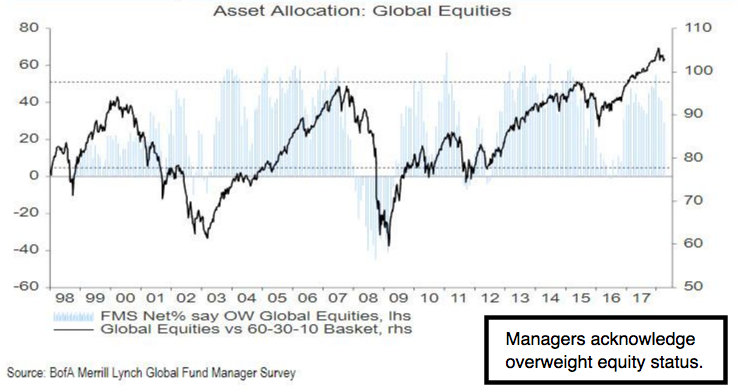

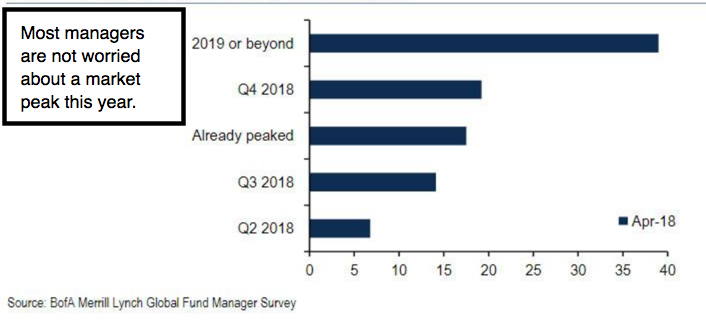

Shangri-La remains elusive as money managers generally behave in a contradictory way. To wit; they don’t envision a market top until next year, while only a few (including us) believed the cyclical peak was in January, writes Gene Inger in IngerLetter.com.

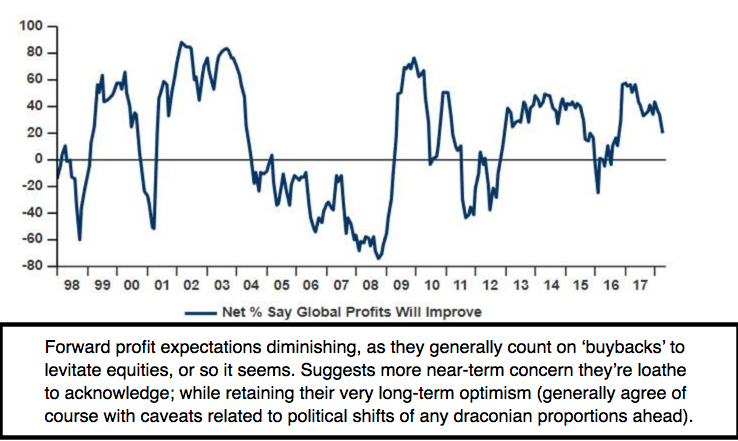

The irony is that most acknowledge inflation gaining and ignore monetary policy. Most expect a slowing in profits and earnings rates ahead and yet are mostly obvlivious to any concern for this market, barring an exogenous event risk.

I’m not at all being contrarian for the sake of it but blindsided optimism in the face not just of our forecast early February break and rebounds has a suspicious aroma to it. It is a bit reminiscent of prior processes by the markets that culminated with significant downside price behavior, if not a more dramatic breakdown in the key major indices.

Bloomberg: Stocks rise on earnings and oil as Treasuries fall Wednesday.

We are focusing a bit on new technologies Tuesday, visiting a commercial as well as space and military optical conference.

One should keep in mind that a giddy market approach after historical earnings and other reinforcing stories should make one wary, not more enthusiastic.

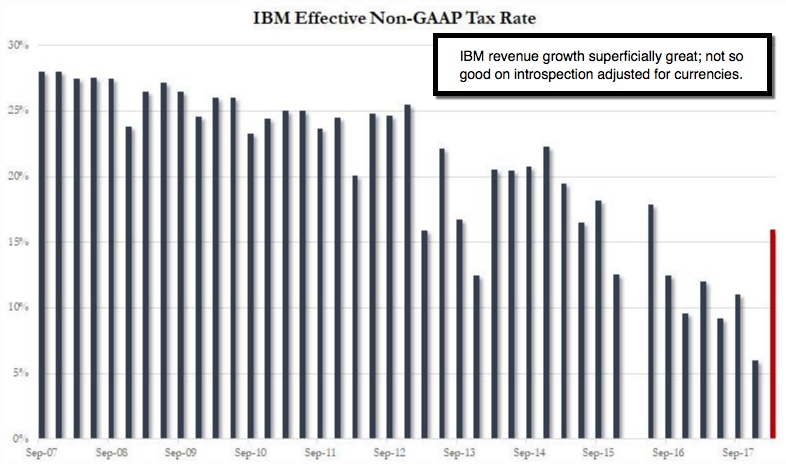

After the close Tuesday IBM (IBM) beat estimates but revenue was not higher when currency-adjustments were made. S&P 500 (SPX).

News that the key NAFTA negotiators will be meeting this week is constructive, but at least yours truly has always thought we’d be making a deal and not disbanding the overall structure.

Rejoining TPP is a prospect too. And Larry Kudlow confirming Tuesday that new sanctions on Russia won’t be immediately forthcoming could be an overture to the Russians to get more transparent and cooperate. (Or it could be a reward for their standing-down and not trying to engage us last weekend.)