Fast-market conditions briefly appeared Tuesday as Larry Kudlow affirmed Trump’s remarks last evening, by saying “the president is disappointed with China’s negotiations” so far. What this means for Apple caught in the crossfire, writes Gene Inger.

The market reacted down and chopping around Tuesday afternoon. Keep in mind even Bloomberg had a 3 am story saying there “is a deal,” then retracted that story.

Reuters: Wall Street turns positive Tuesday on White House adviser's trade comments.

**

However, after Monday’s close the president tweeted gain. This time very importantly on China, saying: if no deal, the U.S. will impose tariffs on ALL Chinese imports. Asked about iPhones, the president said maybe.

He then advised Apple (AAPL) to make iPhones here in the U.S. Apple already has planned to make more products in the U.S. but without much specificity on that.

**

Earlier Monday, Apple sobered a bit perhaps by the market reaction to price cuts of the lower-end iPhone XR, trying to move XR product in Japan. Apple boosts iPhone trade-in credit with up to extra $100 when picking up a new XR or XS. Apple failed to rally much with other rebounding tech stocks in the regular session and along with the S&P (SPX), fell away a bit after-hours. Then Microsoft (MSFT) briefly passed Apple in market cap.

Reuters: Microsoft's stock market value briefly catches up with Apple after hours Monday.

**

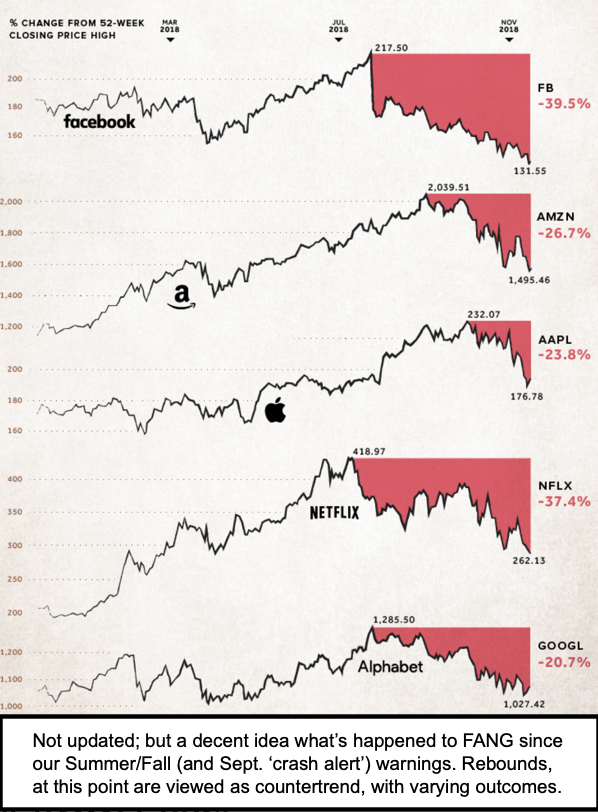

Most of the general liquidations or tax-selling occurring now relates to FAANG or other overpriced stocks, which is probably why institutions are freaking so much. There’s no reason to expect the Fed chairman to depart from a very clearly-outlined theme of offloading the balance sheet. Regardless of what I suspect is not just political, but Wall Street pressures being brought to bear two years into the outlined take the punch-bowl away policy transition.

As I already suggested, the majority of rate hikes are behind as target rate goals for the Fed Funds are approached. This means the Fed has less of a task ahead as for the official rates while laying off hikes (after another) is not going to be bowing to political pressure though some will claim that.

At the same time, we have the Fed Minutes coming-up. And no reason for Mr. Powell to back-off the overall policy because it’s going to be tricky to move paper next year anyway. That’s doubly so in the corporate bond arena.

For cyber-Monday we offer inclusion of my intraday MarketCast comments to new subscribers (not valid for renewals or existing) for the first Quarter of all new subscriptions. Offer ends Nov. 27. All you need to do is: subscribe now to our Daily Briefing at the regular rate; and I’ll add you to the MarketCast group too. It’s a critical market time for investors and I suspect a lot will occur well before my next public seminar at MoneyShow Orlando Feb. 9.