HOT OFF THE WIRE: 13 hours ago

Crown Exploration to Present Live as a Silver Sponsor at the Investment Masters Symposium Silicon ValleyFeatured Content

MARKET MINUTE

The MoneyShow Market Minute for April 24, 2024

STOCKS

TOP PROS' TOP PICKS

FSK: A High-Yielding BDC Targeting Upper Middle Market Companies

FINANCIALS

TOP PROS' TOP PICKS

NXRT: A REIT Worth Targeting Now That Blackstone Has Fired the M&A Cannon

REITS

TOP PROS' TOP PICKS

AMPH: A Generic Drugmaker Looking to Expand Via Acquisition, Biosimilars Moves

PHARMACEUTICALS

TRADING INSIGHTS

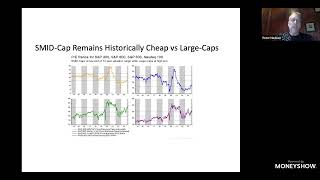

High Quality Small-Cap Stocks Like Core & Main (CNM) Are Thriving in 2024

INDUSTRIALS

TRADING INSIGHTS

Chart of the Day: Pilgrim's Pride (PPC)

CONSUMER STAPLES

Virtual Learning

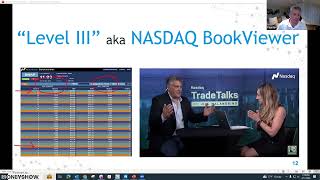

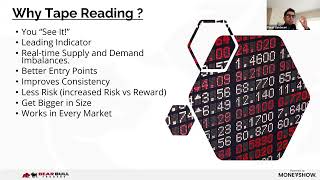

Day Trading 101: Mastering Technical Analysis

TECHNICAL ANALYSIS

Virtual Learning

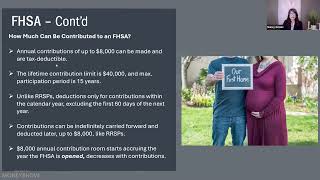

Financial Planning for Parents and Grandparents

FINANCIAL AND ESTATE PLANNING

Conferences

Virtual Learning

Virtual Expos

Sponsored Content

A 40-Year Passion and History

MoneyShow has a long history of creating successful investors and traders through timely investing and trading education, delivered by powerful experts who are best-selling authors, market analysts, portfolio managers, award-winning financial journalists, and newsletter editors. With MoneyShow’s interactive environment, our audience of over one million passionate investors and traders are offered a unique format of live, interactive exchange, which generates unparalleled experience for both the expert and the investor and trader.

With constant network expansion, we continue to create broader distribution of our expert commentary through virtual events, face-to-face forums, social media, and in-depth courses that educate and guide qualified investors and traders to outperform the market. Each session energizes, empowers, and educates everyone who participates. The opportunity for learning and profit within this highly charged atmosphere draws hundreds of thousands of enthusiasts, year after year.

View Courses