Paul Cretien provides an option trade signal through his calculation of the LLP Options Pricing Model.

By computing option price curves with the Log Log Parabola Options Pricing Model we are able to see the accuracy with which each option in an option price chain fits the curve. The objective is to find options that are temporarily mispriced relative to predicted prices so that traders can exploit the mispricing and profit when they move back to the predicted price curve. It is a reversion trade.

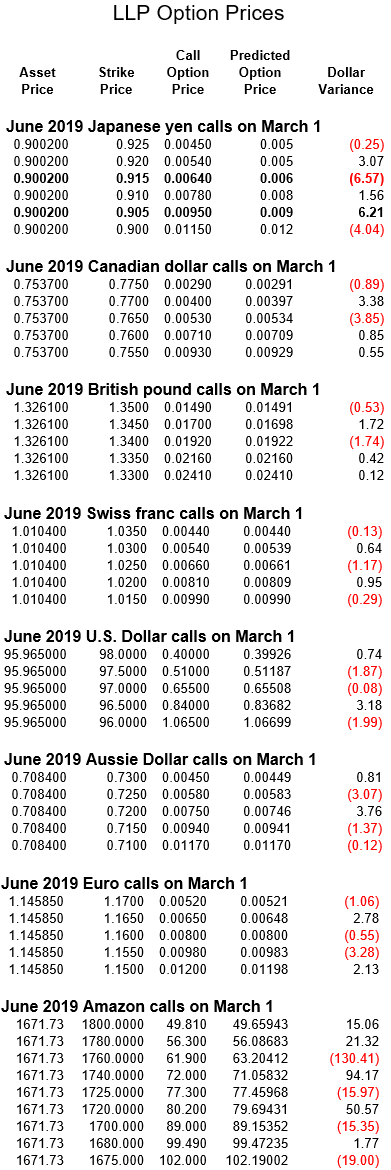

The chart below shows the price curves for seven currencies on March 1: Japanese yen, Canadian dollar, British pound, Swiss franc, U.S. dollar, Australian dollar and the euro.

The chart contains clues to several interesting inter-market options relationships in addition to trades within each currency. For example, the Australian dollar and British pound are close together with the highest ratios of option price-to-strike price. This closeness suggests looking at the Aussie and the pound as a potential pair to be traded against each other when their prices separate. Another pair relates the Swiss franc with the euro, while a third pair combines the euro and U.S. dollar.

“LLP Option Prices” (below) shows the currency prices on March 1, 2019, strike prices in the option price chains. The market price and predicted price at each strike price, and the dollar variance between market price and predicted price. If the price variation is large enough to provide a profit after accounting for commission costs a potential trade is signaled. In the case of currency call options, there is just one potential trade: the Japanese yen strike price 0.915 under-priced by $6.57 and the yen with strike 0.905 over-priced by $6.21. Traders should consider buying the 915 call and selling the 905 call.

The precision with which the options market prices currency calls is impressive. This is shown by the dollar value of each option point multiplied by the difference between the market price and predicted price. Values per point are for the yen $125,000, Canadian dollar $100,000, British pound $62,500, Swiss franc $125,000, U.S. dollar index $1,000, Australian dollar $100.000, and the euro $125,000.

Because the precise nature of option pricing for currencies may be frustrating, an alternative is added to the table of calls and price deviations from predicted curves. The additional options are for Amazon stock which closed at $1,671.73 on March 1. The price variations from predicted range from minus $130.41 for strike price 1,760 to plus $84.17 for strike price 1,740.