The market is in constant search of balance, which means a price where both the bulls and bears feel there is value in placing a trade. They need to believe that they will make money, states Al Brooks of BrooksTradingCourse.com.

This means an area of confusion, a trading range, because how else could both the bulls and bears feel that the price is good?

It constantly probes up and down as it tries to determine the fair price area. Most of these rallies and selloffs fail and the market stays within the range. Occasionally one leads to a breakout, which means that both the bulls and bears are no longer confused. They agree that the price is too high in the case of a bear breakout, or too low in a bull breakout. The market then quickly moves to a new area of confusion, which is another trading range, where both the bulls and bears feel that the price is about right.

Market Cycles Between Trends and Trading Ranges

Price action is a never-ending market cycle of trends and trading ranges. Trends begin with a breakout. Once pullbacks begin, the trend converts from the trend breakout phase to the trend channel phase. This is followed by increasing two-sided trading and the evolution into a trading range.

The seeds of the next trend are planted in every trading range, and once you learn how to read buying and selling pressure, you are in a position to anticipate the next successful breakout. As soon as there is a breakout up or down, the process begins again.

In Trading Range, Buy Low, Sell High, Scalp

Once the market appears to be in a trading range, traders will BLSHS. This means buy low, sell high, and scalp. Buy low can be to take profits on a short or to buy to go long. Sell high can be to take profits on a long or to initiate a short.

A pullback that grows beyond 20 bars loses most or all the influence of the trend that came before it, and the probability of trend reversal becomes the same as that for trend resumption. Once there is a successful breakout in either direction, the process begins again.

When the market is in a trading range, traders should only BLSHS. They should avoid placing trades in the middle third (the gray area) of the range.

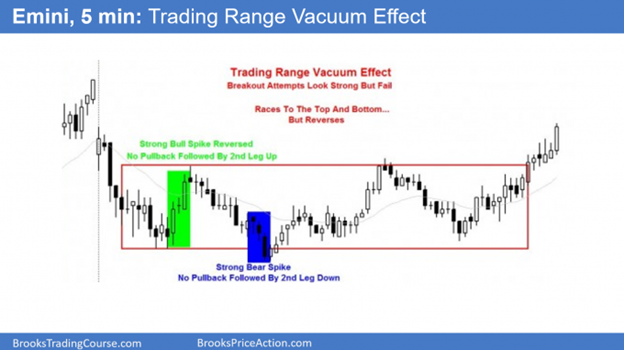

Most Breakout Attempts Fail

Trading ranges always look like they are about to break out. Strong legs up trap traders into buying high (remember, you should only sell high!), since they will assume that the strong leg up will have a second leg up after any pullback. Strong legs down trick traders into looking for shorts at the bottom of the range, again because the move looks so strong that it makes them erroneously believe that there will be a successful breakout.

Again, this is the opposite of what experienced traders will do. People are naturally hopeful, and it takes time to get past the tendency to believe that a strong breakout attempt will succeed. These strong rallies are just buying vacuums that test the resistance at the top of the range, and the strong selloffs are cause by the support at the bottom of the range vacuuming the market down for a test.

The market gets vacuumed to the top and bottom of the range, but there is no follow-through. Beginning traders constantly get trapped into buying big bull trend bars at the top and shorting big bear trend bars at the bottom because being hopeful is part of our nature. Traders are hoping for the next trend, but markets have inertia and when a market is in a trading range, 80% of breakouts up and down will fail.

Tight Trading Ranges

A trading range is simply a horizontal channel, and like other channels, it can be broad or tight. When a trading range is broad, traders can enter with stops, selling at the top and buying at the bottom.

They can also fade breakouts by placing sell limit orders above prior highs to go short and buy limit orders below prior lows to get long. They can also fade breakouts by simply shorting strong bull closes at the top of the range or buying strong bear closes near the bottom of the range, correctly expecting that these breakout attempts have an 80% chance of failing.

When they sell at the top, they are doing so either to take profits on longs that they bought lower in the range or to initiate short positions. When they buy low, they are either taking profits on shorts that they sold higher in the range or to initiate long positions.

Most Should Not Trade

When a trading range is tight, most traders should not trade. Experienced, aggressive traders will scalp with limit orders, buying below bars in the bottom third of the range and scaling in lower, and shorting above bars in the top third of the range and scaling in higher. However, whenever the range is too tight, they should wait for a breakout up or down. An example of a tight trading range that is too tight is one where the height of the range is only twice the size of a scalp.

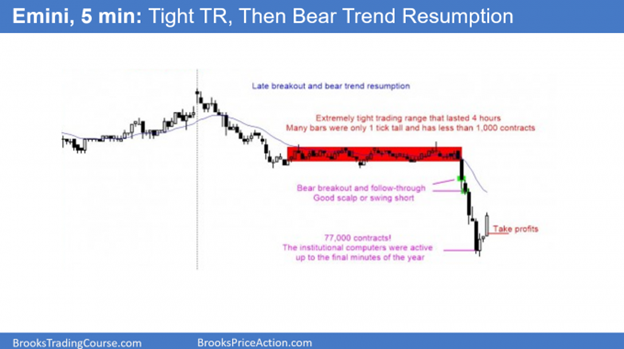

Sometimes a trading range can be extremely tight, with many bars only 1 tick tall, yet still have a big breakout on huge volume. This is a reminder that the institutional computers are always there. The 1:00 pm had 77,000 contracts! Just as it was a very profitable opportunity for them, it can be for us as well, if we are prepared to trade.

The tight trading range was a breakout mode setup, which means that a breakout and swing trade was likely, but it could be in either direction. There could have been a trend reversal up. Here, there was a trend resumption down (the bear trend from before the tight trading range resumed with the bear breakout below the tight trading range).

Learn more about Al Brooks at Brooks Trading Course.