Stock indexes continue to consolidate, reports Ricky Wen.

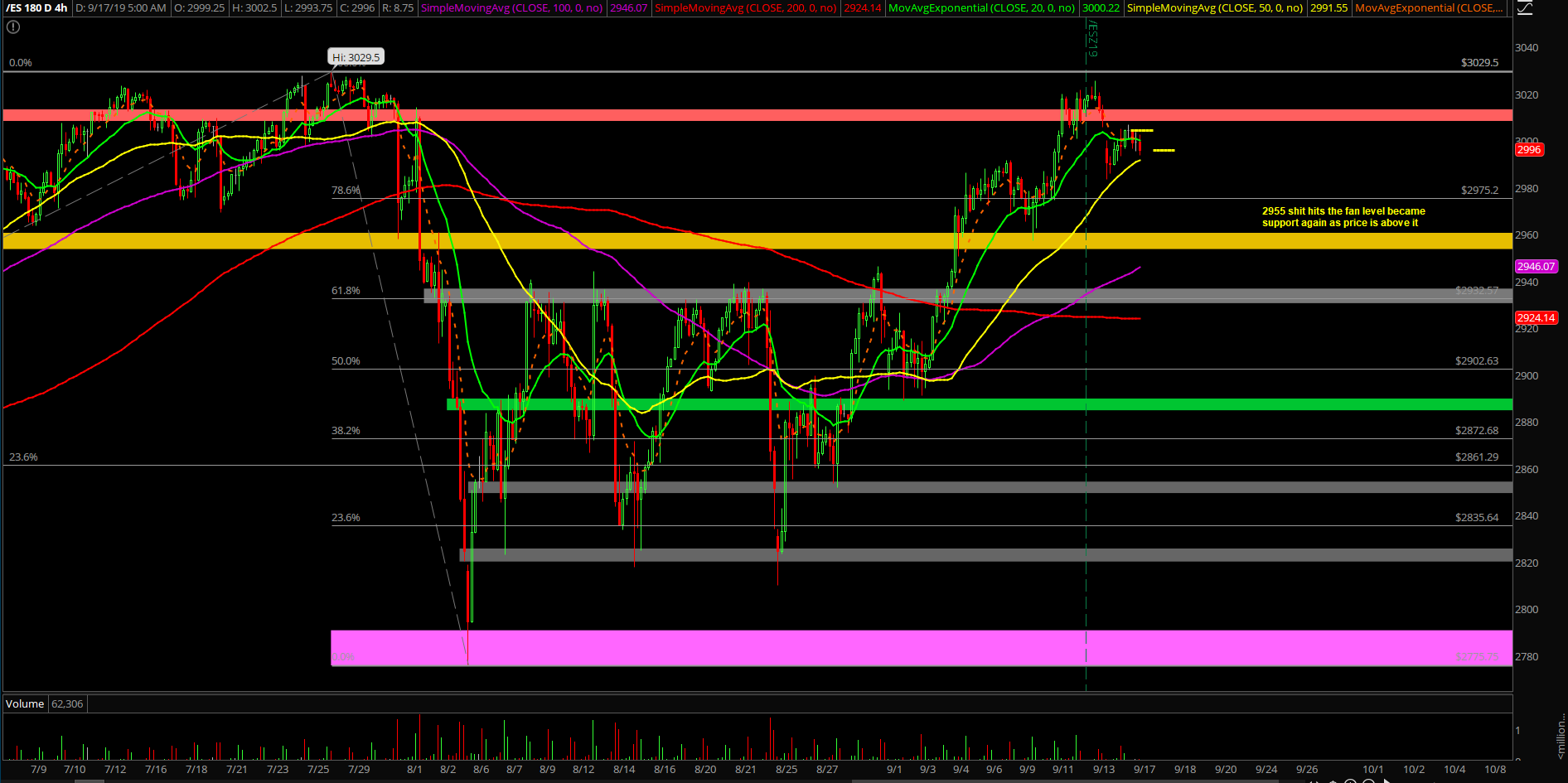

Monday’s session played out as a range/digestion day per our weekend report expectations as the market takes a breather after the bulls completed their three-week upside continuation assault. As you can see on the chart (below), the price action mimicked our four-hour white line projection perfectly into the gap fill as it was a textbook range day. As demonstrated in real-time in the ES trading room, we bought the dip and sold at the dead highs of 3007 on the E-mini S&P 500 (ES).

The main takeaway from Monday’s session is that nothing has changed as bulls still retain full control on the key timeframes and the overall consolidation/digestion expectation of this entire week continues.

We should get more of a decisive answer with tomorrow’s 2 p.m. EDT FOMC announcement.

