Want to make a fortune? Figure out a way to own a monopoly in something. Anything. When it comes to Internet searches, Google (GOOGL) has about as close to a monopoly as you can get, asserts Tony Sagami, contributing editor to Weiss Ratings.

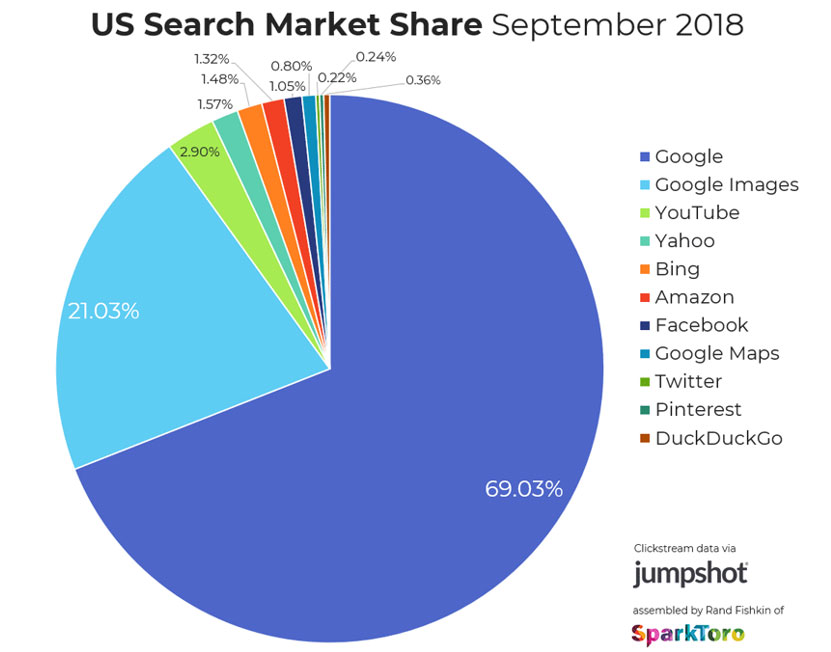

Get this: Google has a 93% stranglehold on the search market. Other household names like Google-owned YouTube, Facebook (FB), Yahoo! and Microsoft (MSFT) fight over the crumbs that Google leaves behind.

Google's search engine is so dominant that it gets over 1 billion monthly users from eight different Google platforms: Search, Android, Gmail, Maps, YouTube, Play, Chrome and Drive.

A big part of that search stranglehold is due to photos and videos. The demand for images is so strong that searches on Google Images generated more than 20% of all search requests this year.

And as much as competitors try to encroach on Google's search dominance, they are miserably failing. Over the last three years, Google's dominance of search — thanks to Google, Google Images and YouTube — has hovered around the 90% range with remarkable consistency.

But search isn't the only business that Alphabet, the parent company of Google, is involved in. Alphabet can be divided into two divisions: (1) Google and (2) everything else.

For example, Alphabet's cloud storage division is growing like crazy, hitting $1 billion in revenues last quarter for the first time. YouTube, with over 1.9 billion monthly active users who watch more than 180 million hours of content every day, will soon turn into a massively profitable cash cow.

Alphabet doesn't disclose how much of its revenues come from YouTube. But most estimates are in the $15 billion range for the year, a number that has been growing at a 20% annual clip.

Alphabet is also making great strides in autonomous vehicles, smart home technologies, anti-aging treatments, space exploration, artificial intelligence and many other disruptive innovations. And again, the one asset Alphabet has that gives it a tremendous advantage is data. It has more information than anybody on the planet, including the U.S. government.

All told, in 2017, Alphabet pulled in $110 billion of revenues (23% year-over-year growth) and pocketed $22.5 billion of profit (16% year-over-year). Lastly, Alphabet has $106 billion, or $153 per share, of cash in the bank.

I'm not suggesting that you rush out and buy Alphabet stock today. As always, timing is everything. But I have no doubt that Alphabet will double, triple, or increase even more over the next three to five years. In fact, about 8% of my retirement account is in Alphabet. And even though I am sitting on a huge open gain, I plan on holding it for many more years.