When investors are confident in growth prospects, bond yields tend to rise, not fall, explains Matt Kerkhoff — a specialist in market behavior and trend analysis — and founder and chief strategist of Sigma Point Capital.

We’re all aware of the old adage that the bond market is smarter than the stock market … is this one of those times when yields are trying to tell us something important?

The yield on the 10-year note recently fell so low that we saw another inversion of the yield curve. This time, the 10-year yield fell below that of the 3-month Treasury. We had previously seen the spread between 5-year and 2-year Treasuries go negative, which is not a good sign, but this new inversion is cause for even more concern.

Why? Because the spread between the 10-year and 3-month Treasuries is the most accurate in terms of predicting whether the economy will be in recession 12 months later.

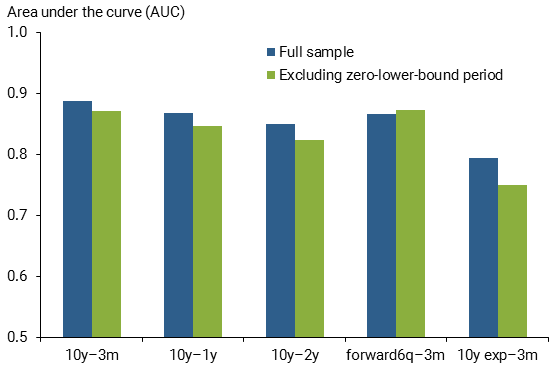

The chart below depicts work done by Michael Bauer and Thomas Mertens, two researchers with the Federal Reserve Bank of San Francisco.

Operating on previous work done by Berge and Jorda (2011), which demonstrated that 12-months is the time horizon with the highest forecast accuracy for yield curve inversions, Bauer and Mertens attempted to calculate the probability that the economy would be in recession based on various yield curve spreads.

As you can see, the 10-year minus 3-month spread is the most accurate, and historically an inversion of this spread has resulted in an 86% — 89% percent chance of the economy being in recession one year out.

Let that sink in for a moment … One of the most reliable recession predictors in history, with an almost 90% accuracy rate, just told us that the U.S. economy will be in recession a year from now. Yikes.

To make matters worse, the 10-year note yield also dipped briefly below the yield on the 1-year Treasury. Notice in the chart above that this spread also has a very high probability of signaling recession one year out.

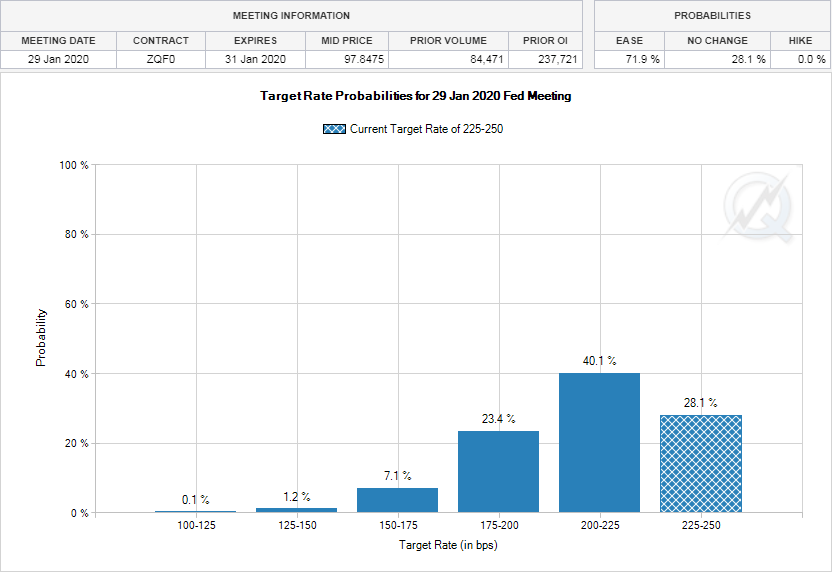

In the chart below, I’ve pulled up target rate probabilities for the Fed’s January 2020 meeting. This is the furthest meeting we have fed funds futures data available for. As you can see, market participants are pricing in a 28% chance of rates remaining at current levels, and a 72% chance of one or more rate cuts.

Again, it’s time to stop and think. If the market is pricing in a zero percent chance of rate hikes, and a 72% chance of rate cuts, it suggests a strong belief that the Fed will need to react to deteriorating economic conditions. Said differently, fed funds futures data also seems to be signaling that a recession is approaching.

Now, since I always like to touch on both sides of any particular topic. I think many investors believe that the yield on our 10-year note is being suppressed by falling yields around the globe.

As a result, I believe many of them are discounting the significance of this inversion, attributing it to low global bond yields rather than deteriorating conditions here in the States.

That’s why they remain comfortable owning both stocks and junk bonds near all-time highs. So the million-dollar question is … are they right?

In a nutshell, while most indications appear that the economy continues to expand at a slow but steady rate, that outlook is increasingly coming under pressure. I think we need to continue erring on the side of defense rather than offense. In this type of environment, I believe the risks are becoming asymmetrical to the downside.

I’m not suggesting that a vicious bear market necessarily lies ahead, but if your focus is more on capital preservation than growth, this might be a good time to de-risk your portfolio a bit.

I would also note that equity markets discount approaching recessions by roughly 6-12 months. This means that if, in fact, a recession is about a year away, the stock market could peak in the next few months, or it could have already peaked.

We simply don’t know. The takeaway here is that you shouldn’t wait until the signs are clear that we’re in recession before adjusting your portfolio. By that point, the major averages will be well off their highs.

I realize this commentary isn’t the most upbeat of notes, but unfortunately we find ourselves late in the cycle and dealing with rather unique and unnerving events. We want to make sure that at times like this, our rose-colored glasses are firmly in their case.

Subscribe to Matt Kerkhoff's Sigma Point Capital Market Analysis here…