While there is definite technical weakness ahead, Joe Duarte of In-the-Money Options, suggests buying dips in the short-term.

Cooler trading heads – algos- surely prevailed last week as the market rebounded. Arguably, there may be some options expirations related reasons for the rally. Thus, what happens in the days ahead will be just as important as last week’s bounce in stocks.

Nevertheless, in my March 10 posting while advising to stay patient and pragmatic while trading this market I wrote “what used to take weeks to develop now often occurs in hours or days. Thus, in order to survive traders must act rapidly. So while this market could be headed down in a hurry, the flip side is that at some point, we will be able to buy stocks at lower prices and perhaps in a shorter period of time than anyone expects.”

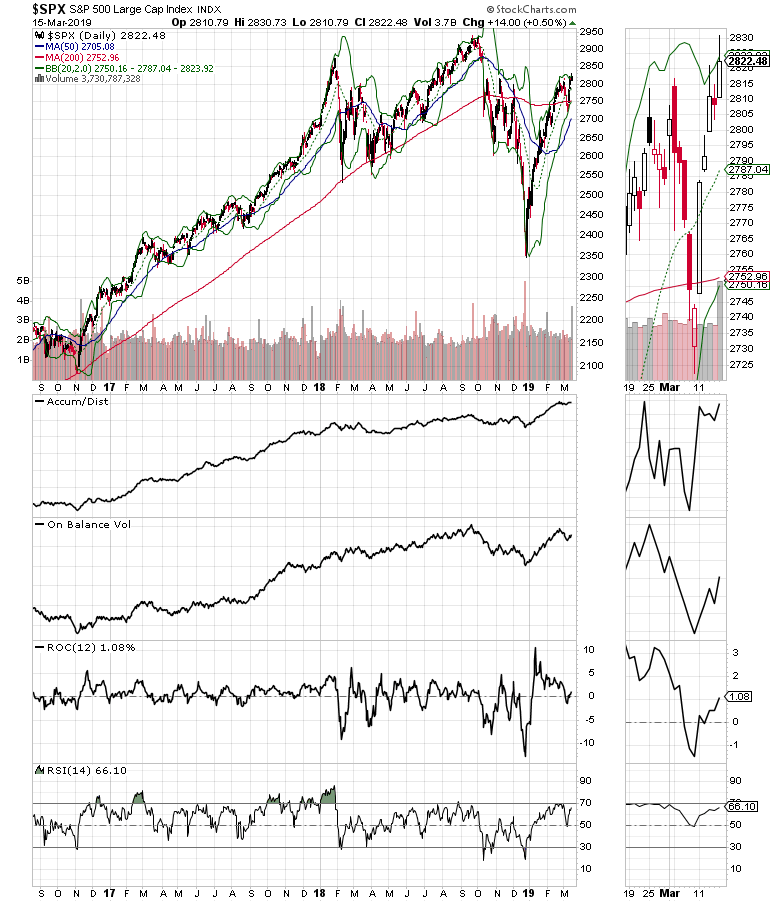

Thus, I was not surprised to see the S&P 500 (SPX) bounce back after the four-day, 3% decline from the past week while the NYSE Advance Decline line (NYAD) – see below for more details – made a new high, suggesting that the short-term trend has turned to the upside for now. Of course, things may reverse again in the next few days or weeks. After all, this remains a headline triggered robot algorithm guided market.

My point, however, is that from a very macro standpoint, despite the volatility we may see from time to time, this market is still responding to the notion that interest rates won’t be rising anytime soon and that the U.S.-China trade talks have not broken down. Of course, the market is hoping that the trade talks will turn out to be very positive and that the global economy will respond to lower interest rates and a trade fix.

Macro Bullets

- Calendar: The Federal Reserve meets as does the Bank of England. Europe and the U.S. will release PMI data while the U.S. will see regional Federal Reserve district data out of Philadelphia. Another Brexit vote is expected.

- Big Picture: The third year of the Presidential Cycle (2019) is traditionally bullish for stocks. But seasonality alone can’t hold up stocks if central banks don’t respond to conditions quickly enough and if the global economy does not respond to lower interest rates or accommodative monetary policy as it materializes.

- Monetary Policy: Central banks are no longer raising interest rates and markets are increasingly impatient as economic data continues to show weakness. Meanwhile, the big three: Federal Reserve, the ECB, and the People’s Bank of China are not showing signs of being in a hurry to ease policy aggressively enough anytime soon because they are essentially out of options.

