While major markets appear headed into a “risk-off” cycle, the softs sector has some sweet set-ups based on COT analysis, reports Andy Waldock.

Foreign affairs and Middle East politics will dominate the market action this week. Friday's gold, U.S. Dollar Index and Treasury inflows combined with the lower close of the equity market created a full risk-off investment picture. However, if we're moving towards defensive investments, the stock market must soften.

Once again, the stock market's early declines found willing buyers, and while the market closed lower for the day, it was basically unchanged for the week. Clearly, the equity markets remain dominated by greed, rather than fear. Long-term moving average and technical support in the S&P 500 is nearly 15% below our current levels, and a 10% decline wouldn't even violate the upward trend in place since the December 2018 low.

Unfortunately, we can't predict the next actions of any of the involved geopolitical parties. Therefore, we'll take a look at a couple of markets with a weaker correlation to the news cycle.

We first brought the current sugar set up to the attention of our readers on Dec. 23. The sugar market has been relatively consistent in its reactions to the commercial traders' price discovery at both the high and low end of the market's price range. The sugar market experienced very little volatility last year. Low volatility made it easy to follow the commercial traders' lead when we went long on June 10. Our next COT buy signal came in September. We were buyers, again following the commercial traders when they set their most bullish net position of the year, by issuing a COT buy signal on Sept. 23.

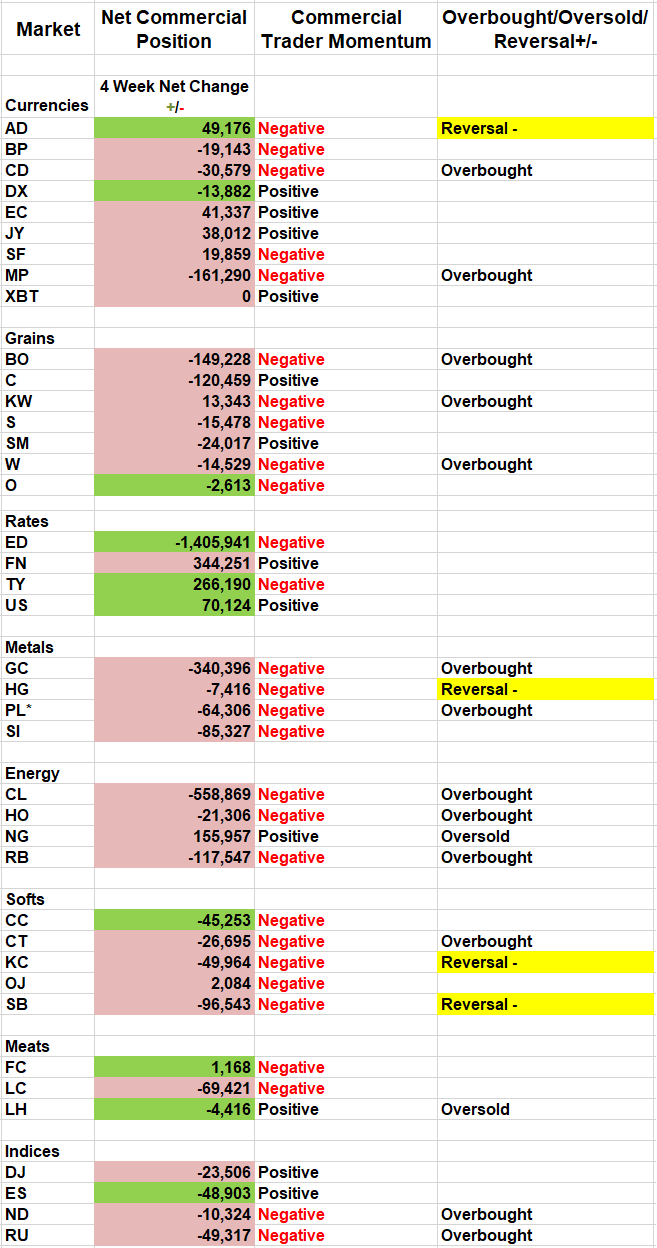

Now, the commercial traders have turned to the sell-side. The flip from commercial buying to selling reveals the balance point between processor purchases at the market lows and producers' forward sales at the highs. The net commercial position grew to 157k contracts at the September low. Then, the commercial traders set a new net long total on an annual rolling basis at 168k in October. The market has continued to rally for the last two months, and now, producer selling has forced the net commercial position to short 96k contracts. That is a shift of 250k in a market with open interest just over 1,000,000 contracts (see table above).

This shift sets the stage for the first COT short sale in the sugar futures market since November of 2018. The setup is comprised of a market that is overbought in the face of a pessimistic forward price projection by the commercial traders. Last week's reversal provided the trigger and the risk measure. This methodology is pattern-based and mean-reverting. Therefore, we use the swing high or low for our protective stop placement.

The trade sets up as follows: Sell March sugar. Place a protective buy stop at the recent swing high of 13.67¢. The current high creates a risk of 36 points or $414 (36*$11.5) based on Friday's close. Look for the first trend line support from the September low around 12.60¢.

Finally, we'll close with a comment on the orange juice market. First, we don't trade orange juice very often because there isn't much liquidity. However, we just noted that sugar producers are selling their forward production on the market's rally. Orange juice producers, on the other hand, are selling their forward production at the market's lows. This is very rare. The last time we saw commercial traders this anxious to sell— which we measure by comparing current activity to standard deviation of their activity over a given period— was in July of 2018 when the market was trading at twice its current prices. Orange juice producers are behaving like trend following speculators by selling into the market's new lows. This is extremely bearish. Keep an eye on the orange juice market's volatility to increase tremendously as this plays out.

Here is what Andy had to say about seasonality and the COT Report at the TradersEXPO New York. Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.