JetBlue Airways calls are particularly affordable right now, with implied volatility on JBLU’s short-term options resting near the lowest levels of the last year, says Elizabeth Harrow, at Schaeffer’s Investment Research.

Get Trading Insights, MoneyShow’s free trading newsletter »

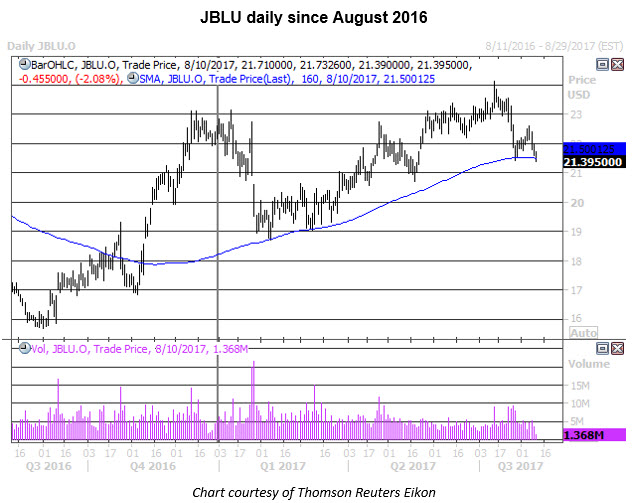

Discount carrier JetBlue Airways (JBLU) has encountered some turbulence on the charts in 2017. The stock bottomed out at $18.71 in early February–coinciding with the site of its Nov. 9 highs, prior to the next day’s election-driven bull gap–and then spent the remainder of the first quarter struggling to regain a grip above the round $20 level.

More recently, JBLU has been attempting to reclaim a foothold in positive year-to-date territory. The stock was in the black for 2017 from late May through late July but has since corrected about 10% from its July 13 annual high north of $24.

In the days since, JBLU has been encountering some pressure around $22.50, which roughly coincides with its year-to-date breakeven.

However, there could soon be an opportunity for traders to jump on a JBLU rally if history is any guide. The stock is currently trading very near its 160-day moving average–located, just like the shares, around $21.50 as of this writing. Data from Schaeffer’s Senior Quantitative Analyst Rocky White shows an unmistakably positive bias for JBLU in the days and weeks following previous meet-ups with this longer-term daily trendline.

Specifically, looking at JBLU’s last seven encounters with its 160-day moving average, the stock registered positive five-day returns 86% of the time, with an average gain of 1.7% for this time frame. But it’s JBLU’s 21-day returns following a 160-day test that should catch the eye of those looking to capture big, fast gains: 83% positive, with an average return of 7%.

Of course, given the broader geopolitical risks currently rattling global stock markets, traders will want to wait for JBLU to stage a successful bounce from its 160-day before diving into a long position. Playing options rather than stock can also help to mitigate risk; the cash outlay required to buy one JBLU call option is considerably smaller than buying 100 shares of stock outright, which minimizes the amount of capital in play.

And JBLU calls are particularly affordable right now, with implied volatility on JBLU’s short-term options resting near the lowest levels of the last year. Trade-Alert calculates the stock’s 30-day at-the-money implied volatility at 26.9%, which arrives in the low 16th percentile of its annual range. In other words, speculative option plays on JBLU have been cheaper, from a volatility standpoint, only 16% of the time in the last 52 weeks.

So for those looking to take advantage of quick profit opportunities without risking an undue proportion of their trading capital, playing a potential bounce from JBLU’s 160-day moving average looks like a compelling short-term trade opportunity.