When we sell a cash-secured put, we are agreeing to buy the option holder’s shares at the strike price by the expiration date, states Allan Ellman of The Blue Collar Investor.

In return, we are paid a cash premium. The broker will require us to place a certain amount of cash [(put strike – put premium) x # shares] into our cash account in the event that the option is exercised. Ten-Delta means the strike is deep out-of-the-money (lower than share price) and approximates a 90% probability of not being exercised…it is a defensive approach to option-selling,

Exit Strategies for Cash-Secured Puts

There is a myriad of exit strategy opportunities that may arise during our contracts, and we must be prepared to act, when appropriate. During this particular contract, INMD appreciated in value significantly and also completed a two-for-one stock split.

Rolling-Up and Still Retaining the Ten-Delta Status

The Delta of puts is signified with a minus sign because the put value is inversely related to share value. As share price rises, put value declines. This means that we can frequently buy back the short put at a lower price and re-sell a higher strike for a net credit while still retaining our required Ten-Delta status.

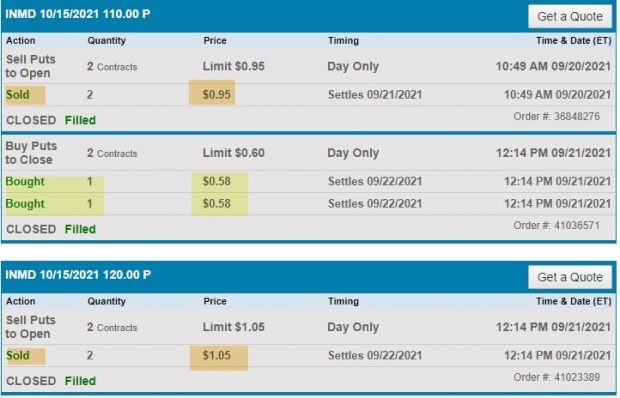

Broker Screenshot of a Rolling-Up Trade With INMD on 9/20/2021

Rolling-Up From the $110.00 to the $120.00 Put Strike

The put was sold for $95.00 per-contract and then rolled-up for an additional net credit of $47.00 per-contract.

Summary of Rolling Put Trades Generating Six Income Streams

Six Income Streams for one-Monthly Cash-Secured Put

Post exit strategy calculations

- Total option credits = $1050.00

- Total option debits: $530.00

- Net option credit: $520.00

- Last cash required amount (4 contracts): $29,480.00 –[($75.00 x 400) – $520.00]

- One-month return: $520.00/$29,480.00 = 1.8%

- Annualized return: 21.1%

- Exit strategies doubled initial annualized returns (10.5%)

Discussion

- Selling deep OTM cash-secured puts with Deltas of ten or less creates an ultra-conservative approach to option-selling

- Ten-Delta strikes approximately a 90%+ probability of success

- Returns will be lower than traditional put-selling in exchange for greater downside protection

- Exit strategies remain an integral part of the strategy approach

- Rolling-up while still retaining our Ten-Delta status is a viable exit strategy when share price accelerates

Learn more about Alan Ellman on the Blue Collar Investor Website.