or what it’s doing.

This is why business is still being conducted on a fairly normal fashion in the developed world which is further being spurred further by deficit spending and nearly full employment in the U.S.

Real people have real money?

Arguably, the clincher, and the fly in the ointment for those making market bets on traditional data is that because there is still an excess of cash available in the world, even everyday people are starting to see more money come their way.

This time is different. At the same time businesses have reduced capacity, which when combined with the legacy of just in time production and delivery has led to some pricing power and to some degree a predictable book of business which can be managed with supply chain software and artificial intelligence.

The net result is steady sales at reasonable if higher prices based on the current balance of supply and demand. This is evidenced by what I see in the retail stores that are still open and doing well because they have discovered how to manage their supply chains and their pricing and marketing strategies.

Of course, some areas of the country are doing better than others and it’s difficult to know how much of the activity I’m seeing is based on credit card or in store financing. But what’s different is that I’m not seeing the madness that was prevalent during the later stages of the dot-com boom or the subprime mortgage crisis. I see only steady commerce between savvy customers and businesses that are doing the right things. These are not signs of a blow off but of a trend that could last longer than anyone expects.

Stock picking is t-h-e t-h-i-n-g

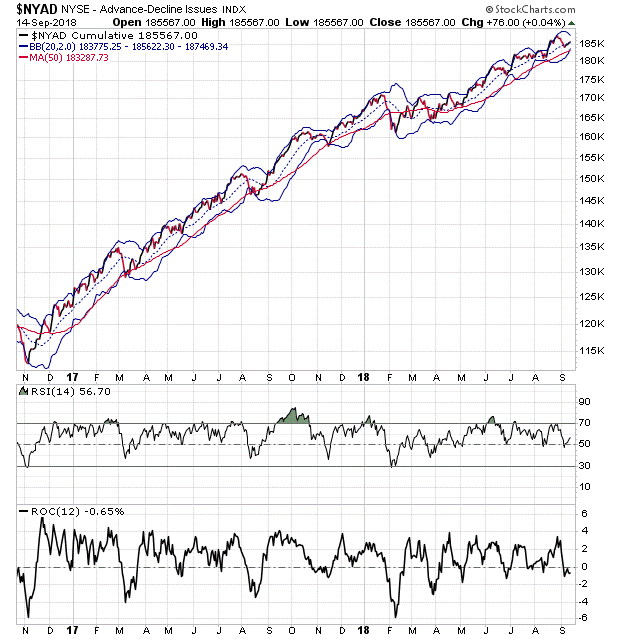

The New York Stock Exchange Advance Decline line (NYAD) remains the most accurate indicator of the stock market’s trend since the 2016 election. And its current posture suggests the uptrend remains in place but as I will show below stock picking is the key to success in this market.

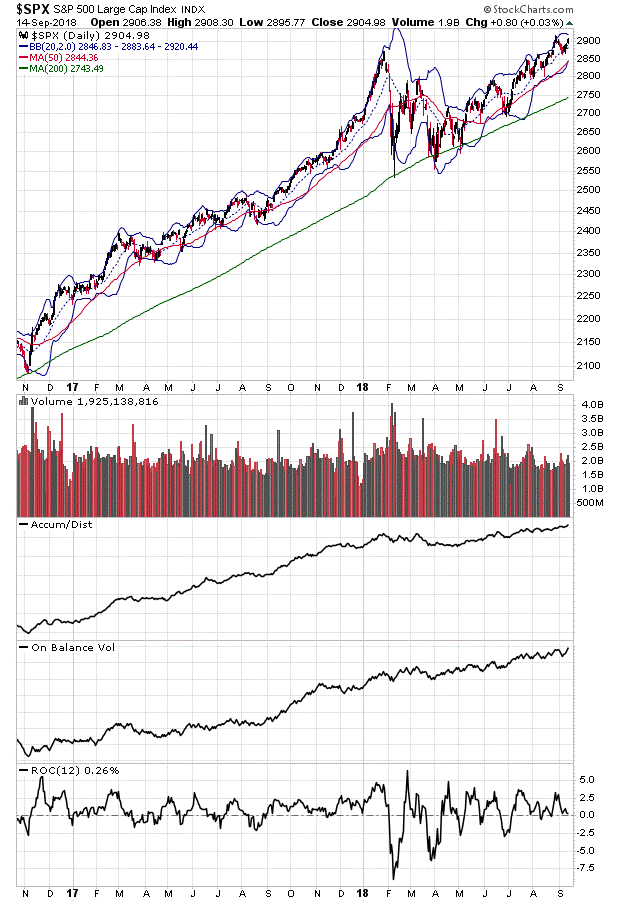

The S&P 500 (SPX) is once again within striking distance of another new high and is clearly confirming the uptrend illustrated in NYAD.

Note the rising slope of the Accumulation Distribution (ADI) and On Balance Volume (OBV) on SPX which is signaling positive money flows into stocks.

