Tesla competition in the emerging self-driving vehicle market is mounting as existing auto manufacturers such as General Motors and upstart rivals including Google-funded Waymo are advancing to launch commercial ride-hailing services, writes Paul Dykewicz Wednesday.

Tesla Inc. (TSLA) is grabbing headlines partly due to its high-profile founder and CEO Elon Musk and his news-making tweets, but investors should not expect any of the rival companies to become a near-term self-driving vehicle Goliath in light of the practical challenges that Waymo and others have incurred.

Waymo had intended to launch commercial ride-hailing services later this year but those efforts are not progressing smoothly, since its autonomous vehicle testing in Phoenix is showing excess caution in the view of some human drivers there.

Waymo has driven more than 9 million miles on public roads in 25 U.S. cities and 9 billion miles in simulation since it began in 2009, so it shows the long-term nature required of any company that seeks to enter that fledgling but highly competitive field. Plus, Waymo’s self-driving Chrysler Pacific hybrid minivan prototypes recently have incurred problems crossing a T-intersection near its Phoenix-area headquarters, indicating that commercial self-driving ride-hailing services still face huge hurdles.

A recent count is that 19 companies already have committed substantial time and investment to launch service. The self-driving vehicle competition is fierce with Tesla, Uber and Apple Inc. (AAPL) omitted from a list of the current top 10 entrants compiled by Navigant Research.

Tesla competition for self-driving vehicles starts with GM and Waymo

Many of the self-driving vehicle companies have progressed from research and development to production engineering.

Navigant Research ranks the top 10 right now as General Motors, Waymo, Daimler-Bosch, Ford Motor Co. (F), Volkswagen Group, BMW-Intel-FCA, Aptiv, Renault-Nissan Alliance, Volvo-Autoliv-Ericsson-Zenuity and PSA.

Paul Dykewicz: Trading Idea: Tesla's valuations & what traders, investors should know.

The 10 criteria used by Navigant Research in its rankings are: vision; go-to market strategy; partners; production strategy; technology; sales, marketing and distribution; product capability; product quality and reliability; product portfolio and staying power.

Navigant Research’s proprietary Leaderboard methodology profiled, rated and ranked market entrants with a goal of providing an objective assessment of their relative strengths and weaknesses in the development and deployment of automated driving technology.

“Innovations in vehicle electrification, automated driving technologies and the emergence of shared mobility services are disrupting all segments of the automotive sector,” according to Navigant Research.

Tesla competition focuses on self-driving vehicle safety

General Motors aims to begin commercial ride-hailing service with its all-electric self-driving cars in 2019 by integrating the software expertise of Silicon Valley with the systems safety and manufacturing expertise of Detroit and its teams around the world. GM management envisions such vehicles eliminating human driver error, which the auto company reports is the primary cause of 94 percent of crashes.

GM’s self-driving vehicles are designed and tested to improve safety and to reduce accident-related injuries and deaths, company officials said.

Waymo was the first autonomous car company to issue a public safety report to the federal government outlining its technology's features. However, General Motors also has produced a 2018 public safety report as it seeks to maintain its industry leadership position in the development of commercial self-driving vehicles.

Self-driving vehicles understandably tend to attract heightened publicity when they are involved in any accidents on public roads, but experts expect improved public safety once they are found ready for widespread use.

Tesla competition motors ahead toward commercial ride-hailing services

Toyota Motor Corp. (TM) announced on Aug. 17 that it will invest $500 million in Uber Technologies Inc. to work jointly to develop self-driving cars. The companies, which did not make the Navigant Research top 10 list, are seeking to keep up in the competition to offer autonomous vehicles.

Auto manufacturing giant Toyota and Uber, the biggest current ride-hailing service, are viewed as laggards in developing self-driving cars. The partnership gives Uber new hope in the autonomous driving market after one of its self-driving Uber SUVs killed a pedestrian in Tempe, Arizona, last March. After the accident, the ride-hailing company took its robot cars off public roads, laid off hundreds of test drivers and closed its autonomous testing hub in Arizona.

One advantage that the Toyota-Uber self-driving vehicle partnership will have over Tesla, in particular, is a minivan as part of its prospective ride-hailing fleet, said Hilary Kramer, a seasoned Wall Street professional who recently recommended the sale of Ford to subscribers of her Turbo Trader and Inner Circle advisory services.

Toyota’s Sienna minivan will be able to accommodate more passengers at once and have better scale for ride-sharing than what Tesla could offer with its current models that are all cars, she added.

