The Federal Reserve Open Market Committee raised the upper bound a quarter percentage point of its Fed Funds limit to 1.75% Wednesday. Here what it means, writes Nell Sloane of Capital Trading Group. More on the Walmart e-commerce dispute, Larry Kudlow, Facebook and Abra.

Well, it means two things.

First, the short rate inches ever so closely upward to the all-important US 10Y rate which means the curve continues to flatten.

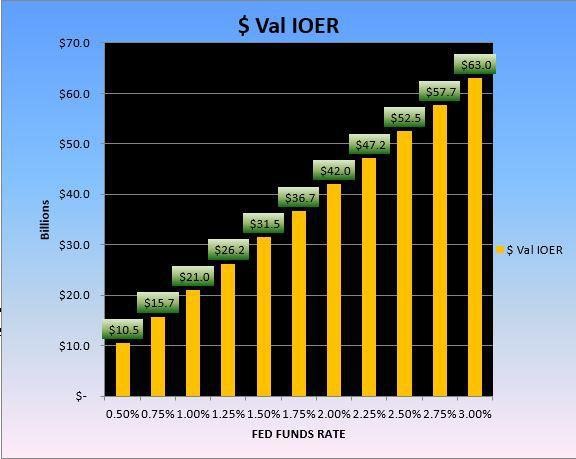

Secondly, it means the banks around the globe will get an extra $5Bn a year give or take from this 25bp hike. In total and through the IOER (Interest on Excess Reserves) mechanism, which is essential in keeping inflation tame, the banks will receive in annual terms nearly $37Bn for doing nothing.

Well, not doing nothing, rather keeping the money out of the hands of consumers and kept in the round about circle of central banking abyss. Here is the chart:

We love using that chart because it’s so simple. Take the current Fed Funds rate and it displays the amount given to the banks by the Fed for not lending money out to the system. It’s really that simple.

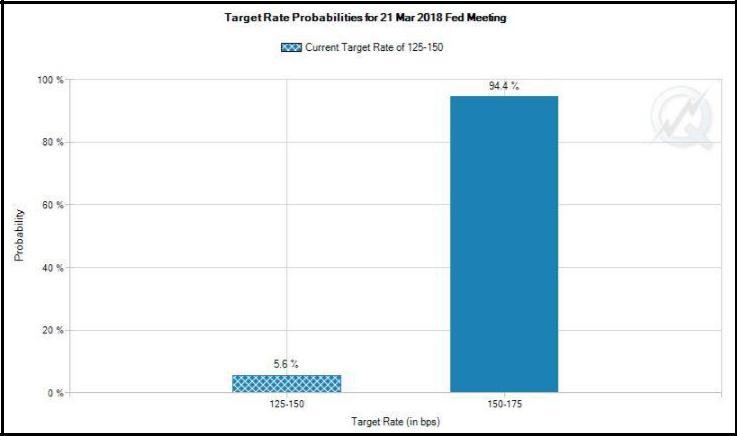

So, we can expect all eyes today to be on that stupid dot plot chart, as if they are held accountable, as if! Anyway will 2018 turn out to be 3 hikes or 4, will December be a no show? Odds are for Fed Funds to end 2018 at 2.125% so right in the middle of the 3 or 4 hike scenarios, how convenient.

There is a flipside to all this monetary printing, interest rate hiking and we’re beginning to see the creep show up in the form of higher yearly interest costs and accelerating U.S. debt levels. The U.S. debt is now over $21 trillion, and it seems like we add a trillion dollars in debt each year now. The funny, or should we say a sad thing about math is the larger the numbers get the faster they multiply and does anyone honestly think we can raise rates and stay fiscally sound?

