In part 1 of our commentary we covered a great deal of critical fundamental developments, which are bearishly impacting French equities and the US-listed ETF, iShares MSCI France ETF (EWQ), writes Landon Whaley Friday. He's presenting at MoneyShow SF August 24-25.

In part 1 we discussed the current Fundamental Gravity of our Draghi’s Dilemma macro theme. If you missed part 1, I would encourage you to read through that first, before jumping into part 2 here.

Quantitative Gravity Says What?

As a quick reminder, the Quantitative Gravity component of our Gravitational Framework is not technical analysis, which is ineffective and misleading. Rather, we use quantitative measures based on the reality that financial markets are a nonlinear, chaotic system.

We’ve identified four primary quantitative dimensions of financial markets that affect price movement: energy (trend), force (momentum), rate of force (buying pressure), and a market’s irregularity (level of imminent drawdown risk).

Social is our measure of a market’s current energy (or trend). EWQ’s Social reading indicates it is asleep, which is neutral. For the uninitiated, when a market is asleep, we need to wait and see whether it wakes up partying or in a hangover. Given the current Fundamental Gravity, we think it will be the latter.

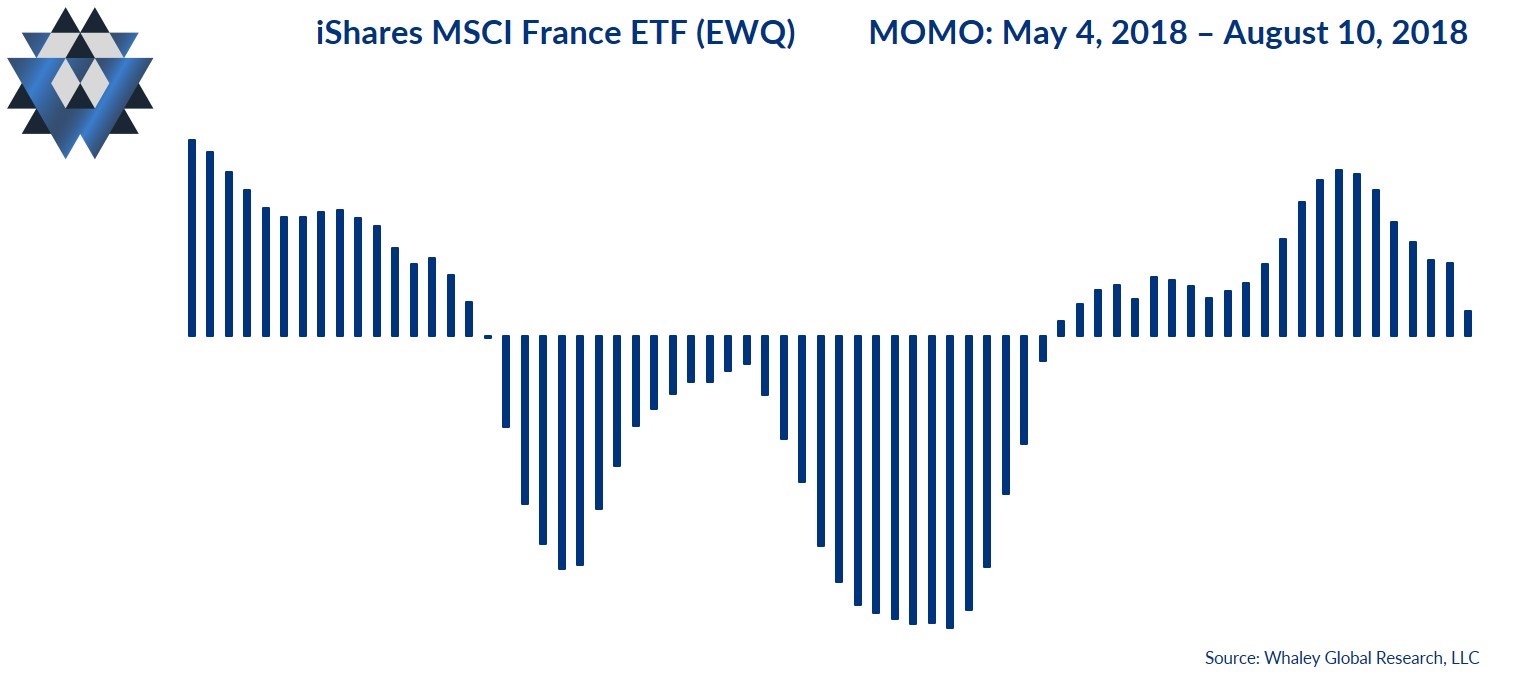

Momo is our measure of the amount of force behind the market’s current state. EWQ’s Momo has been bearish most of the year but is currently flashing a neutral reading. Despite the neutral reading, Momo has declined for the last five trading days, which at the margin is bearish for EWQ.

