A global correctionhas been rolling across markets for months, part of why funds had flowed into U.S. markets, where it was easy just to buy ETFs and indexes, to play the currency advantage too, as so many Emerging Markets turned submerging, writes Gene Inger.

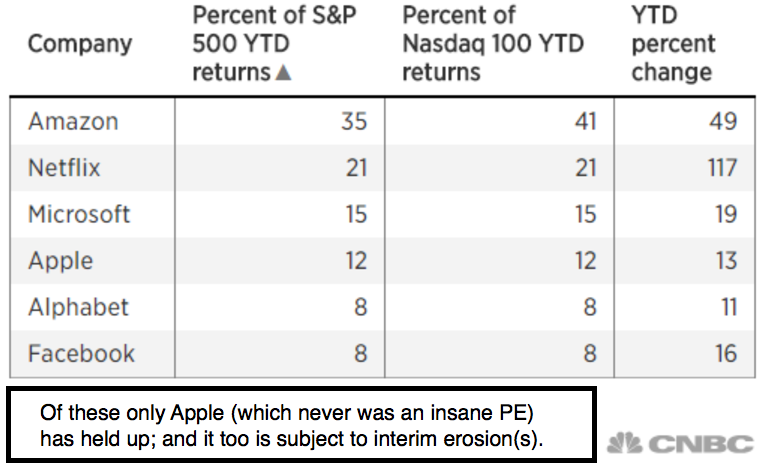

That was foresight (believing in rotational corrections rather than crashes); while also emphasizing that the concentration of capital in FANG-type high velocity, overpriced and absurdly valued stocks would mask some of the distribution that was ongoing for months. It inevitably would not sustain past another key time technically and seasonally.

Reuters: Wall Street rebounds Tuesday, led by industrials, tech.

That was a call for a September S&P (SPX) resistance zone of 2810-20, with notably a call for the Google (GOOGL) earnings just a week ago to result in an unsustainable pop-and-flop, as the high-end of that 2810-20 range would briefly give way but primarily to short-covering.

TheStreet.com: Apple shares rise on quarterly earnings beat here

Because nobody in their right mind would of course be buying such stocks (any of the FAANGs) on technical breakouts, in already overbought territory technically.

It was also the time-frame I have-kidding referred to as the Mom’s Birthday rally, which sure is something I’ve noted in years past; but in this case well correlated with my projection of an Index peak by early-to-mid July. Got it.

All this matters because the foreign fund flows may be drying up; the game was too long in the tooth. The pundits are already out there saying, don’t panic, which is ironic as what you’re seeing isn’t panic, I should add not yet. That comes when and if the trap door is swung open.

In-sum: therein lies the main risk to the big picture. While some stocks like an AT&T (T) corrected (arbitrage and absurd downgrades on the merger took it down to our ideal 29-31 buy zone all the way from 38-40) and benefited as well from not just the dividend floor (latest payout is tomorrow) but also a low multiple relative to Warner Media being accretive to earnings within a year, in fact this year. I wondered if (and suggested) the schmoes were selling and pros buying.

At this point T has now been upgraded by Merrill Lynch to a buy today; in a review that acknowledges they probably underestimated the symmetry a combined Warner and AT&T could deliver, in a stable business with fairly low risk.

They also concur that the Justice Department efforts to stay the deal for the most part are likely headline grabbing so actually will come to naught. None of us know for sure; but that’s the most likely outcome.

Now the more exciting part of this was the idea of selling Netflix (NFLX) at 405+ to buy AT&T (T) around 30 +/1. Worked out, even though I really was making a bigger point too: selling or scaling-out of excess and buying with a low risk profile, even if the hot money trend-chasing crowd didn’t like it.

Of course, AT&T is not a serious momentum stock (yet anyway), but with a potential we think of $10-$20 upside over two years and that dividend, it seems well-suited to a market that is in dire need of serious adjustment.