The economy is starting to show signs of weakness, but for the labor market and retail sales that only means growth is slightly off their peaks. I wouldn’t be concerned with jobless claims or retail sales growth if other indicators were positive, writes Don Kaufman.

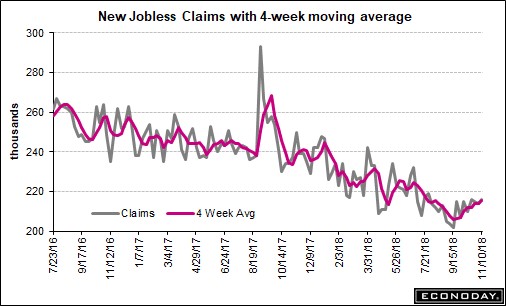

Jobless claims for the week of November 10 were 216,000 which is up from 214,000 in the previous week. That’s not much of an increase, but it is slightly worrisome with the overall weakness in the economy. I follow the 4-week moving average more closely.

As you can see from the chart below, the 4-week moving average increased from 213,750 to 215,250. It has been increasing for several weeks now. Since overall economic growth is weakening, I’m more concerned with every tick up in this average.

A few more weeks of this steady increase or a couple weeks where it jumps noticeably will be enough for me to be bearish in the short-term because jobless claims and stocks are highly correlated.

Recently, Starbucks (SBUX) announced it will lay off 5% of its corporate workers which is 350 people. That’s not much, but stories like this should start to pop up more frequently in the next 6 months. Continuing claims were up 46,000 in the week of November 3 to 1.676 million. The 4-week average increased 9,000 to 1.644 million. The unemployment rate for insured workers was up 0.1% to a very low 1.2%.

2019 slowdown will be intense

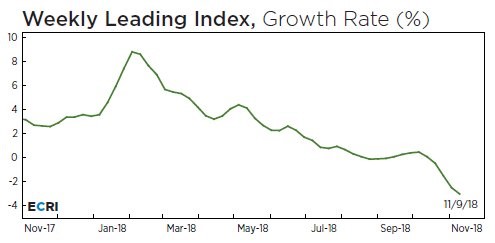

The ECRI leading index has shown weakening growth for over 6 months. Its predictions are finally coming through. As you can see from the chart below, its latest reading is -3% year over year growth. Q2 GDP growth was the peak for the year.

Q3 was slower than Q2 and Q4 will be slower than Q3. By the time we get into the beginning of 2019, GDP growth should be below the cycle average.

As of November 15, Goldman Sachs stated its Q3 GDP tracking estimate shows 3.6% growth which fell by 0.2. Goldman expects Q4 GDP growth to be 2.5%.

The CNBC rapid update shows the median Q4 GDP estimate is for 2.8% growth and the average is for 2.9%. It’s important to keep in mind that the labor market is still strong which means consumers are as enthusiastic to spend money as they’ll ever be. Growth below 3% isn’t that great with that context.

It would be terrible, but not shocking, to see business investment fall quarter over quarter in Q4.

Retail sales growth beats estimates

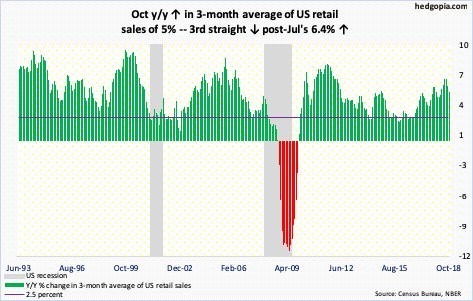

As I expected, retail sales growth was strong in October. The consumer sentiment and Redbook same store sales report showed the consumer didn’t react to the volatility in stocks.

The consumer won’t care about stocks as long as their wages are up. The problem is the catalyst for weakening stock prices will eventually hurt their spending growth. For now, it’s fine as month-over-month headline retail sales growth was 0.8% which beat estimates for 0.5%. The highest estimate was 0.7%.

Part of the reason monthly growth beat estimates is because September sales growth was revised from 0.1% to -0.1%. As you can see from the chart below, the 3-month average year over year sales growth was 5% which is the third straight decline since it was 6.4% in July.

That decline in growth is because of tougher comparisons. It’s still very strong. However, since I expect growth to taper off in 2019, this trend of falling growth should continue.

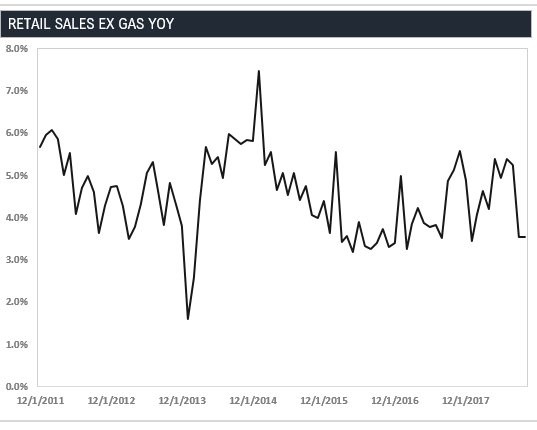

Retail sales growth excluding autos was 0.7% which beat estimates for 0.5% and was above the -0.1% growth in September. Auto sales were up 1.1% on a month over month basis, but down 1.6% on a year-over-year basis. The big variable which helped boost overall retail sales was spending on gas because prices were up in October.

That will change this month. It will be interesting to see if consumers use that money to spend, save or pay down debt. It will be a combination of the three, but the weighting is critical. Because consumers are confident and it’s the holiday season, the money may be spent.

Excluding autos and gas, retail sales growth was only 0.3% month over month which is low considering last month was flat. It missed estimates for 0.4%. As you can see below, year-over-year retail sales growth just excluding gas wasn’t great. However, that’s because gas bit into normal spending. That will reverse in November.

The most important reading is the control group as it tells us the underlying growth trend. It wasn’t great considering September growth was revised from 0.5% to 0.3%. It was 0.3% which met estimates.

Now let’s look at the details of this report. Building sales were up 1% month over month which is a good sign for residential investment. That’s a rare example of good news on housing.

However, it was boosted by increasing prices for primary metals. Gasoline sales were up 3.5% which won’t continue in November. It’s tough to say if prices will be up or down on a year over year basis, but they will definitely fall from October.

Restaurant sales were down 0.2% which is a bad sign because they were down 1.5% and 0.1% in the prior two months. Restaurant sales were strong in the first half of the year. This might be an early warning sign of consumer weakness. Furniture sales were down 0.3% which is bad news for housing as people fix up their homes when prices are rising. General merchandise sales and department store sales were up 0.5%. Online sales were up 0.4% which isn’t great for this segment which usually outperforms by a lot.

Conclusion

The economy is starting to show signs of weakness, but for the labor market and retail sales that only means growth is slightly off their peaks. I wouldn’t be concerned with jobless claims or retail sales growth if other indicators were positive.

The stock market is also monitoring the economy closer than this summer as there has been much more volatility in the past few weeks. The holiday shopping season will be fine, but it might be the last good one this cycle. Stock investors are more forward-looking than consumers.

Subscribe to TheoTrade here...

View a brief video interview with Don Kaufman on volatility for traders and investors here

Recorded at TradersExpo New York Feb. 25, 2018

Duration: 2:34.