Big U.S. banks have been on a tear since passing the Fed's annual stress test and announcing plans to increase dividend payouts and share buybacks, notes Dr. Carla Pasternak, editor of Dow Theory Letters's The Income Investor.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

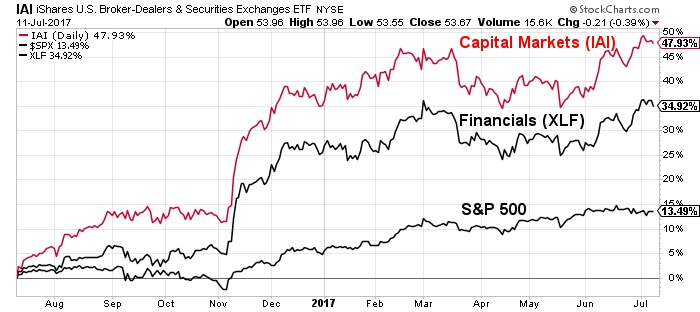

But there is more to the financials sector than the 34 "too big to fail" banks. The sector covers more than half a dozen industries from banks and insurance to capital markets and real estate. Many of these industries are doing well, but one of them is making exceptional gains—capital markets.

What exactly is the capital markets industry? Essentially, it provides investment services. The industry includes investment banks asset managers, brokerages and exchanges.

Investment banks benefited from a 29% year-over-year increase in equity underwriting, thanks largely to a tenfold increase in initial public offerings (IPOs), says the Securities Industry and Financial Markets Association (SIFMA).

Debt also increased, with corporate bond issues rising 18% and asset-backed loans up 38% compared to the 2016 first-quarter.

Together, equity and long-term debt issuance in the U.S. is on a positive trend, rising 19% from the prior quarter and 13% from the prior year. And investment banks that raise these securities for fees and a percentage of the asset values are prime beneficiaries.

Mergers and acquisitions (M&As) in the U.S. also kicked off the year strongly with volumes up 19% and deal size up 52% year-over-year, reports Mergermarket.

Meanwhile, asset managers, after five consecutive quarters of growth, enjoyed a further 5% year-over-year jump in assets under management to an all-time high of nearly $11 trillion in the first quarter.

Looking ahead, the positive trends look to continue, with the capital markets likely to benefit from rising interest rates. Earnings for banks and bank-related firms are generally favorably affected by higher rates.

That's because their net interest margins (NII)—the difference between long-term investment income and short-term funding costs—generally increase if long-term rates rise more than short-term rates.

So, as the Federal Reserve hikes rates, analysts are raising 2017 earnings estimates for these money managers.

Proposed corporate tax reforms are another potential positive for the capital markets sector.

To profit from the favorable backdrop for capital markets, you can invest in individual stocks or and exchange-traded fund, the SPDR S&P Capital Markets ETF (KCE), which carries a better than 2% yield.

The ETF tracks the returns of the S&P Capital Markets Select Industry Index. About 80% of its $100 million portfolio of 55 holdings is divvied up between asset managers and investment banks & brokerages, with the remaining allocated to financial exchanges.

Top holdings include investment brokerage TD Ameritrade (AMTD) and asset managers Northern Trust (NTRS), and Waddell & Reed Financial (WDR).

Over the past year, the fund has gained 44% (versus 18% for the S&P 500) and, in the last three months the shares have rocketed with 9% total returns, almost triple the broad-based index.

Technically, a sustained breakout above the $50 level would be highly bullish, indicating that the shares have completed a basing formation dating from June 2015.