We can get some further psychological gains depending on Europe from Oil, or incidentally from Apple (AAPL). Its worldwide developer Conference started Monday, writes Gene Inger.

Daily trading action remains irresolute with an early June upward bias, which may not be sustained very far into the new trading week incidentally.

Apple’s worldwide developer conference historically focuses on SDK (for application developers an outlined of new or revised Software Development Kits). The recent trend has been to outline the next versions of both IOS (iPhone and iPad) operating systems as well as the change to OSX (Mac operating systems).

Apple's new phone software speeds up older devices: Reuters Monday.

This year speculation is that IOS 12 will tie-in closer to the next OSX, which might be named Mojave, given the names in consideration.

Reuters: Technology rally Monday helps Wall Street push higher, led by Apple, Microsoft.

**

Early-June levitation dismissed more pressure in Italy, Spanish change at the top or the various geopolitical events, preferring to focus more on the technical prospects of simply extending the market.

My view was it was to be expected at the start of the month and likely wouldn’t carry far.

I welcome a Teflon market; but believe that's what we had led by FANGs, and later by Oils, over the past year and a half.

While there may be further upside (in the face of mixed global data but progress towards Asian peace on the Korean peninsula), gains should not come easily and this is frothy.

While I continue to prefer U.S. stocks (in general) to Emerging Markets (for sure that’s been a good view, including optimism on the dollar versus the majority looking for big weakness), it’s all so long-in-the-tooth to remain on the wary side of those complacently looking for an upward Summer glide. S&P 500 (SPX).

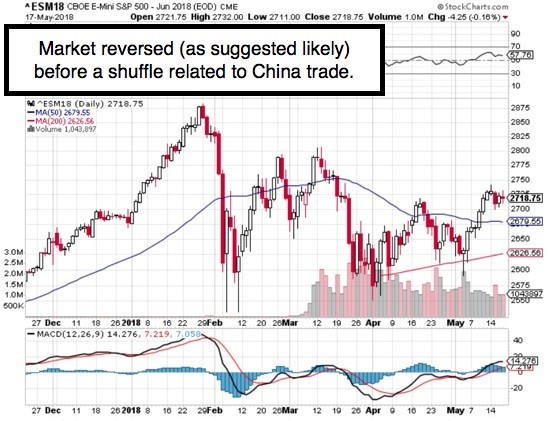

That doesn’t mean we’re on the verge of a dramatic slide instead, because you have so much cushion about the 50-day and of course 200-day moving averages in both cases. Those moving averages will eventually merely confirm any new up-down reversal after-the-fact, whereas a new parabola in what very quickly becomes a new overbought daily basis condition, would be clearer as a potential sell signal (and I hate the word signal) such as January was of course.

Bottom-line: The market continues trading in a ranging pattern with slight efforts now to break-out to the upside after many recent faltering attempts that briefly rolled-over back into declining or consolidation phases.

Hence, you've had no real resolution to the overall pattern for quite some time.

Recorded at MoneyShow Las Vegas May 14, 2018

Duration: 4:10.