Tesla competition looks daunting in the self-driving vehicle market

Tesla also lacks a partner to handle the autonomous part and the electric car manufacturer “desperately needs cash,” Kramer told me.

This is still early in the self-driving ride-hailing competition, Kramer said. It is hard to say which companies will become the winners and whether the market will be much bigger than what major ride-hailing services Uber and Lyft have today with annual revenues of $7.4 billion and $2.2 billion, respectively, she added.

Hilary Kramer: 5 Defensive stocks to weather a future correction.

Dr. Mark Skousen’s Forecasts & Strategies investment advisory service earned a 64.1 percent return in Ford between December 2009 and January 2011 when the auto company struggled, but he is not investing directly in Tesla or any auto company right now.

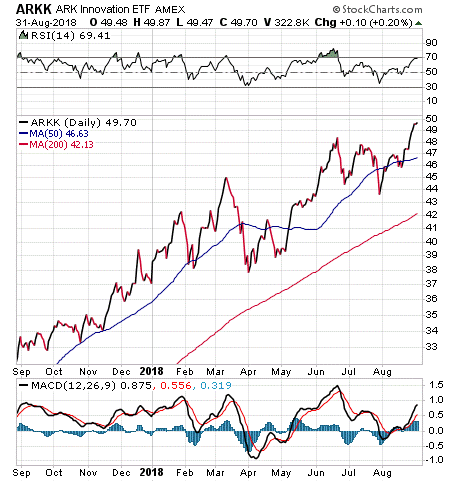

However, Skousen is recommending ARK Innovation (ARKK), which recently hit an all-time high and has soared 34 percent so far this year. He advised his Forecasts & Strategies subscribers to buy the fund on December 18, 2017, and Tesla is ARKK’s top holding.

Skousen called ARKK “one of the most successful ETFs in history,” with more than $6.6 billion assets under management. Three of Ark’s funds are among the ETF leaders ranked by Investor’s Business Daily.

Chart Courtesy of stockcharts.com

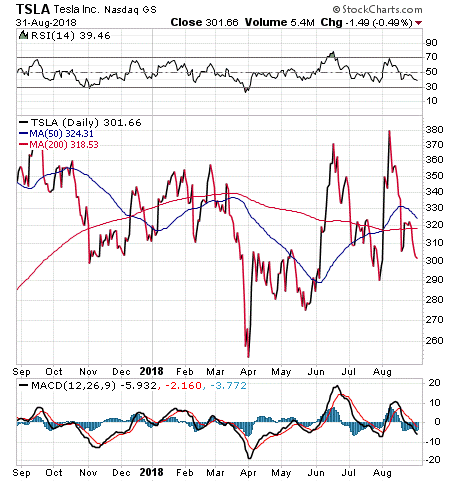

ARKK has proven to be a better investment this year than Tesla, which has taken investors on a wild ride that basically has left the stock price roughly where it was at the start of the year.

Chart Courtesy of stockcharts.com

Tesla competition chases Mobility-as-a-Service opportunities

Catherine Wood, chief executive officer of ARK Invest, said she ultimately expects Tesla to produce big profits from Mobility-as-a-Service (MaaS), a business that could “enjoy 80 percent gross margins.” That profitability forecast is based only on cars and certain autonomous taxi networks, not from trucks, drones, utility scale energy storage or the MaaS opportunity in China, she added.

Wood, who also heads the technology-focused mutual fund company, ARK Investment Management LLC, said her prediction includes the possibility that the traditional automotive industry may be “subsumed” by Mobility-as-a-Service platforms that could become one of the most valuable public investment opportunities.

Google, the financial backer of Waymo through its holding company, Alphabet Inc. (GOOG), seems to be erring on the side of caution, with plans for a remote operator network to assist confused autonomous cars, ARK Invest reported.

ARK estimates that a remote network will cost roughly 5 cents per mile, accounting for nearly 15% of the 35 cents per mile that consumers will pay on average to ride in an autonomous car. If remote vehicle operators help autonomous vehicles avoid problems, customers may tolerate slower rides in exchange not only for reduced travel expenses but also for more convenience, comfort and leisure time.

Tesla competition in autonomous vehicles is stiff and intensifying as prospective market entrants form partnerships to combine strengths and compensate for weaknesses.

Tesla needs to focus first on producing enough of its Model 3 electric cars aimed at the mass market to achieve its goal of becoming cash flow positive in the second half of this year and then look for its best options to have a viable future with self-driving vehicles.

Subscribe to Paul Dykewicz' Stock Investor Insights here…

Watch Mark Skousen: Five stocks that could be the next trillion dollar companies here.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 46:04.