The QuantCycles Oscillator is showing unusual short- and long-term convergence in Coca-Cola (sell) and Amgen (buy), according to John Rawlins.

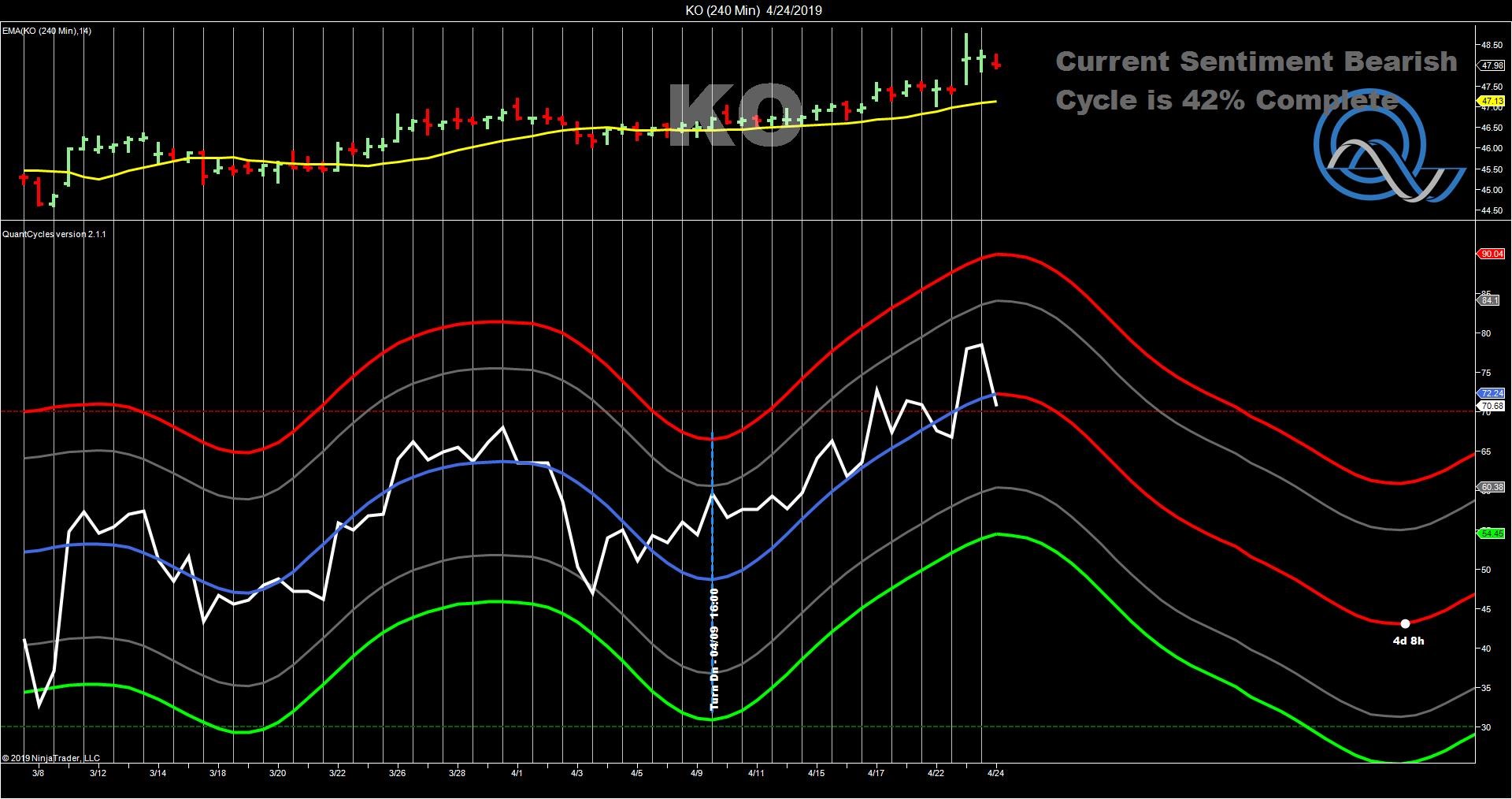

Iconic U.S. soft drink brand Coca-Cola (KO) delivered a strong Q1 earnings report earlier in the week. The resultant rally had pushed Coca-Cola near extreme overbought territory in the QuantCycles daily oscillator while it forecasts a downward trend (see chart). The QuantCycles Oscillator expects KO to trend lower for the next five days.

