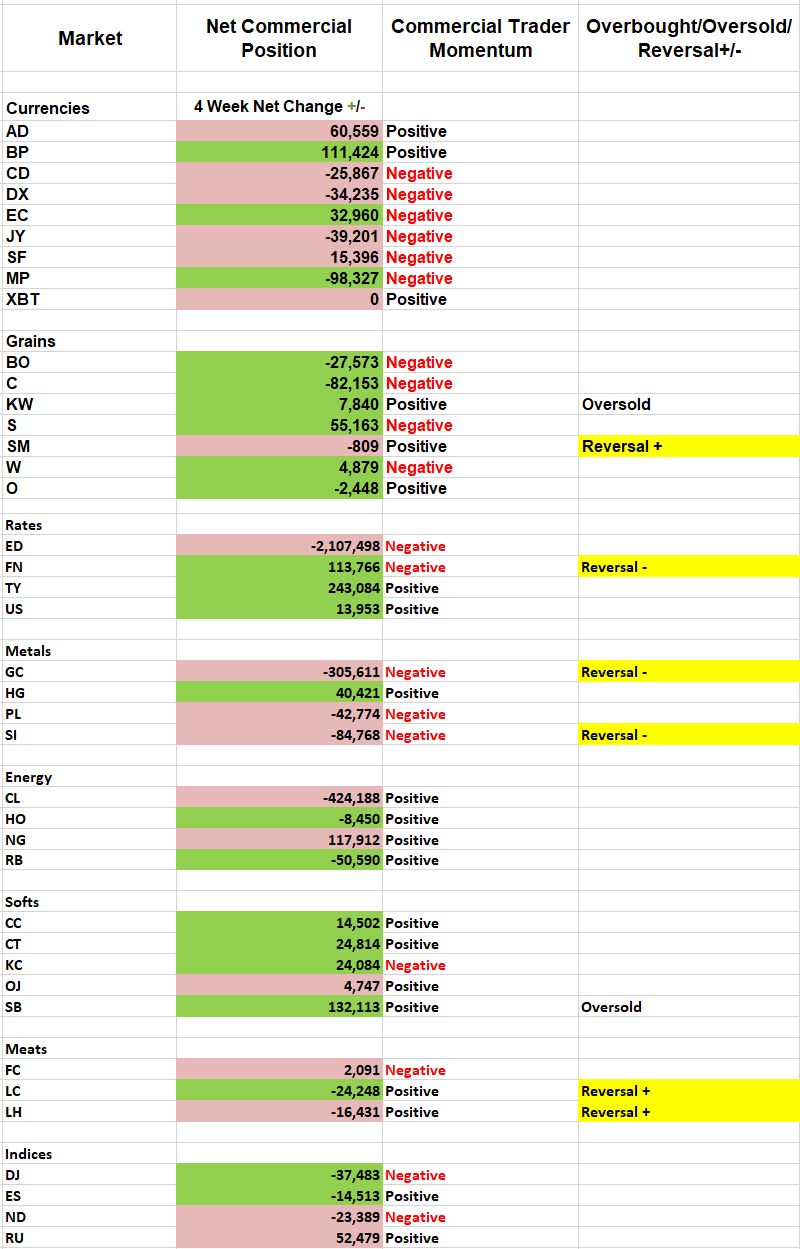

The COT report is showing a reversal in precious metals and a great opportunity in an extremely oversold sugar market.

We use the Commitments of Traders (COT) report to determine if a market that has moved into overbought or oversold territory is due to continue or, reverse. Our primary data stream of the COT report monitors the commercial traders who produce or refine a commodity, and the speculators attempting to catch the next new trend.

Markets are rarely in a trending mode. If a market is not in trend mode and the commercial traders within that market are anxious to hedge their needs at a given price, it's because they don't expect prices to be in the same area by the time their hedge is due in the physical market. We quantify "anxious" through a combination of proprietary indicators available on our site.

This week we have a classic setup involving commercial trader behavior and seasonality in the sugar futures market. The sugar market has been trending lower for more than two years. We aren't forecasting a turnaround of multi-year magnitude. However, we do know that the speculators have been pressing the short side of the market since late June. They have also run their position to a record net short level. In fact, speculators have added more than 120k short contracts in just the last month at prices between 12.30 and 10.89. Over this same period, the speculative position has grown by 140k (see table below).

Another way of stating this is, the speculators have added short positions at a 7:1 pace over the last two months. Their total COT ratio is now short 1.64 contracts for every contract they are long, also a new record. We see this as pent up buying potential. Commercial traders have taken the opposite approach, as sugar has become a value proposition, nearing its lowest prices in 10 years and ahead of anticipated seasonal strength.

We'll side with the commercial sugar processors who are locking future supplies as fast as they can. Commercial traders not only set a new net long record but, their purchases for the last week were more than two standard deviations above their average. The commercial net position surge is just one of the ways we define anxious.

Finally, the sugar market tends to strengthen from mid-September through mid-October. We plan to piggyback this trade in our seasonal strategies.

Stay tuned for a buy stop run in the sugar market as it punishes the overly greedy speculators.

Open Position Commentary:

Currencies

Nice jump in the Aussie. Raise the protective sell stop to your entry price plus commissions. Make it breakeven, worst case scenario. Look to take profits near resistance between .7015 - .7065.

Metals

Raise the December copper sell stop to $2.5900. This should cut risk to less than $1,000 per contract. Look for profits on a move towards $2.800.

Precious Metals

I'm targeting $1,415 in gold and $16.50 in silver.

Energy

Raise the October unleaded gas sell stop to $1.5150.

Grains

Be careful with the soybean meal buy signal. This is counter-seasonal. The soybean complex tends to fall through harvest.

Here is what Andy had to say about seasonality and the COT Report at the recent TradersEXPO New York.

Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.