Featured Content

MONEYMASTERS PODCAST

This Week's MoneyMasters Podcast: Tullman and Fitz-Gerald Talk Tech

TOP PROS' TOP PICKS

Q1 Earnings: Reports Suggest Economy Slowing, But Not Tanking

TOP PROS' TOP PICKS

CALF: Bet on the Little Guys with this Cash Cow ETF

VALUE

TOP PROS' TOP PICKS

Targeting Perpetual Dividend Raisers Can Pay Off Handsomely. Here's How...

INCOME

TRADING INSIGHTS

High Quality Small-Cap Stocks Like Core & Main (CNM) Are Thriving in 2024

INDUSTRIALS

TRADING INSIGHTS

Chart of the Day: Pilgrim's Pride (PPC)

CONSUMER STAPLES

Virtual Learning

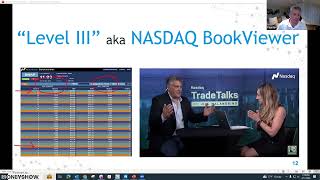

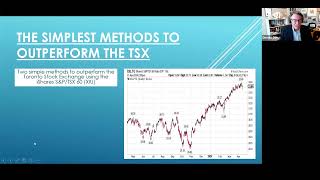

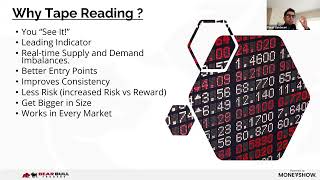

Day Trading 101: Mastering Technical Analysis

TECHNICAL ANALYSIS

Virtual Learning

Financial Planning for Parents and Grandparents

FINANCIAL AND ESTATE PLANNING

Conferences

Virtual Learning

Virtual Expos

Sponsored Content

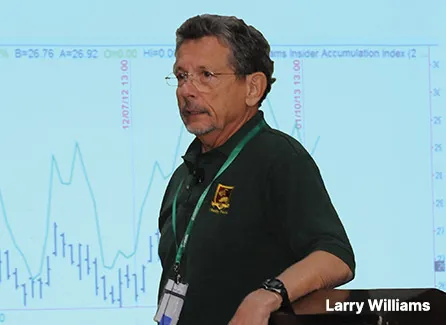

A 40-Year Passion and History

MoneyShow has a long history of creating successful investors and traders through timely investing and trading education, delivered by powerful experts who are best-selling authors, market analysts, portfolio managers, award-winning financial journalists, and newsletter editors. With MoneyShow’s interactive environment, our audience of over one million passionate investors and traders are offered a unique format of live, interactive exchange, which generates unparalleled experience for both the expert and the investor and trader.

With constant network expansion, we continue to create broader distribution of our expert commentary through virtual events, face-to-face forums, social media, and in-depth courses that educate and guide qualified investors and traders to outperform the market. Each session energizes, empowers, and educates everyone who participates. The opportunity for learning and profit within this highly charged atmosphere draws hundreds of thousands of enthusiasts, year after year.

View Courses