Drilling down to the four-hour oscillator confirms a short position. The four-hour chart is at the top and just turning down sharply over the next week.

While not as dramatic of a signal, the weekly oscillator confirms that KO is overbought and trending lower. Three strikes for Coke.

AMGN

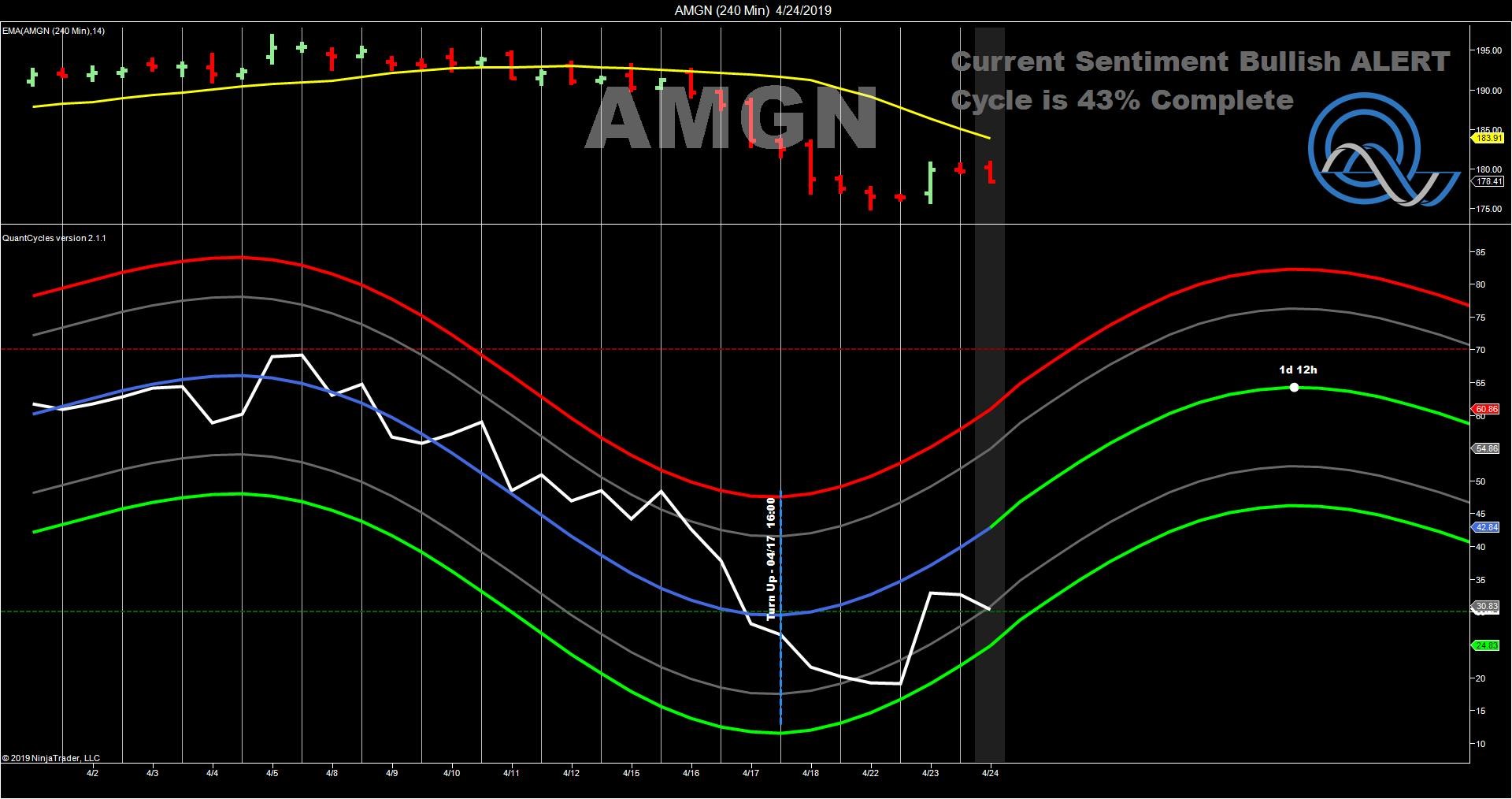

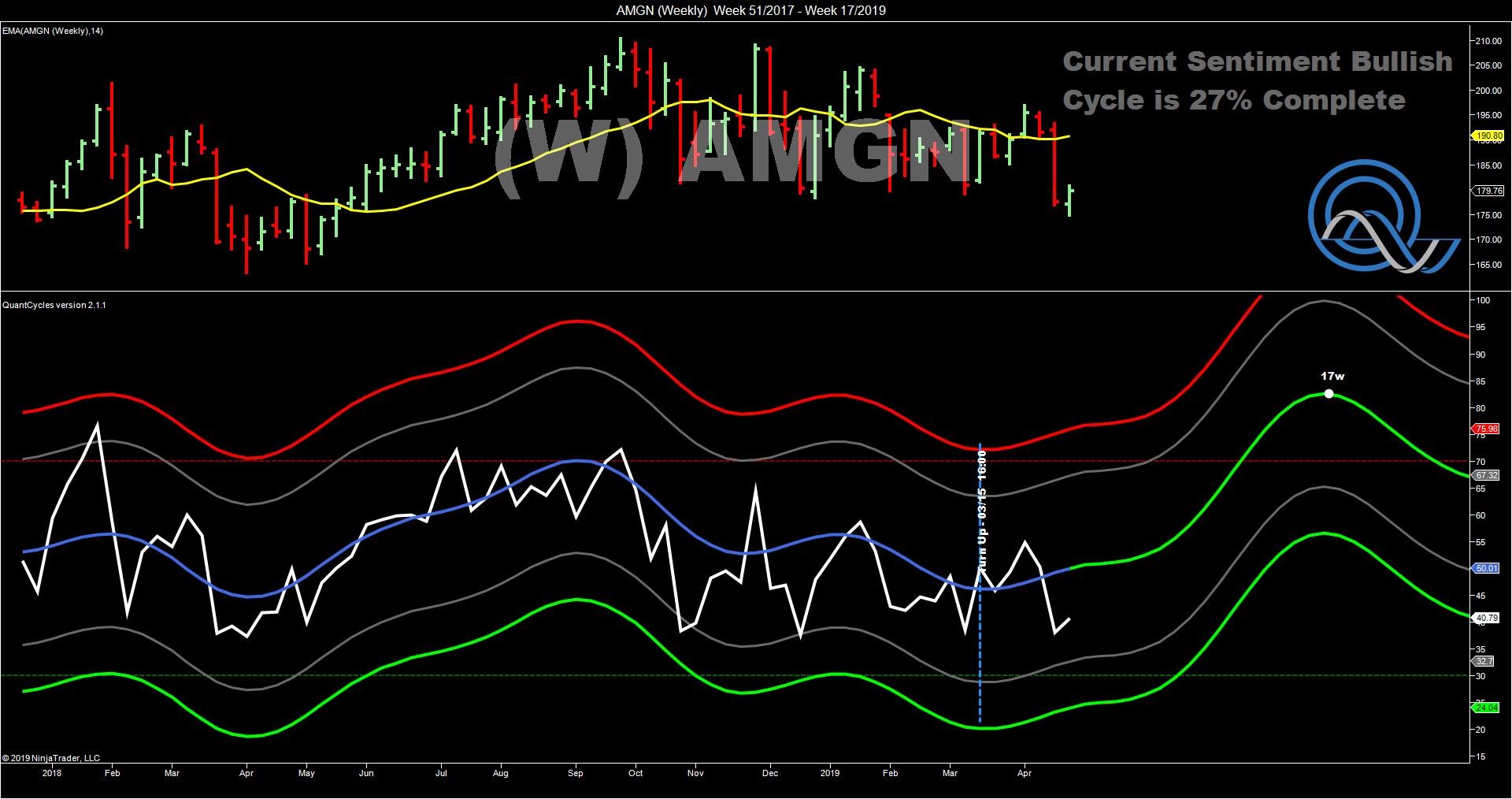

Biotechnology heavyweight Amgen (AMGN) recently dropped along with the sector on worries of Congressional action over high drip prices.

That recent weakness pushed AMGN into massive oversold territory on the daily QuantCycles Oscillator, just as its upward bias turns sharper (see chart).

Both the short-term (four-hour) and long-term oscillator confirms the upward bias.

While this is a strong buy signal, traders should be aware that AMGN is announcing Q1 earnings on April 30, and should take appropriate defensive measures.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.