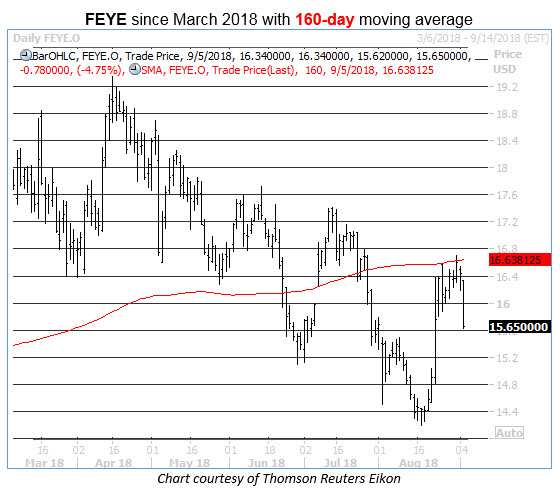

It’s been rough sledding for cybersecurity stock FireEye (FEYE) in 2018. Since the equity peaked north of $19 on an intraday basis in mid-April, FEYE has declined steadily, creating a series of lower highs along the way, writes Elizabeth Harrow Wednesday.

The stock’s mid-August low was contained precisely at the site of its year-to-date breakeven point of $14.20, and the shares moved higher from there -- with an additional boost coming from the Aug. 23 announcement that FireEye had been engaged by Google to provide intelligence regarding an Iranian operation linked to YouTube.

However, FEYE’s rally off that nadir of a few weeks ago may have created an entry point for opportunistic bears to bet on the stock’s next leg lower, if history is any guide. That’s because, according to data from Schaeffer’s Senior Quantitative Analyst Rocky White, the security’s previous tests of resistance at its 160-day moving average have been resoundingly unsuccessful.

Looking back at the past three years of data, there have been five prior occasions where FEYE has bounced up to trade within one standard deviation of its 160-day moving average after having spent the majority of its time below this trendline over the preceding two months.

Following those five previous signals, the stock was trading lower one month later 100% of the time, with the average return over this time frame amounting to a loss of 6.94%. At FEYE’s current price of $15.65, another rejection of this magnitude would put the shares right around $14.56 by this time next month.

Short sellers certainly appear to be betting on more downside for FEYE in the weeks ahead. Short interest on the stock rose by 16.5% in the past two reporting periods, and now totals 10.5% of the security’s float. Going forward, a continuation of this shorting activity could provide a stiff headwind for FEYE, potentially accelerating its pullback from that overhead 160-day resistance.

Downgrades could also be forthcoming. Despite the lackluster price action, FEYE still boasts 11 Buy or better ratings from brokerage firms, which leaves plenty of room for downward revisions. Any negative notes from this group could spark fresh selling pressure.

Price-target cuts could also come into play, as the average 12-month price target of $19.05 stands north of the equity’s 2018 daily closing high.

Meanwhile, now is an ideal time to bet on short-term FEYE losses via the stock’s put options. Schaeffer’s Volatility Index (SVI) -- a measure of front-month at-the-money implied volatility -- checks in at 37%, which registers in the low 12th percentile of its annual range.

In other words, front-month FEYE options have priced in lower volatility expectations only 12% of the time over the past year, creating an attractive environment for prospective option premium buyers.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here