The reality is that retailing is morphing in ways that aren’t entirely realized. A company like Apple set the bar for ecosystems (still not entirely warranted, as the universe of customers to buy services depends on the installed-base of course), writes Gene Inger.

But there’s a cloud of fear, and some of that radiates to Amazon (AMZN) as well. because Amazon is transforming into a service-based business to a greater degree.

And while it is somewhat insulated compared to Apple or Google (GOOGL) in that regard, it has backdrop antitrust risk. Amazon has variety of offerings at this point and combinations that do marry too many at the expense of others.

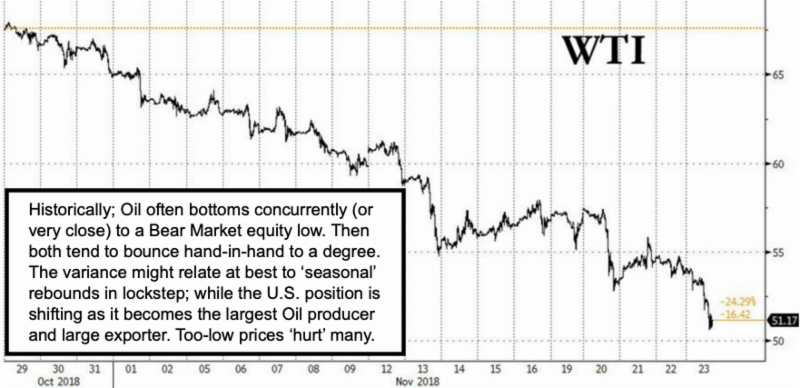

In-sum: not much changed on Friday as far as the intraday market action. It wasn’t noticed by many as Iran commandeered or detained a Saudi Arabian fishing boat. Or that next week’s OPEC meeting might provide opportunity to reduce production levels with deniability that it was part of a deal with Trump so that we didn’t crack down on them harder due to the journalist’s murder. In a sense it’s pathetic but also understandable (even if not presented well).

**

The new week should not see tech or oil catching much of a bid. But a fair amount of stability might be seen pending both OPEC and the G20 meeting that will almost entirely focus on the trade & tariff issues.

**

Tax-loss selling persists pretty much across the board gently on the abbreviated Friday session. The market is not terribly low, with really too much confidence by those who point out (accurately) that 40% of S&P (SPX) issues have already decline 20% or more. So much of that is from the highs that were absurd to start with. hence one shouldn’t be comforted too much.

**

Many companies are facing a time of low-returns and not just energy. From my chat with a major Panasonic (PCRFY) and other electronics distributor at dinner last week he confirmed the upcoming price increases (barring real changes in the U.S./China relationship) we all know about. He also shared experiences at home shows across the country where attendance is low, and anecdotally exhibitors/vendors report about 20%-30% sales declines.

For sure that contradicts what the financial media is saying about retail. But it’s also a reality that younger generations shop online. And no longer even browsing through stores and shows to try before shopping even if online.

It clearly suggests exhibitors are increasingly wasting their money aside online marketing. something we already knew from electronics shows and the huge Swiss watch show (Basel), which had shrunk exhibit space more than half. And it wasn’t just because of competition from smart watches like Apple (AAPL).

**

Media is ridiculously optimistic about consumers with no reflection upon all the money spent. They are ignoring crosscurrents (or the ability to pay down debt that might seem too adult for so many).

Core consumer demand is strong but it is sensitive to tariffs. And it ignores many contradictions that are debatable.

**

Of course, the biggest one might be assumptions some analysts make, with respect to tax refunds coming in 2019.

Almost every retail analyst is focusing on refunds as contributing to a big consumer boom next Spring. Actually, I’d question that. at least as relates to households with solid income and homes that have property taxes in excess of the reduced allowable amounts.

If the reduced withholding (or quarterlies) for salaried workers has inadequately or inaccurately reflected what their tax returns will actually reflect.

Well, that’s a reason to watch carefully not just retail sales, tariff moves. but tax returns. Most don’t plan ahead adequately. So, they may not be prepared for a shock if a large number of Americans (especially in tax-heavy states) withheld an inadequate amount and thus end-up owing lots more tax come April.

For cyber-Monday we offer inclusion of my intraday MarketCast comments to new subscribers (not valid for renewals or existing) for the first Quarter of all new subscriptions. All you need to do is: subscribe now to our Daily Briefing at the regular rate; and I’ll add you to the MarketCast group too. It’s a critical market time for investors and I suspect a lot will occur well before my next public seminar at MoneyShow Orlando Feb. 9.