Here is a short-term bet on AMD continuing its climb, writes Jay Soloff.

There are generally two reasons why a stock makes a sudden big move. Either the overall market is having a big up or down day, or the company itself has some specific news causing a large move. Most stock specific news is related to earnings or product announcements, although it could also be related to its sector or management as well.

Sticking with the more standard explanations, we tend to see gap moves in stocks after a surprising earnings announcement or an unexpected product announcement. Earnings surprises are generally straightforward but product surprises are a different matter. What kind of product announcement can cause a stock to gap?

For example, look what just happened with Advanced Micro Devices (AMD).

AMD is one of the biggest graphic card companies in the world (GPUs). The company’s Radeon line of graphics cards are particular prevalent in the gaming universe. The video game industry is huge and continues to grow as e-sports becomes a more mainstream phenomenon.

So, when Alphabet (GOOGL) announced a new video game streaming platform called Stadia, it was huge news. What was even bigger news for AMD is that Google announced it would be using their GPUs to render the graphics for its new gaming system.

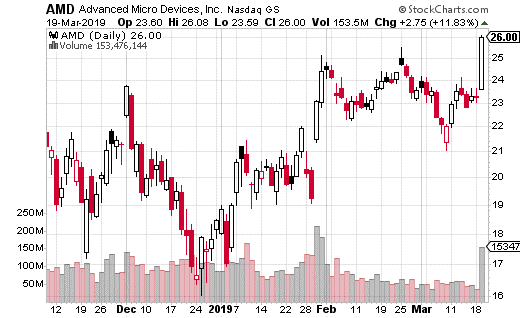

The response by investors was overwhelming positive for AMD. There’s a massive amount of potential with this service and it will clearly boost sales and profits for the company. In fact, the stock jumped 12% on the day of the announcement.

What’s more, bullish options action in AMD substantially increased. The 30-day average for bullish trades on AMD was at 60% of activity. But, the day of the announcement, bullish activity jumped to 76% of all options activity.

The 27.5 strike expiring on April 5 saw a lot of action. With the stock around $25.50 about 2,000 of these calls were bought for 40¢. That’s a breakeven price of $27.90 for roughly a two-week trade.

The stock closed at $26 the day of the spike, so the trader clearly thinks the stock will keep running. The buyer is spending about $80,000 on this bullish trade, but could generate $200,000 per $1 above the breakeven price.

If you want to make a short-term bet on AMD continuing its climb, buying those short-term calls is a reasonable trade. However, you can also buy yourself more time without spending too much more in premium.

The April 18 27 calls cost about $1 with the stock at $26. So, for a full month before expiration (and with the stock 50¢ higher and the strike 50¢ lower) you can spend $1 instead of 40¢. The breakeven point is still right around $28, but you have two additional weeks (and about four total weeks) for the trade to work.

That’s a reasonable tradeoff and will give you a better chance to succeed if the stock keeps climbing. Given the massively bullish news, it certainly wouldn’t shock me if the stock takes a shot at $30 or above in the near future.