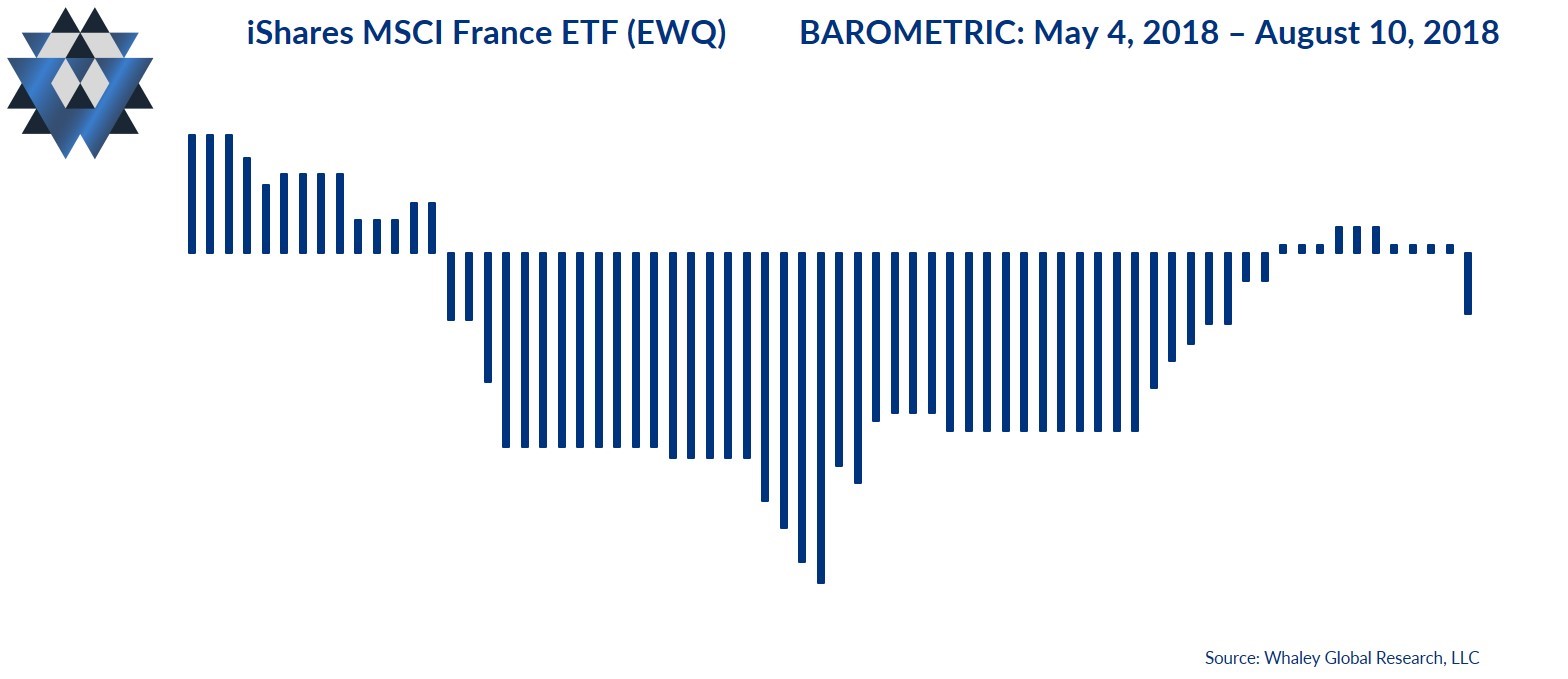

Barometric is our measure of the rate of force behind the current Momo. EWQ’s Barometric indicates a fair fight between bulls and bears. Only time will tell who ultimately gets the upper hand in this market. Here again, sellers have been in control most of the year, and we think they’ll reassert their dominance in the weeks ahead.

