Multiple currencies are at extreme overbought levels and are turning bearish on the QuantCycles vs the Canadian dollar, reports Daniel Collins.

The value of multiple currencies has soared vs. the Canadian dollar since crude oil prices went negatively briefly in April.

Looking at the QuantCycles Oscillator shows multiple currencies vs the Canadian dollar nearing overbought conditions.

Not only is the weekly oscillator in the euro/loonie (EURCAD) and British pound/loonie (GBPCAD) near extreme overbought territory, both are turning from bullish to bearish conditions in the QuantCycles Oscillator (see charts below).

The GBPCAD pair has blown through overbought territory on the daily oscillator and appears prime for a reversal (see chart below).

As you can see, not only is the GBPCAD pair extremely overbought, it also is showing a sharp downturn.

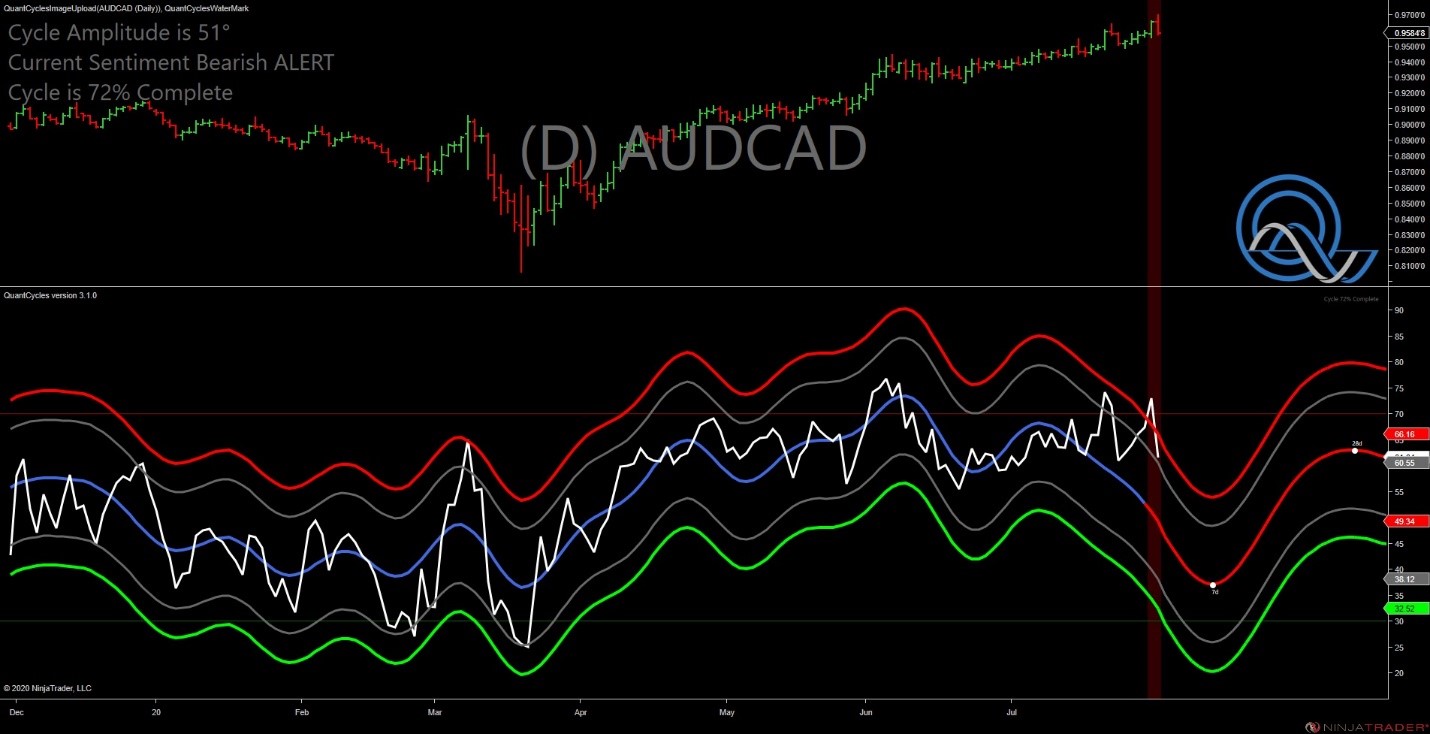

Let’s take a look at the loonie vs. another pair. The Aussie dollar/loonie (AUDCAD), shows the same trend, but turned on Friday, suggesting it may be time to take a position (see chart).

The main question is how to play this trade, i.e. what pair to trade the loonie with?

Given the recent U.S. Dollar weakness, it may best to trade the CAD vs the Aussie, as it already appears to be turning from overbought territory. The EURCAD and GBCAD pairs both are at extreme overbought levels, and both appear to have a double ceiling as resistance.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.