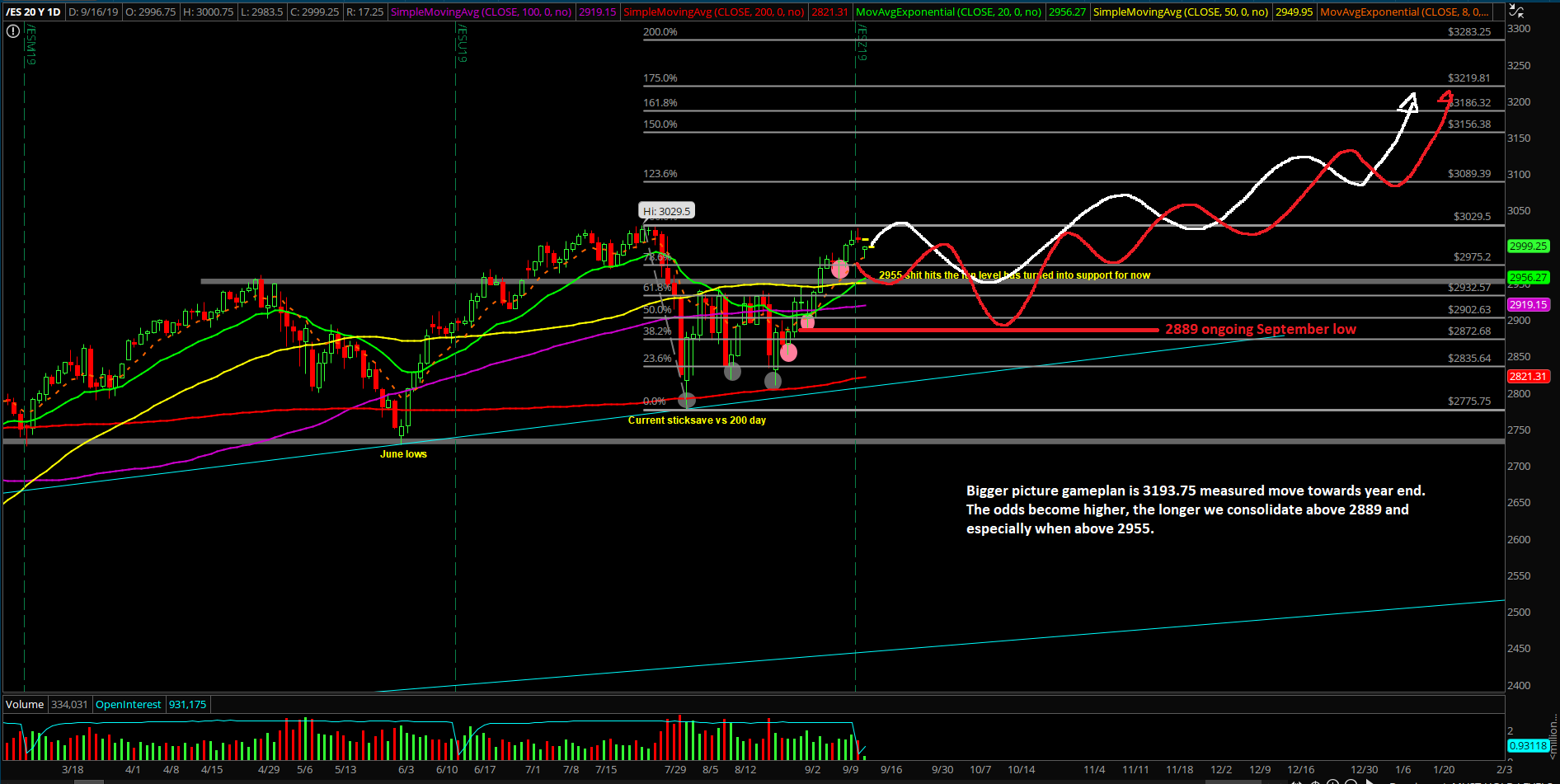

If you recall, the market bottomed at 2957.25 last week and made a textbook higher lows pattern. Heading into this week with a few timing catalysts, it’s fairly obvious on what the goals are for each side after the consolidation pattern takes place. Bulls are trying to immediately make new all-time highs and be on their way towards the 3193.75 measured move year-end target from months ago. Vice versa, bears are trying to break 2955 and open back up the threat that they resurrect themselves from extinction and maybe go for the September monthly low of 2889 backtest to see if it holds or breaks. Be aware of the inside week range expectations until proven otherwise.

What’s next?

Monday closed at 3004.5 on the ES at the high of the session with 2983.50 as the Sunday night low pivot.

On our charts, we're decisively above the 2955 "sh*t hits the fan level" of July and also riding on top of the daily Bollinger Band highs and doing a little mean reversion since the Sunday night gap down.

On the weekly chart there's a picture perfect “hold half and go” continuation pattern playing out since the last week of August. Bulls completed week 3 of the continuation pattern, so it’s normal to expect some sort of consolidation/digestion for this week given the overall range 3025.75-2957.25 and the timing catalysts on Wednesday and Friday.

As you can see, it is technically no longer an inside month anymore (within the August range of 3014.25-2775.75) as price broke above it for a few hours last week. Let’s see if price sustains above it in the coming weeks to enhance odds further for the bull train.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.