Shares of San Diego-based Kratos Defense & Security Solutions (KTOS) had a rocky start to 2018. They’ve been blazing a path higher since about halfway through the second quarter. The stock is now up about 37% on a year-to-date basis, writes Elizabeth Harrow Wednesday.

That is more than doubling the percentage gain racked up by the broader Nasdaq Composite since the start of 2018.

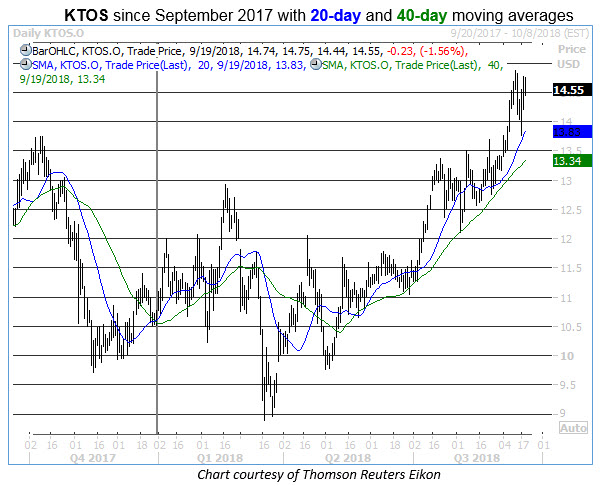

The equity’s rise has been underlined by support at its rising 20-day and 40-day moving averages, which have propelled KTOS consistently higher since mid-May. After the stock set a fresh eight-year high of $14.87 on Sept. 12, the ensuing pullback was successfully contained by the 20-day moving average, which is currently resting near the site of the shares' October 2017 highs.

The company is involved with unmanned defense systems, satellite communications, cybersecurity/warfare, microwave electronics, missile defense, training and combat systems.

With KTOS ending Tuesday’s session just fractions of a point from its newly set multi-year high, it's interesting to note that call options on the stock are still cheaply priced, from a volatility standpoint.

Schaeffer’s Volatility Index (SVI) of 38% arrives in the 13th percentile of its annual range, which means that short-term, near-the-money options on KTOS have priced in lower volatility expectations only 13% of the time in the past year.

According to Schaeffer’s Senior Quantitative Analyst Rocky White, this combination of a near-annual high stock price and near-annual low implied volatility could have bullish implications for KTOS. Since 2008, there have been just three prior instances where the equity has traded within 2% of its 52-week high at the same time its SVI has ranked in the 20th annual percentile or lower. Following the three previous signals, the stock collected an average return of +6.93% for the period, with two of those three returns positive.

With the shares at $14.55 as of this writing, another “average” post-signal bounce from here would put KTOS at $15.56 one month from now -- a forecast that represents yet another new multi-year peak.

While it’s an admittedly small sample size to draw from, the sentiment backdrop right now certainly supports additional upside for KTOS. Short interest on the uptrending defense name represents a formidable 15.5% of float, or 15.2 times its average daily volume. That means a short-squeeze rally could potentially take more than three weeks to fully play out.

Meanwhile, options players are heavily skewed toward puts over calls.

Schaeffer’s put/call open interest ratio (SOIR) stands at 2.22, with bearishly oriented options more than doubling their bullish counterparts among contracts set to expire within three months. With technical support firmly in place, an unwinding of this heavy-handed pessimism could provide tailwinds.

Plus, KTOS isn’t expected to report earnings until the final week of October or early November. That gives traders plenty of time to capitalize on this “high stock price/low volatility” buy signal before event risk and options premiums begin to ramp up ahead of the event.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here