The S&P 500 SPDR (SPY) has eked out a new high this week, notes Marvin Appel

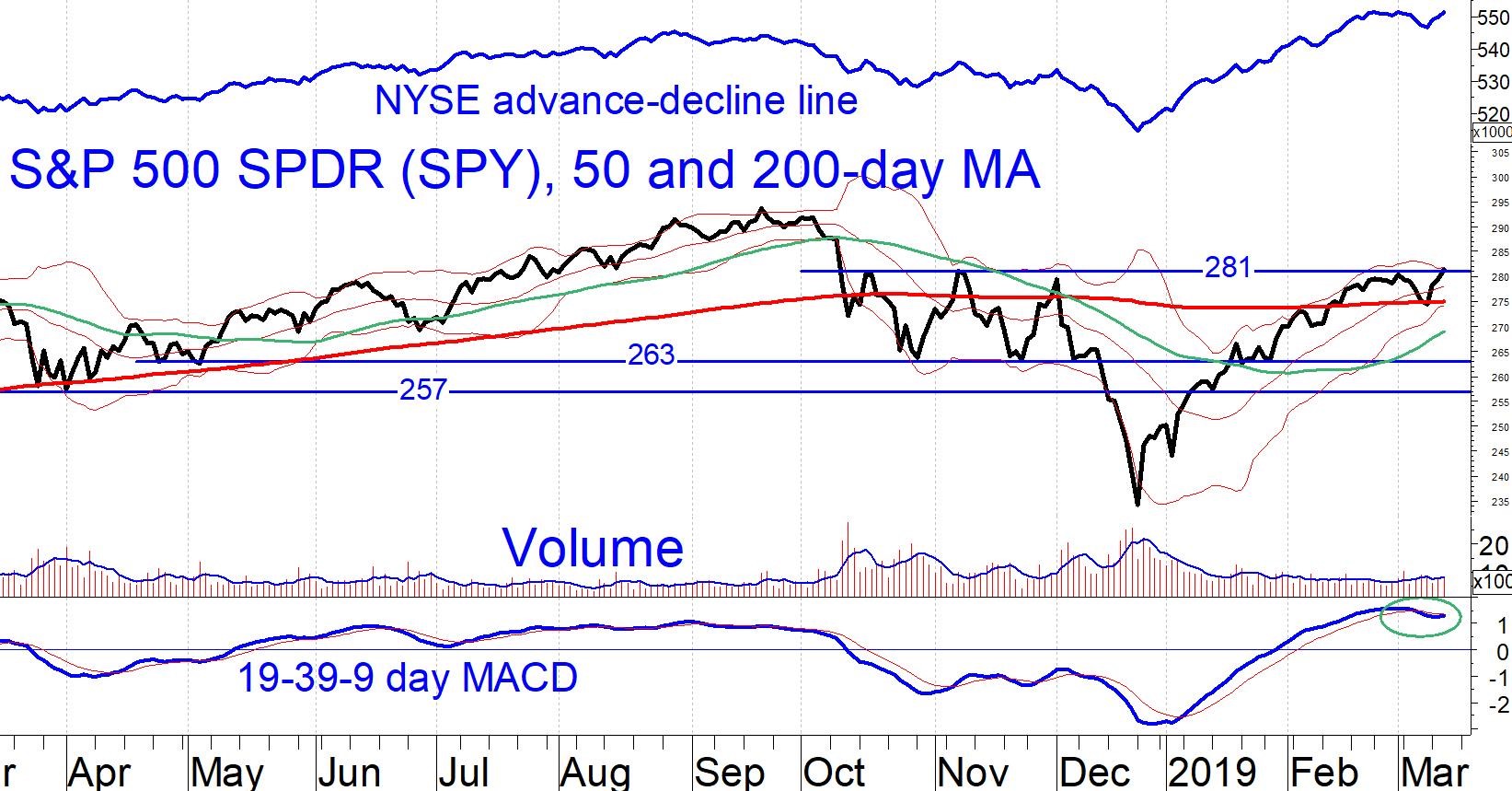

The S&P 500 SPDR (SPY) has eked out a new high this week, recovering from last week’s losses. Our U.S. equity timing model remains a buy, resistance remains at 281, but SPY enjoys support from both the 50-day (269) and 200-day moving average (275). Expect the next breakout from this narrow range to be higher, ultimately retesting the all-time high from Sept. 20 at 294. However, MACD is quite overbought (circled in chart below), suggesting that gains from here will be slowly won. (SPY has historically achieved gains more slowly when MACD has been overbought than at other times.)

On March 8, the intra-day low appeared to represent a potential breakdown of SPY below the 200-day moving average. Although it was scary, key moving averages that serve as support or resistance can act as trampolines; markets can stretch support or resistance levels without shattering them. We have seen this frequently around the 200-day moving average, most recently in the October-November timeframe when SPY crossed of the 200-day average several times, mostly without changing or establishing a trend.

Bottom line

The market advance is holding on. However, don’t be complacent. Expect corporate high yield bond funds to roughly match market returns for the remainder of 2019 at much less risk. Accordingly, we have reallocated some client assets from equities to high yield bonds.