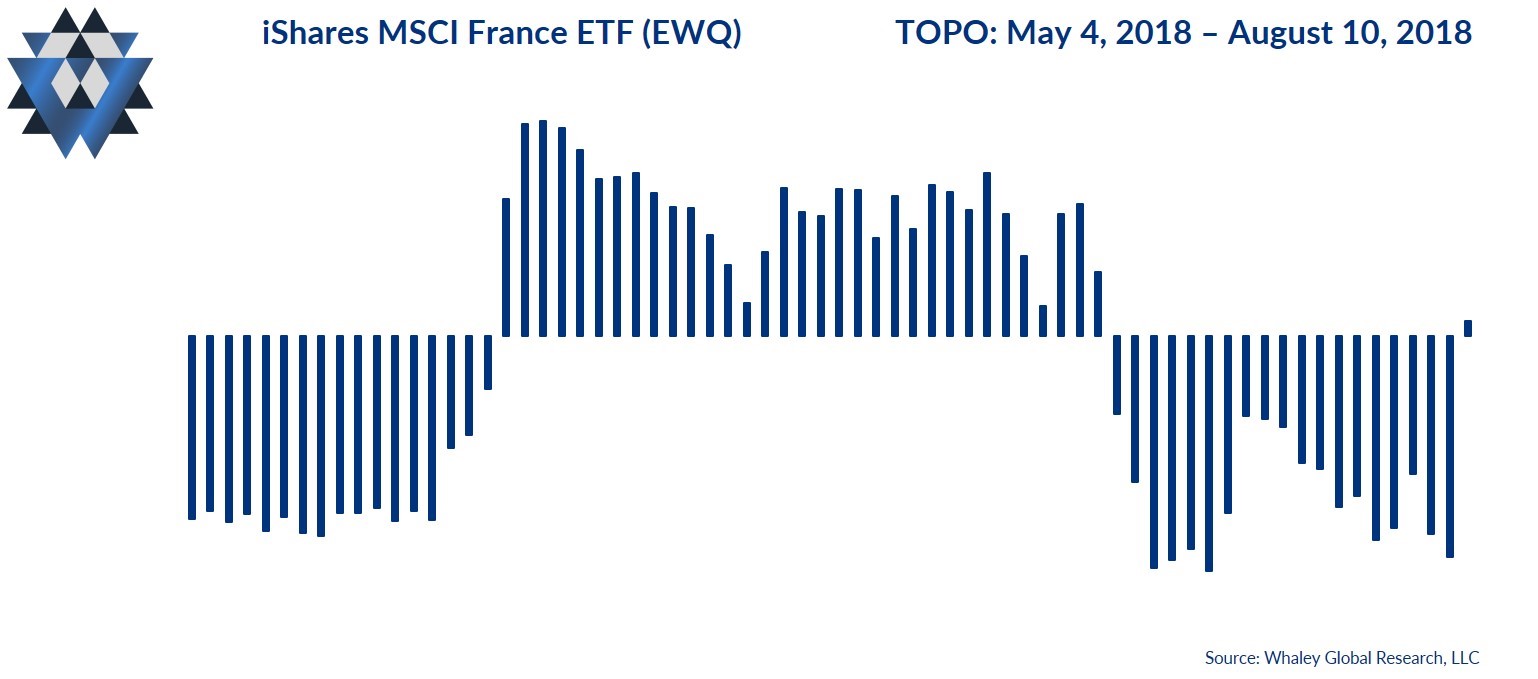

Topo, which measures the probability of a drawdown, is indicating that a rising drawdown risk for EWQ over the next 10 trading days.

Most investors are hyper-focused on price action. Unfortunately, price is nothing more than the current point where there are equal parts of disagreement on value and agreement on price. If you’re new to our Quantitative Gravity framework, it’s important to note that the four quantitative dimensions of a market that we monitor typically move ahead of price.

In other words, price is the last aspect of a financial market to move, quantitatively speaking.

The Quantitative Gravity bottom line is that EWQ is currently flashing mostly neutral signals. We will wait until the QG turns decisively bearish and can see the price we want before initiating a short trade in this market.

Behavioral Gravity says what?

Behavioral Gravity allows us to evaluate investors’ perception of this market and how that perception changes and shifts over time.

So far this year, investors have added $242MM to the iShares MSCI France ETF (EWQ). This amount represents 25% of EWQ’s current asset base of $952MM! What’s more, a significant proportion of this inflow has come in the last few months against a backdrop of EWQ rallying from $30.00 to $31.50 area. Humanness says what?

The Behavioral Gravity bottom line is that despite decisively bearish Fundamental Gravity, investors continue to plow money into this market at a ridiculous pace. This behavior is humanness on display, doing exactly the wrong thing at exactly the wrong time.

The Trade Idea

As long as EWQ trades below $31.75, new short trade ideas can be initiated opportunistically on rallies. Depending on your entry and how much room you want to give this trade idea to move, use a risk price between $31.27 and $31.75. That said, your risk price line in the sand is $31.75. If EWQ closes below that price, exit any open trades. If the trade moves in your favor and EWQ trades up to the $30.12 to $29.72 area, consider closing some, or all, of your position.

In addition to providing detailed analysis and trade ideas like this commentary on a weekly basis, we also provide real-time email alerts whenever we add, or close, a position in our Asset Allocation model inside our Gravitational Edge report. We are currently out of EWQ in our Asset Allocation Model and will send out an alert if we get the right entry price that skews the reward-to-risk characteristics of the trade in our favor.

Please email us at ClientServices@WhaleyGlobalResearch.com if you’d like to participate in a an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.