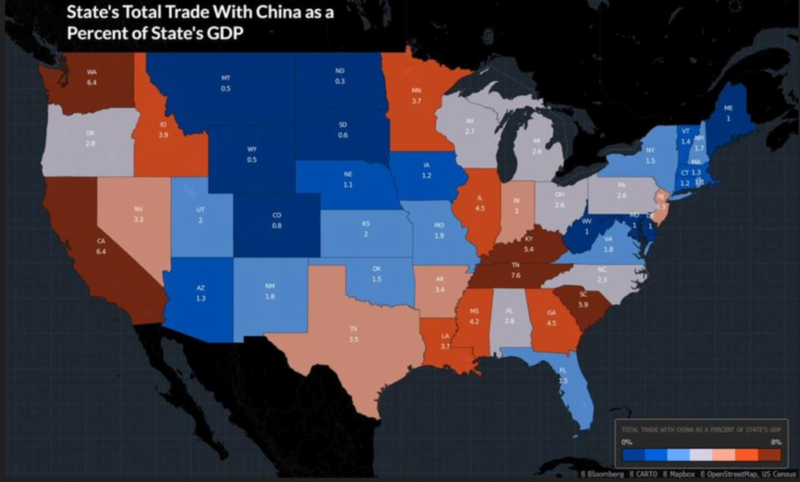

All that need be said trade is that if China retaliates and Trump doubles-down in respect to new tariff implementation, the market won’t like it, says Gene Inger.

For us, our purpose is not to debate the merits of pressing China. Or whether or not there is legitimacy in their stance, or whether or not disputes related to IP (intellectual property) should continue to just be sorted legally or not. Our purpose is to assess the probable response of the U.S. stock market. And in that regard, we have already said failure would not be good. Hence the trigger catalyst for a decline.

And we have said should the parties to all of this make some sort of deal, then any relief rally will be sharp but not sustainable. I suspect holding the promise of negotiations as some sort of market savior is a hook for now, since all it would do is get us a rebound ahead of (macro) midterm risks.

I still ponder whether this market has any chance to advance meaningfully for a protracted additional leg higher, unless we get not just a trade deal of course, but through the November midterms without earthshaking shifts.

**

Wednesday is Yom Kippur with many observers away for the session or in limited attendance. This makes trading thin and may set-up a dull day but a thin day can be sensitive to news developments, should any occur.

Reuters: Banks lift S&P, Dow Wednesday. Nasdaq weighed by Microsoft.

Tuesday, daily action was erratic throughout the pre-Yom-Kippur session, even as the Dow Industrials (DJI) showed a solid gain. Some of that was rotation into the perceived better value stocks, plus strength in AT&T (T) and ExxonMobil (XOM).

**

Analysts seem challenged trying to suggest areas to invest in. A such it’s a further affirmation that the market is essentially fully-priced in many areas. It has been for some time, and FANG-type stocks merely rebounded now. Tuesday saw lots of value strength as managers try to shift into a myriad of other stocks. They have a challenge with rates climbing too.

**