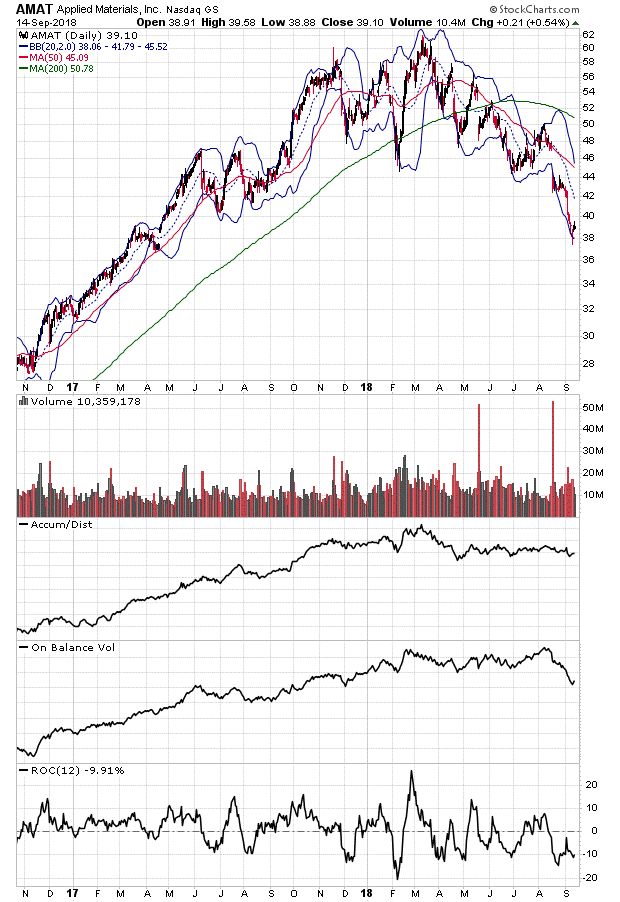

But not all stocks are in bull markets. First, look at the chart of semiconductor equipment manufacturer Applied Materials (AMAT) which has fallen 37 percent since topping out in February 2018.

AMAT is well into a bear market, trading significantly below its 200-day moving average with ominous looking Accumulation Distribution (ADI) and On Balance Volume (OBV) while ROC is still showing no imminent recovery in its down side momentum.

How much more pain can the bears endure?

I understand that my conclusions are not universally held. And I appreciate the fact that I may be wrong and the whole world may come crashing down at any time.

After all there are plenty of reasons, based on what up to now seemed to be sound historical perspective to expect a bear market and perhaps worse; especially rising interest rates, the turmoil in the emerging markets, and the wild and wooly politics of the moment.

But here is what I see on Wall Street. Analysts are still fighting the old war. Traditional benchmarks are not currently as reliable as they once were, in the markets or in the U.S. economy. Only technical analysis seems to work because the robots are still buying every single dip in the stock market. Furthermore, stock specificity is the key to success while the wall of worry grows bigger by the day.

On Main Street well informed consumers and surviving businesses seem to be operating in a balanced and unusually cautious and responsible fashion, at least compared to past cycles. Furthermore, some things, even in this market, remain consistent. Not the least of which the fact that rising stock prices and bearish sentiment are the combined lifeblood of bull markets.

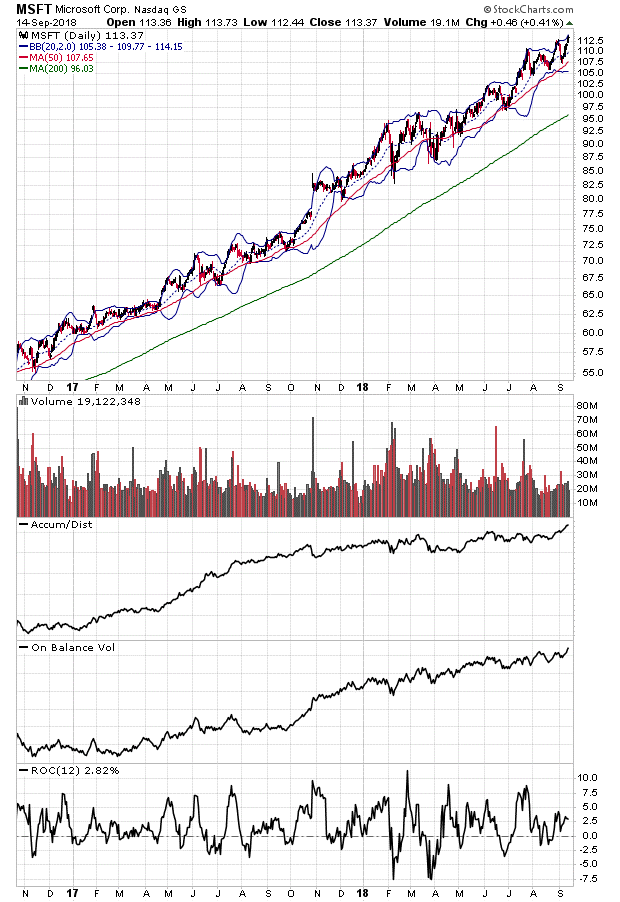

Let me put it another way. How many hedge funds with big marquee’ names at the helm have bet on the end of the world and have missed the huge gains in Microsoft and other bull market stocks in 2018? These funds, many of which are bracing for massive redemptions are facing the possibility of having to write yet another “so sorry” letter to their clients before the end of the year. All of which suggests that they will have to reverse their bearish stance and buy, buy, buy before too long in order to save their paychecks.

This time is different because the game has changed. The big guys have been raked over the coals by the bots and the overkill money printing by central banks and need to save their gigs. Furthermore, there are still too many bears banging the table and too many things that are holding up the wall of worry. Thus, until proven otherwise the odds favor a continuation of this very nervous, highly selective and unforgettable bull market.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com - now in its third edition, The Everything Investing in your 20s and 30s and six other trading books. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit our website.