Gene Inger’s Trading Notebook: Why retailers like Nordstrom, Walmart and Home Depot are flat as well as XRT. Slumping NVIDIA, Micron and Apple. Facebook flushes. LightPath Technologies clarifies at its annual meeting.

Just look at Nordstrom (JWN) last week, reflecting not just a shift to online retail. but perhaps a serious slowing, related to consumer reticence to spend excessively. The Santa Claus-will-save-everything crowd is hesitant to consider the possibility. Why Nordstrom is selling off despite beating earnings and raising guidance.

Similarly, at best top-lines are flat for retailers. Walmart (WMT) is the same story. It does not mean a dearth of consumers, just that the year has been stagnant and not robust as I’ve contended most of the year.

Homebuilders suffered of course and some of that helped Home Depot (HD) but guidance even there is fairly conservative. Why people keep chasing patterns that were strong (the reward for having bought a couple years ago or more) is mind-boggling. The companies involved may swing around a bit this time of year but easy gains are certainly behind and not ahead, at least for the intermediate time.

Reuters: Wall Street hammered Monday by Apple and US-China trade concerns.

**

Now, if you get a China trade deal, sure, you should see more rebounds of the type that could assist a late-year comeback as well as perhaps the early 2019 action. Again, that’s pending and unlikely to be an entire leg-up for the very broad market. Decent rallies for the downtrodden or small-caps that were under pressure or are languishing (after multi-month corrections).

**

If you look at retail ETFs, like the SPDR S&P Retail (XRT), the pattern has been odds of failing after any short-term rebound tries contrary to most of the Street’s thinking.

I also don’t understand why traders hung-around stocks like NVIDIA (NVDA) so long given a probability that they’d disappoint as well as issue sluggish guidance. That’s been clear for some time in Semiconductors (even the SOX) and Micron Technology (MU) set the pace.

So, if anything, market giant Apple (AAPL) was clearly slowing (during months of distribution over the 200 area), as we pointed out pricing/upgrade issues that related to many waiting for 5G. That will be a very huge upgrade cycle and one reason most of the present analyst discussions are basically mute.

The China story about lower-priced phone and apps unavailable in any iPhone for chat and digital pay purposes- was out there months ago.

It does relate to NVIDIA, like others, with preceding and near-term slowing. A minor P.S. for Apple: their much-delayed AirPower (a wireless charging pad intended to charge multiple devices simultaneously) was approved Nov. 14 by the FCC. Perhaps they’ll introduce it at a high price along with the pricier revised bedside charger for AppleWatch in time for the holidays.

**

Finally, there is Facebook, (FB) which continues to lead the downside giving it a college try to counter the New York Times story. Zuckerberg acknowledges a degree of fairness in some of the critique.

New York Times: Delay, Deny and Deflect. How Facebook's Leaders Fought Through Crisis.

They need to do more and that matters to advertisers too as that’s their business model so far. (Many of us would rather pay a fee to them and have greater privacy but that’s so difficult in this everyone-wants-everything-for-free-era.) I’ve warned sliding by FB would develop also for months and distrusted every rebound. We did actually recommend the shares once at 20 after it came out of lockup after the IPO. That’s a long time ago.

Any of these stocks may do OK over the next five years while others will be merged or acquired by then. Or in the case of social media who knows the future? (There will be another platform which goes beyond the best days as being behind. For now, there’s not much of an alternative.)

We are likely at peak concentration into a limited number of services, and this broadens a bit over the next few years. Just hard to say (for now) who profits the most.

