We remain in an uptrend and those who trade it cautiously will make money, until things change. I am staying long but I continue to trade small lots of stocks that are working, and I continue to hedge my bets, writes Dr. Joe Duarte Sunday night.

Skynet: A self-aware fictional and widely connected neural internet based conscious group mind and artificial general intelligence system featured in the Terminator franchise of movies.

As far as I can tell cyborgs are not walking the land, yet. However, their distant cousins, Wall Street’s robot trading algorithm army is busier than a bee hive on a honey high these days. Indeed, the bots are making the most of their cyberspace opportunities by driving stock prices higher on a regular basis and creating what seems to be a new reality – one in which the real world doesn’t seem to have any lasting effect on what happens to the major indexes.

Sure, as we saw early last week headlines about the “trade war with China” will move the market for a few hours. And with Trump calling the EU names and meeting with Putin this week, more volatility is possible.

But if the recent past is any guide to the future, as soon as the news cycle turns it will be time to buy the dip in stock prices yet again. Of course, this can’t go on forever, but so far, the pattern has remained very reliable and it would be foolish to act without proof that it’s about to reverse.

Breadth remains near highs as indexes break out

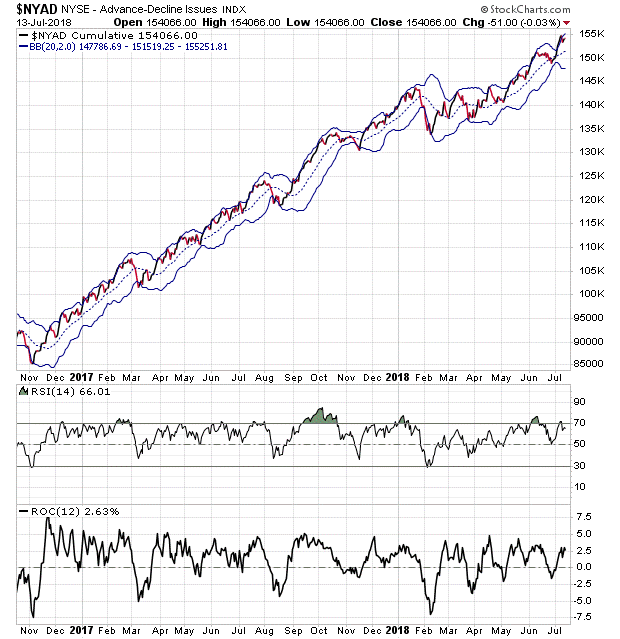

In what has become the norm the New York Stock Exchange Advance Decline line (NYAD) remains within striking distance of yet another new high. This indicator remains the most accurate predictor of the market’s trend since the election of Donald Trump and it continues to signal that higher prices for stocks are well within reasonable to expect in the near and intermediate term.

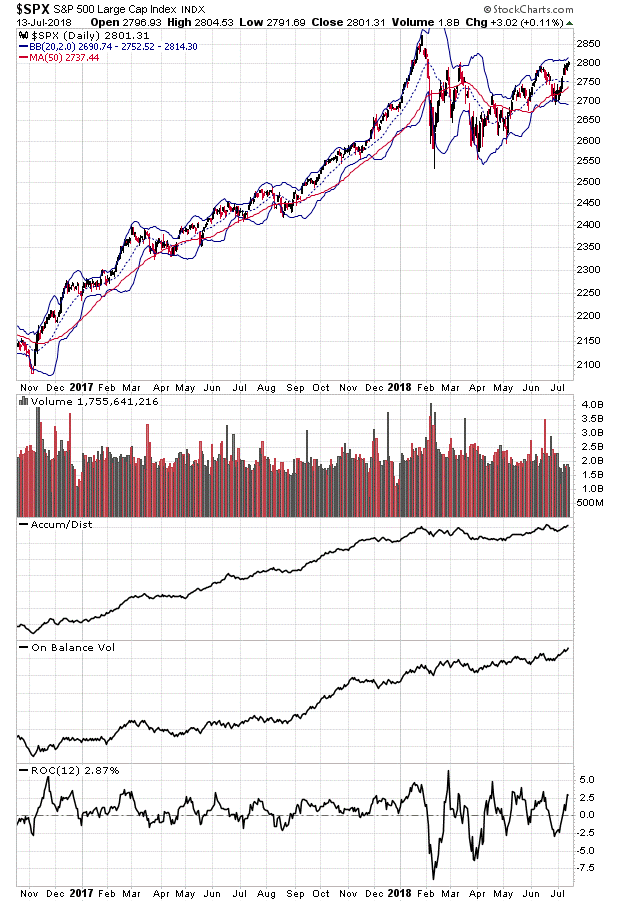

More important, both the Nasdaq 100 (NDX) and the S&P 500 (SPX) indexes both broke out of their recent trading range with NDX making a new high, a confirmation of the new high in NYAD last week.

Volume remains a sticking point, as it has for some time.

First, volume was fairly low most of last week, which may be related to the traditional summer trading pattern. But even with low volume both the Accumulation Distribution (ADI) and the On Balance Volume (OBV) indicators for the indexes moved nicely higher.

This suggests that even though there is less activity in the market, at least more money continues to move into stocks than that which is moving out. So regardless of what happens tomorrow, the net effect of this ongoing dynamic is the same whether volume is high or low; higher stock prices.

Uncharted waters and ignored warnings

The real question is whether any of the things that triggered major market massacres in the past will matter over the next six to twelve months. It’s clearly a different world we live in. And those of us who thought we knew some stuff are standing by, owning stocks, and praying that the market doesn’t go to zero tomorrow.

I don’t mean to sound old fashioned. But in the old days what now are considered useless facts are still worth noting. Consider these lessons of history that seem to be repeating themselves and are being ignored:

1) The Fed raising interest rates is bad for stocks.

2) Inflation is a thief.

3) Stagnant incomes and economic growth are mutually exclusive.

4) Easy credit eventually runs out.

5) The Great Depression was triggered by the combination of higher interest rates the Smoot-Hawley tariff.

Frankly, I haven’t given up on history. I know what’s happened before can happen again. But I don’t see it happening right now and I don’t see anybody who’s been crying about this stuff rolling in the dough. So, I stay invested in stocks because that’s what’s working, albeit without my heart being in it.

Moreover, even though dwelling on the past doesn’t currently seem to help my portfolio, it does keep me alert. Therefore, I trade the technical momentum wave and wait to see what happens next as the robots ignore what’s happening in the concrete jungles, the board rooms, and the halls of global politics for more than a day and hope that when the brown stuff finally hits the fan, I can get out before they do.

As I’ve said seemingly a million times since the post-election bull market cranked up.

Perhaps the scariest of thoughts is what may happen if and when the Wall Street robots, like their fictional cousin Skynet, become self-aware or just wake up and look around.

Joe Duarte is an active trader and author of Trading Options for Dummies, now in its third edition and The Everything Investing in your 20s and 30s. To receive Joe’s exclusive stock, option, and ETF recommendations, including trade results, visit www.joeduarteinthemoneyoptions.com.