- Risk: Headline risk remains. Think U.S.-China trade war, global tariffs, slowing economic data, politics. Of the four, it seems politics is starting to get near some sort of boiling point.

- Market Behavior: Volatility is likely to depend on headlines. Expect swift and until proven otherwise shallow pullbacks with buying of the dips.

- What to do: Stay cool. Trade the market.

Market Breadth Makes New Highs

It’s hard to be bearish when the New York Stock Exchange Advance Decline line (NYAD) makes a new high. In fact, given this indicator’s solid record of predicting the future market trend, it’s hard to consider that the future holds anything but higher prices in the short to intermediate term.

Of course, given the general headline climate, it’s also reasonable to expect sudden short-term reversals in the price trend. Accordingly, it’s important the “buy the dip” mentality remains in place. Yet, as long as the NYAD remains above its 20- and 50-day moving averages, the likelihood of a decline such as the one we saw in Q4 2018 seem low.

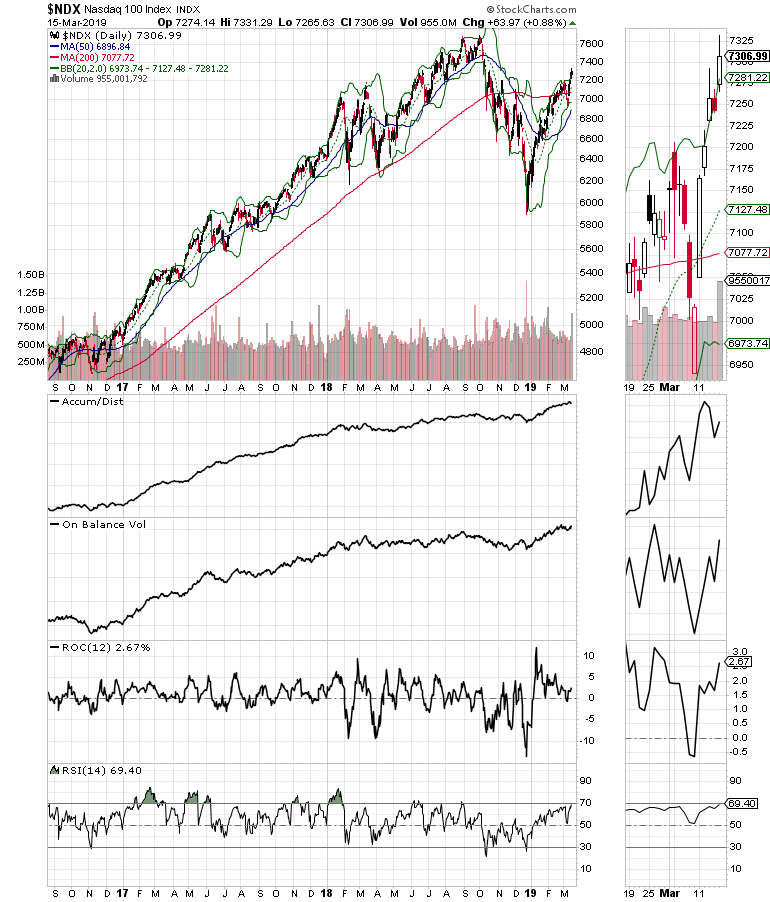

For their own parts, the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes continued to move higher after a four-day 3% decline last week. Moreover, both indexes closed above key resistance levels – 7200 for NDX and 2800 for SPX- albeit in lower volume than I would like to have seen.

Furthermore, both indexes closed the week above their upper Bollinger Band, a sign that trading might have gotten a bit ahead of itself for the moment. So, for now, it’s all about the market staying above recent support and what happens when 2900 on SPX approaches.

It’s How Things Develop that’s Crucial

The market bounced back from a shallow, although scary 3% pullback and is becoming slightly overbought. That means that how stocks work out their overbought status is the next big trading worry.

The best scenario would be a slow and steady sideways consolidation. But there is no guarantee that this will occur, which means that we could see another 3% to 5% decline come on rapidly starting this week. For now, however, the 20- and 50-day moving averages have proven to be support, so they get the benefit of the doubt.

Moreover, staying cool and managing each stock individual position on its own merits is the best approach to this market. If there are opportunities to short individual stocks and sectors, it’s not a bad idea to consider. Finally using options for high priced stocks will reduce risk while the opportunities for Buy-Write strategies and building positions in high yielding dividend plays is on the rise.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies.