Let’s talk about shifting internals. Market One is the capital-weighted S&P 500 Index (^SPX), largely carried by the ten largest mega-caps (AKA, The Nephilim). Market Two is the other 490 stocks of the S&P 500. Whether the storm breaks or the dawn widens depends on future capital deployments, notes Buff Dormeier, chief technical analyst at Kingsview Partners.

Since Q4 2022, Market One has marched in a strong bull advance, powered primarily by the AI-fueled surge of the generals. Meanwhile, Market Two plodded along more modestly, with equal weight inching higher and small caps stuck in sideways trenches.

Now, as we described last week: “The market stands at a crossroads. The troops rally with renewed strength, suggesting a new hope. Yet the generals hang suspended in silhouettes of doubt, evoking the chill of a gathering storm.”

Last week those themes extended. The generals – the Invesco QQQ Trust (QQQ) – retreated another 0.27% on above-average downside S&P 500 Capital Weighted Volume and capital outflows. By contrast, the troops – the iShares Russell 2000 ETF (IWM) – advanced +0.14%. Much of the rest of the market was flat.

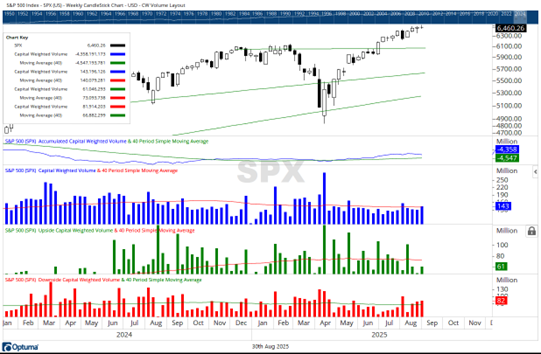

Meanwhile, the accumulation uptrends of both Capital Weighted Volume and dollar volume remain well above price. But unlike price, they are now shifting downward. Adding to the drama, Nvidia Corp. (NVDA), the leader of the Nephilim, reported earnings this past week. We warned that “the delta between price action and volume momentum could prove pivotal.”

Post-earnings, that slightly bearish delta widened: NVDA’s RSI now hovers at 50 while MFI has slipped under 40. Moreover, the generals failed to make a higher weekly high for the third straight week, even as the troops posted higher weekly highs for three weeks in a row.

The battlefield imagery captures the tension. As in past campaigns, markets often whisper their warnings before shouting them. A tactical investor must listen carefully. Today, the whisper suggests that hope and storm clouds coexist. Disciplined, risk-managed strategies are not optional. Rather, they can be essential. They may help defend portfolios when the storm inevitably arrives, while still leaving open the opportunity to advance should hope abound.