Rolling up winning options trades in the same month can be profitable but traders should not risk a bird in the hand, and only roll when time value nears zero, writes Alan Ellman.

Position management or exit strategies is one of the most important skills for traders. It a close third to stock selection and your strike selection for your options. It is particularly important in managing covered call writing and short put positions.

First, we must determine if an exit strategy opportunity actually exists and then, which one to execute. On May 3, 2019, a subscriber wrote to me regarding a successful trade he was in. He was considering a rolling strategy in the same contract month. There are pros and cons in rolling up in the same contract month and evaluate if this is the best course to take.

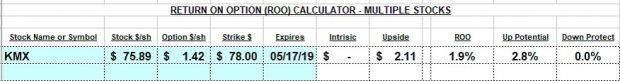

Rob (our subscriber) was long a covered call on CarMax, Inc. (KMX)

- On April 25 he bought 199 shares of KMX at $75.89 and sold 1 $78.00 call (May 17 expiration) at $1.42.

- On May 3 KMX was trading at $78.50, so the cost-to-close the $78.00 call was $1.15

Initial structuring of the trade using The Ellman Calculator

KMX: Initial Calculations with the Multiple Tab of The Ellman Calculator

Rob received an initial 23-day return of the option of 1.9% with an additional upside potential share growth of 2.8% resulting in a 23-day potential return of 4.7%. This is where the trade is positioned as of Rob’s May 3 email.

Evaluating rolling up in the same contract month

Rob was considering three paths to take:

- Rolling up to the $79.00 strike for an option net debit of $0.55 ($1.70 – $1.15)

- Rolling up to the $80.00 strike for an option net debit of $0.95 ($1.70 – $0.75)

- Taking no action and possibly getting assigned after expiration

Now, why would we roll up to then lose money on the option? Frequently, moving the strike up will create an unrealized stock gain to the strike or current market value of the stock, whichever is lower. In this case, share value would move up 50¢from the original $78.00 strike to current market value of $78.50. In both cases, we would be rolling up to a losing scenario. Should share price move up to the new strikes, we would now have net credits in both rolling scenarios:

- $79.00 strike: (-$0.55 + $0.50 + $0.50) = +$0.45 = 0.6%

- $80.00 strike: (-$0.95 +$0.50 + $1.50) = +$1.05 = 1.3%

To achieve these relatively small additional credits and avoid losses on the option side, we would be dependent on continued share appreciation of a stock that has recently enjoyed significant price acceleration. In a way, we are taking a (currently) very successful trade and putting the results at risk.

Best strategy when share value increases significantly mid-contract

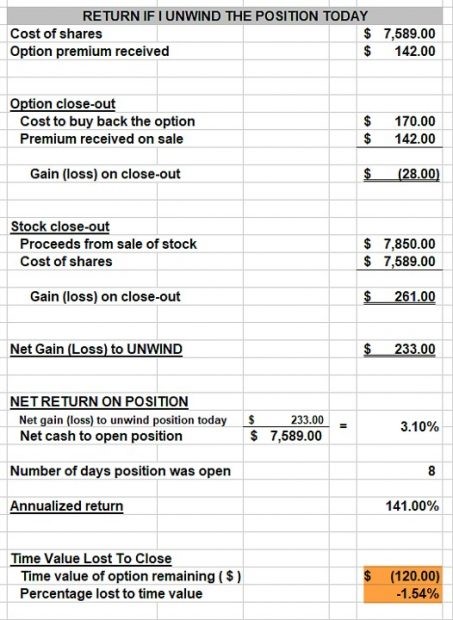

The mid-contract unwind exit strategy can be employed when the time value component of the premium approaches zero or such that closing the entire position and using the now available cash will allow us to generate at least 1% more than the time-value cost-to-close. For this calculation, we use the “Unwind Now” tab of the Elite version of the Ellman Calculator:

Time-Value Cost-To-Close Using the Elite Version of The Ellman Calculator

The calculator shows a cost-to-close of $120.00 per contract or 1.54% of current market value. The original return was 1.9% so closing the entire position is way too expensive and not appropriate here. It may become viable should share price continue to accelerate in the next few days.

Discussion

There are many times when the best action is no action at all. In this case, Rob has maximized his initial trade as long as share value remains at or above $78.00. We must remain focused and prepared to act should a viable exit strategy opportunity arise. If the strike remains in-the-money as expiration approaches, there is also the opportunity to roll the option out or roll-out-and-up to the next contract month.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. FREE Beginner’s Corner Tutorial for Covered Call Writing has Been Enhanced and Updated here: