Equity markets continue to look solid. When markets rise amid such turmoil, it could mean that they want to rise, notes Gene Inger.

Investors are rejecting chaos, as they have for some time, despite a continued siren's call. The number of quantitative analysts or technicians calling for declines— for weeks if not months— exceeds the number of known issues that have potential to wrack havoc on markets.

In this brief commentary, we observe several well-regarded technicians gravitating away from their prior bearish viewpoints and recognizing what I have generally contended. And that is a realization of a market forming a nearly symmetrical pattern, which is a variation of an ascending wedge.

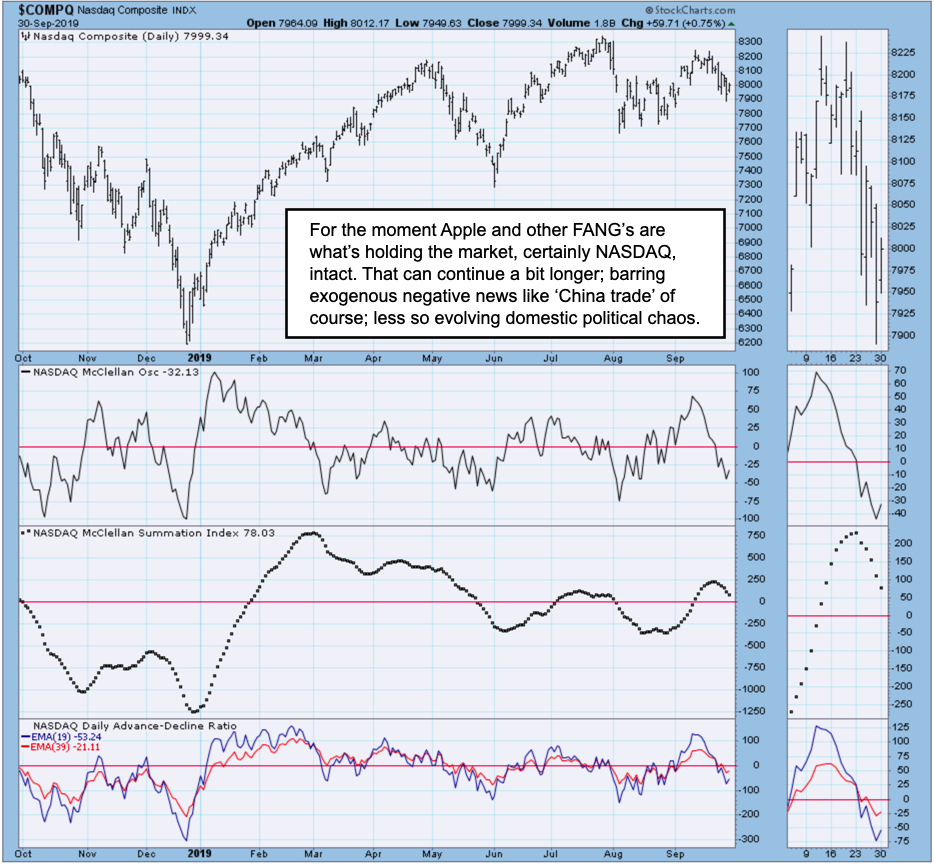

I suspect that a few things are evident: a) the market has been unable to respond negatively to the expanding aspects of the political challenge; and b) if the market ignores what may be viewed as bad news; then it often is saying it wants to go up, rather than down.

Of course it's much more than that: Peter Navarro claimed that there was no consideration of delisting all Chinese stocks at any time, and it increasing seems like there's an orchestrated effort to disrupt more than the Presidency, when they shift to fabricating (or misguiding) reports as relate to trade, or the Chinese intention to come to the U.S. for resumed formal trade negotiations this month (not this week). Of course, this may have been floated by the Administration to push China back to towards the table.

Like others we could spend lots of time debating whether what is going on regarding Ukraine rises to the level it has; whether it's even accurate. But what we do know is that the market is not responding with a great deal of fear (see chart).

Policy and event uncertainty is the highlight of the moment, with many of course deliberating, but with few certainties or determinations as to a course of results; whether related to trade, monetary policy, war, or domestic politics.