Attend and Acquire Insightful Advice to Navigate Market Volatility with Confidence

- ETF Tips, Tools, and Tactics for Canadian Investors

- Updated Asset-Allocation Strategies for Volatile Markets

- How to Use Options for Income, Profits, and Protection

- Savvy Solutions for Investors Seeking Reliable Monthly Cashflow

- Steps for Evaluating Real Estate Investment Risks and Rewards

- Rising Rates: Capturing Megatrends Via Thematic Investing

"The MoneyShow Toronto was an excellent tool for new investors wanting a good overview of investing, varying strategies and methods, access to assistance with trading, tracking, and planning."

What You Will Experience

Gain real-world financial education and make profitable connections that will last a lifetime when you attend The MoneyShow Toronto.

Meet and Greets with Experts

Get to know your favorite speakers better, take selfies with them, engage them in conversation, and interact with them on a more-personal level.

Attend Networking Receptions

At the end of a productive day of absorbing profitable insights, relax and unwind over casual drinks with your fellow market enthusiasts.

Book Signings with Popular Speakers

Pick up an autographed copy of the latest book by your favorite speaker/author and ask them specific questions to supercharge your investing or trading.

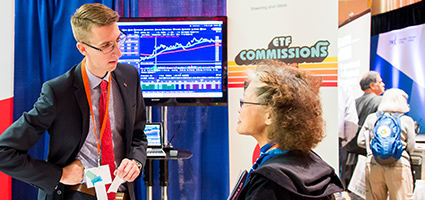

Visit the Interactive Exhibit Hall

Browse, comparison shop, and “test-drive” best-in-class financial tools, technological innovations, and investment opportunities—all under one roof.

Live Market Analysis & Demos

Watch the experts identify promising opportunities and show you step-by-step how they execute their entries and exits.

In-Depth Workshops

Make the biggest strides in the shortest amount of time with these 45-minute sessions, which deliver the highest-caliber investing and trading education.

Thank you to our sponsors