**

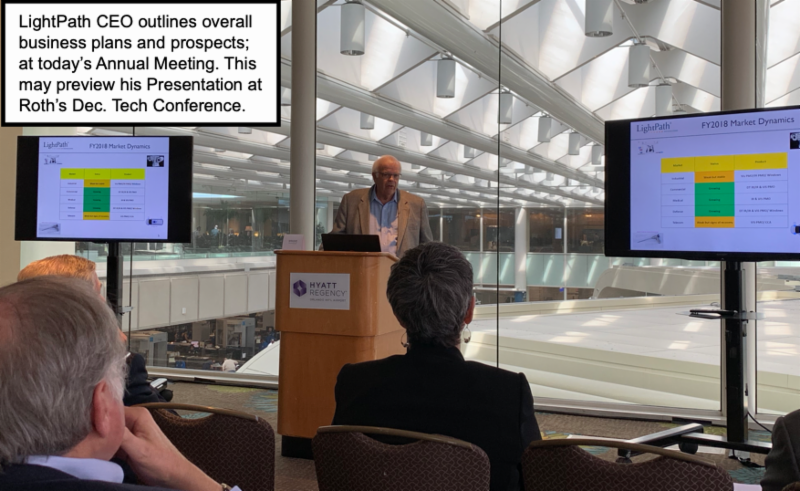

I spent part of Thursday attending the LightPath Technologies (LPTH) annual meeting at Orlando Airport Hyatt Regency. Very little gleaned beyond that I shared after the quarterly report just a week ago.

It was good to listen to a few clarifications and about the future from those entrusted to continue the integration and relocation of some of ISP Optics manufacturing operations as well as grasp the possible timeline for a time when the clearly-growing top-line increasingly improves the bottom-line not only with better margins, but as non-recurring relocation costs diminish.

CEO Jim Gaynor suggested to those in attendance that means working through the integration/relocation expenses associated with a transition to Orlando (and Riga Latvia), which along with growing revenue and backlog should see a gradual improvement to margins, and bottom-line. Sort of a bell-curve where diminishing expenses become more-than-offset by rising top-lines (or overall revenue). Hence improving the bottom-line in time.

Dr. Joseph Menaker, infrared optics exec, appointed to LightPath board of directors Nov. 19.

They believe business will get better throughout this fiscal year without for sure clearly knowing what everyone wants to know: economic variables of course related to trade (more so in China than the U.S.).

Although notably the part of LightPath business growing fastest remains Infrared, and that is primarily a U.S. and European customer base.

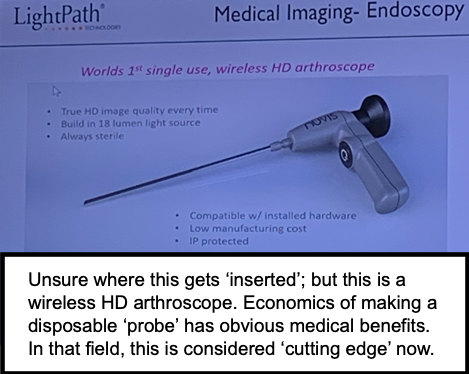

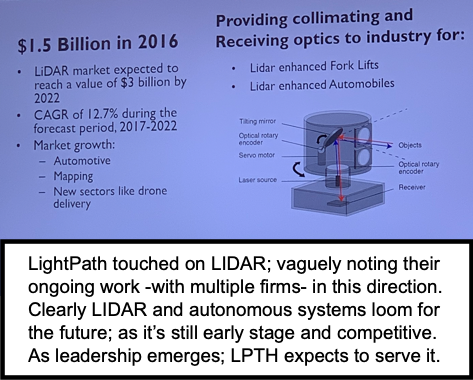

So, to a degree they are just a bit more insulated. Although many customers who buy lenses sell globally of course care about their end-user sales. Gaynor made a point to say that China sales, and particularly U.S. sales in defense and medical are growing. They highlighted the newly-growing field of disposable endoscopes and certainly fire & police and military uses for surveillance or detection.

So, it’s a small company. And clearly the hot money from last year vanished and ironically that’s good, when one considers nobody seems to recognize a possible pop in results on a progressive scale as non-recurring expense items (higher than anticipated) diminish during the course of 2019 ahead.

It is a process. At some point share-price should recognize the mitigation of expenses (planned or unforeseen) and start pricing-in growth prospects.

The summary: optimistic patience that reduction in expenses to mitigate an earnings impact LightPath has seen recently, combined with solid growth for both revenues and backlog (and margins too), will improve earnings not just gradually, but solidly over time.

That’s management’s view, and it makes sense. So, we’ll view LPTH as a speculative Hold (perhaps even a Buy) requiring patience at the same time the current fiscal year should gradually see good results.