With Netflix hitting new highs, and IBM going the other way, we now have a market which has something for everyone, both bulls and bears, says Jeff Greenblatt Wednesday.

The stock market is hanging tough as bulls are not giving up without a fight. Mostly the fight is coming from oil stocks and the Dow Jones Transportation Average (DJT).

There was an interesting condition Wednesday morning. Transports were leading while the Dow was lagging. From recent memory, we’ve seen sequences where it was the other way around. What does that mean? It means the Dow Jones Industrials (DJI) should catch up to the better performance of the Transports.

But it’s strange because with oil prices going up, so does the cost of transportation.

In the short term, markets enjoy higher oil prices as oil stocks recently have been on fire. We saw this in 2008 after the stock market already topped for good, the Dow rallied 12% into May 2008. At that point, oil was on its way to all time highs.

Unfortunately, there comes a point where enough is enough. Gas reached $4 per gallon for the first time and it became like a devastating tax on the economy. It got to the point where one had to burn an Alexander Hamilton just to go to the grocery store and back.

With oil and oil stocks higher, it’s a case of immediate gratification.

The Dow was lagging Wednesday as IBM (IBM) got hit hard in the aftermarket on Tuesday. That’s important because Mr. Watson has the eighth-ranked weighting in the Dow at 4.47%. Additionally, Goldman Sachs (GS) seriously lagged as well. GS has the number two ranking at 7.05%. A lot of the other Dow members were either up slightly or flat after Tuesday’s decent session.

In terms of resistance, many charts were close or right at important overhead resistance.

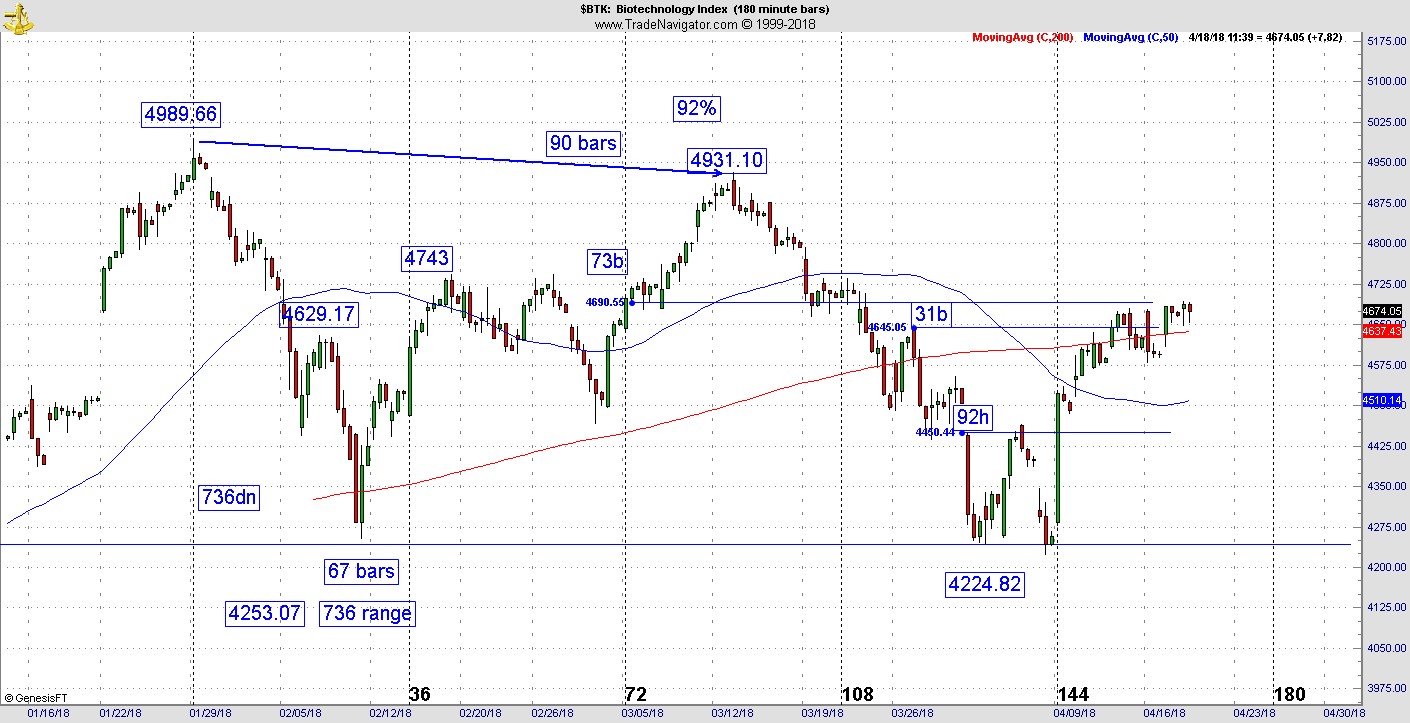

The Dow is just short of the balance bar we’ve discussed for two months. Here’s the BTK which is right at a key inflection point. The resistance zone called 31b is a cluster of balance bars relating to the 4931 high and the original range down in February of 736 points.

The zone formed as a result of 73 bars off the original top and 31 off that 4931 pivot. It doesn’t have to top here but it might. Given markets dodged a huge bullet over the weekend, the VIX is complacent again as it is testing its lowest levels in over a month.

In this instance, Netflix (NFLX) had a good earnings report, went to a new all-time high and the crowd went back to sleep.

It could be a dangerous development given the events in Syria this weekend. Am I the only one who found the timing very curious as the attack became public on a Friday night after markets were closed?

Fortunately, there was no retaliation because it became an emotionally charged situation. It’s highly unlikely markets would’ve gone back to business as usual on Sunday night if the worst fears were realized.

But by Monday, as far as markets were concerned, the stock market developed a case of amnesia. Unfortunately, oil did not, as traders likely fear a bigger conflict. Oil has violated some key technical readings to get to new highs not only for this year but the past few years. It can end up as a vicious feedback loop eventually.

Despite the fact the CBOE S&P Volatility Index (VIX) is so low again, we remain in a high-risk environment where surprises can come to the downside on any given day. At this point, the crowd is fortunate the geopolitical situation didn’t boomerang out of control over the weekend.

Subscribe to Lucas Wave International newsletter here