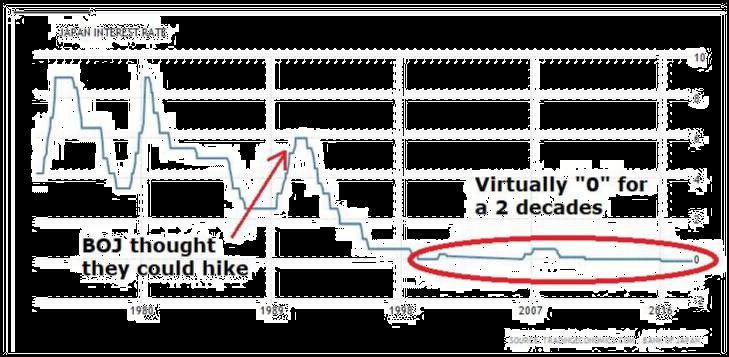

Look at Japan, That is the only proxy we need, in fact, it’s a time machine.

The Nikkei peaked on Dec. 29, 1989 closing the year at 38,916. Many analysts were calling for Nikkei 45,000. Sony bought Columbia Pictures Entertainment that year for $3.45B and Mitsubishi Estate Bought the Rockefeller Center1, all was going swimmingly.

Then reality hit the BOJ was raising rates, raising the nationwide sales tax, Emperor Hirohito passed away and as the old saying goes, “that’s all she wrote folks.”

Now you can look at that chart and say America is not like Japan, interest rates can never go to zero and stay there for two decades.

Or you can face the stark reality of mathematics and realize, you can’t issue debt indefinitely and raise interest rates, sorry they are oil and vinegar, as Japan has clearly displayed. There comes a point in time, a singularity by which there is no return and we have passed that long ago.

So, we oblige the Fed to embark on such an envious path, but as our long-time readers know, it’s time they are truly buying nothing more. Well, nothing more than private assets, private shares, private debt, well you get the picture, the Fed and the rest of the central banks aren’t just supporting the markets, they have become and are by default, “the market.”

Ok with all that tutorial out of the way, what else have we learned over the last week?

In the aftermath of Trump actions this week, the administration announced that none other than CNBC’s own Larry Kudlow would be named Trump’s top economic adviser. Our readers know our disdain for media types, but we will cut Kudlow a break here and give him a chance.

He is extremely knowledgeable and seems quite rational in his thought processes and worked as an adviser during the Reagan administration.

Some of his recent thoughts on tariffs and trade specifically highlight NAFTA and the fact that it needs to be fixed and refurbished, he also went on to say it’s in the country’s economic and national security interests to get NAFTA fixed. Kudlow is not a huge fan of tariffs and punishing our partners but will see just exactly how much Trump is ready to acquiesce on any of those deals.

Walmart (WMT) stock continues to languish, and the word was out last week that an internal whistleblower and former director of business development leaked information regarding misleading e-commerce results.

In a report from Bloomberg, information regarding the firing of Tri Huynh was tied to the director raising concerns about Walmart’s “overly aggressive push to show meteoric growth in its e-commerce business by any means possible -- even, illegitimate ones.”2

Facebook (FB) was hammered as political research firm Cambridge Analytica allegedly harvested 50 million user profiles. Seems Facebook is scapegoating saying there was an agreement in place for app developers not to sell user data, and there is no possible way they could have policed that. The alleged app in question is “This is your digital life” a kind of personality test, which allowed Cambridge to access user’s data through an affiliate firm called Global Science Research, reported the Guardian.

Zuckerberg has remained missing and silent on the situation until Wednesday night, which is not what you want from a CEO at a time like this. Given his arrogant nature, we aren’t too surprised. Anyway, now there is a growing #DeleteFacebook movement and damage control should be in order but will see how this story progresses. As for the stock it’s down around 10% from its recent high of $186 trading near $166 now.

Just to touch a bit on the bitcoin (BTCUSD) crypto space, Fox Business had some great interviews last week.

One featured Peter Thiel who is a big proponent of bitcoin and a major supporter and another video focused upon an interesting new startup called Abra. Abra, a new start up in the cryptocurrency space has built a very user-friendly app and have raised $40 million in new funding.