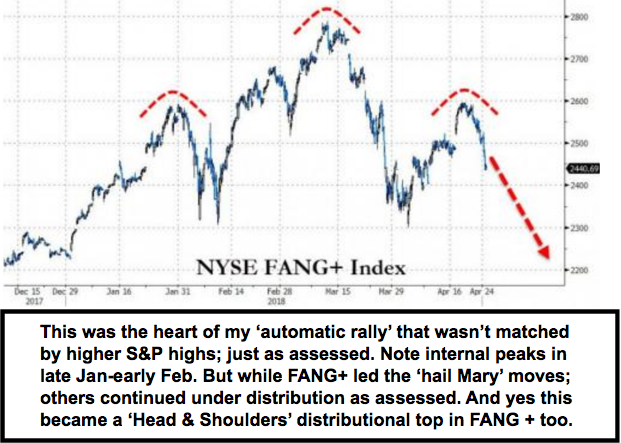

Efforts to restrain volatility were feeble in recent days, right atop what I specifically outlined. In my view, whether we bounced around for a couple days more or less, the resolution would be to the downside. That now occurred with vengeance, writes Gene Inger.

Bloomberg: stocks turn positive; optimism is hijacked by rates Wednesday.

Plus, we were critical not only of FANG+ stocks, but saw Oil fully-priced, if not for concerns over geopolitical spikes. Oil wavers Wednesday as Iran nuclear talks overshadow US inventory data.

Mostly I criticized the big firms for a slew of favorable Oil calls in the 60s, while they were bearish on Oil for a few months and even calling for absurd drops to the 30s. (Our bullish Oil view was from the 40s and consistent with our firm U.S. dollar view too.)

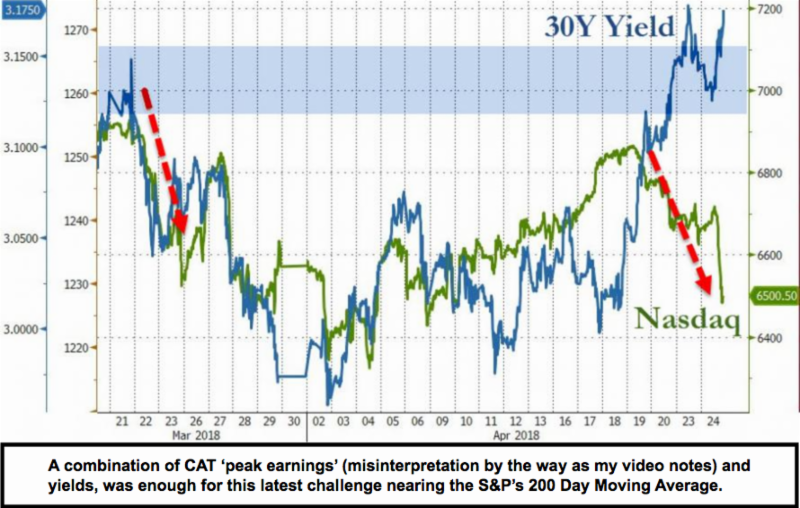

And it's a similar story with Industrials like Caterpillar (CAT) which popped and flopped notably.

CAT’s CFO talked of peak earnings for the past quarter, which freaked the entire market. Although they didn’t listen to him well as he spoke of investment levels that would limit higher relative earnings for now.

That means CapEx, which actually envisions longer-term growth. At the same time, I don’t disagree about the near-term. In fact, CAT was one of several Industrial stocks I specifically singled-out on election night in 2016 as likely to soar with an infrastructure and trade-oriented election of Trump, which promised real benefits for heavy industry in the U.S.

For sure that hasn’t changed despite opposition. But just like so many we liked back in 2016, the preceding move up was the reward for buying on a dime on that slight dip after Trump’s win. January of this year was the last best chance out of the big winners of 2017. That’s a reason why I’ve called every rally since the specifically forecast February break as rebounds within-context of late-stage distribution, and suitable in some cases for trades, but at no point for big-cap investments.

I called it Greater Fool Theory insanity chasing pricey equities, since I’d labeled January’s parabolic thrust in no uncertain terms for the S&P an unsustainable blow-off and sell-signal.

That is to say indicators like we share, whether Stochastic, MACD, RSI, Standard Deviation Envelopes (or variations called Bands), plus Oscillators, a couple wave cycles or the like have measures that suggest a move is near an end. And then that’s really not a signal, but a confirmation of what already occurred.

This matters because some sectors rolled-over rotationally last year. Others masked that by perpetuated gains until their high-water mark in January which in part had to do with delaying sales into a new tax year.

Earnings were never expected to sustain the market this month as they were fully priced-in and generally projected to be sold-into on good news. That now looks like an understatement, but not if you factor in the technical perspective that I’ve nurtured through this.

Bottomline for this big sell-off on Wall Street is that it is no surprise at all, totally expected.

Amazon (AMZN) and for sure Alphabet (GOOGL), along with Apple (AAPL) are leading markets lower too. I have specifically warned that all those were likely to see 50-point declines or more and repeatedly urged investors not to chase after-the-fact rallies that have not shown attractive entry points for such stocks in months.

So, beware obvious rebounds that may be attempted after technical breakdowns. They won't last even if rationalized by pundits hoping to revive things prematurely.