State of the market—Trade war fears knock down foreign equity ETFs and boost the U.S. dollar. Our models remain on a Hold, suggesting profitable market conditions but with potentially significant market volatility, writes Dr. Marvin Appel Wednesday.

U.S. equities continue to weather potentially bad news. For example, on June 19 the president announced tariffs on $200 billion of imports from China. This amount of merchandise is roughly 60% of the amount of our annual trade deficit with China and is more than the value of our total exports there.

The S&P 500 (SPX) looked at the open to be in for a decline of more than 1%, but by the close that loss shrank to just 0.4%. The Russell 2000 Index (RUT) was basically flat (as small-caps are expected to be less affected by trade tensions).

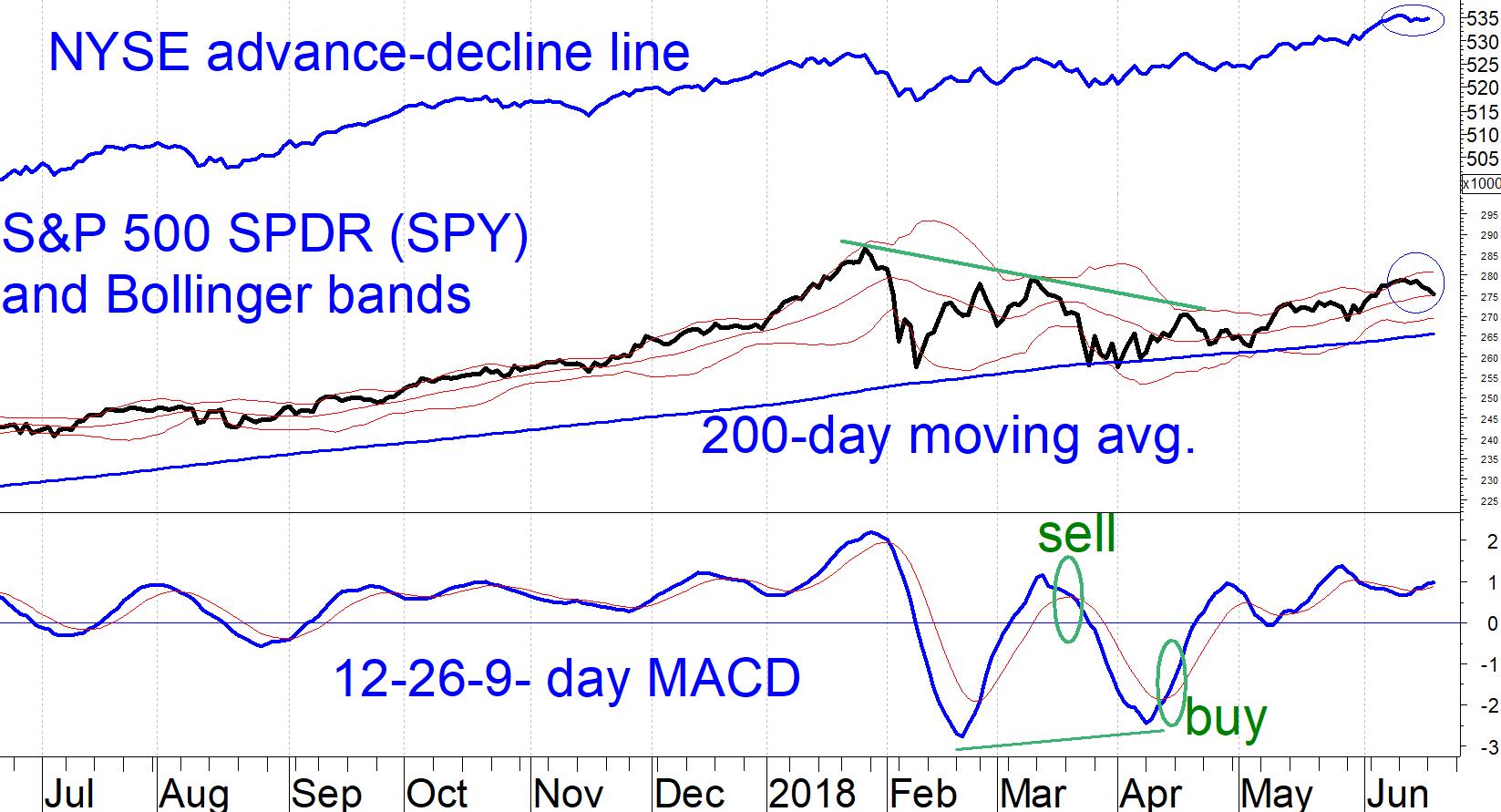

The chart below shows that the NYSE advance-decline line remains very close to its all-time high even though the S&P 500 SPDR (SPY) pulled back from its upper to middle Bollinger band. MACD could form a negative divergence.

Nonetheless, risk to the S&P 500 remains modest, with support at 269 (lower Bollinger band) and 265 (200-day moving average).

John Bollinger: How to use Bollinger Bands (video).

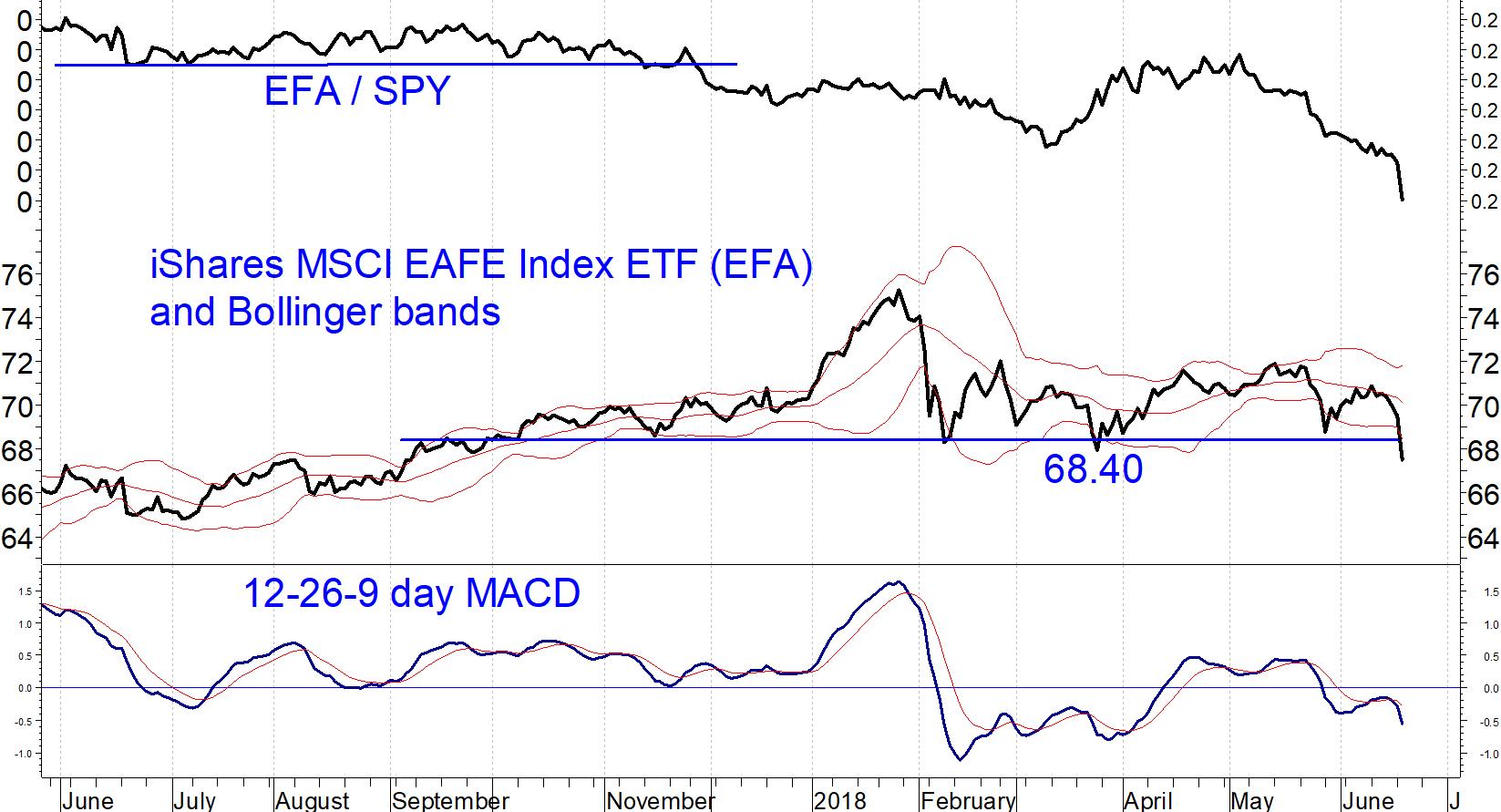

Foreign stocks are another story. Important technical breakdowns occurred in ETFs tracking the MSCI EAFE, the iShares MSCI EAFE Index Fund (EFA), mostly Europe and Japan and Emerging Markets Indexes, iShares MSCI Emerging Markets Index (EEM).

Recently I opined that EEM would enjoy support at 45.30. That level was broken Wednesday. Both the relative strength of EEM vs. SPY and the MACD of EEM made 18-month lows.

The positive divergence between EEM and its MACD that occurred in May turned out to be a false signal and is now negated with the new lows in price and MACD. (See chart below.) If you took the recommended covered call trade, time to cut losses.

EFA fell to a more than nine-month low, violating the 68.40 support level. Its MACD made a two-month low. But most impressively, the relative strength of EFA vs. SPY is at an all-time low (counting from the inception of EFA in 2001—see chart below).

I had expected a multi-year period in which foreign equities would outperform the U.S., but that turns out to have been premature. On top of everything else facing Europe (trade wars, electoral upheaval), the ECB has started tip-toeing to the exit, announcing its intention to phase out quantitative easing by the end of this year and to begin raising its negative interest rate target in mid-2019.

Even though the recent rally in the U.S. dollar may be due for a pause, you should remain skeptical about holding foreign equity ETFs. Stay domestic and broadly diversified. —Marvin Appel

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.

Watch Dr. Marvin Appel share ideas on MACD during interviews at TradersExpo New York:

I find a weekly MACD is most effective for bonds.

Duration: 3:41

Recorded: Feb. 25, 2018.

Duration: 2:57

Recorded: Feb. 25, 2018.