One sector that begins its seasonally favorable periods in March is utilities, explains Jeffrey Hirsch, seasonal timing expert and editor of Stock Trader's Almanac.

Last year, the Utilities sector started off the year on a near chart-perfect bullish climb from the bottom left to the top right that lasted until an early-July high.

So far this year Utilities have been somewhat dull, moving mostly sideways. The sector is not at all-time highs, but it is not too far away either. The sector is generally defensive in nature and does offer a relatively hefty dividend.

This year could prove to be an interesting year for Utilities. If the Trump administration stumbles and disappoints the market, the defensive nature of the sector could attract traders and investors.

However, if the new administration is successful and economic growth does begin to accelerate, then the sector could benefit from the increased demand that is likely to come from higher growth.

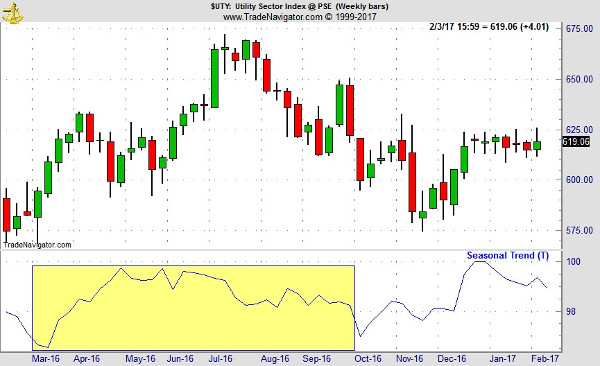

As can be seen in the following weekly bar chart of the Utility Sector Index (UTY), seasonal strength (lower pane, shaded in yellow) typically begins following an early March bottom and usually lasts through early October although the bulk of the move is typically done sometime in May.

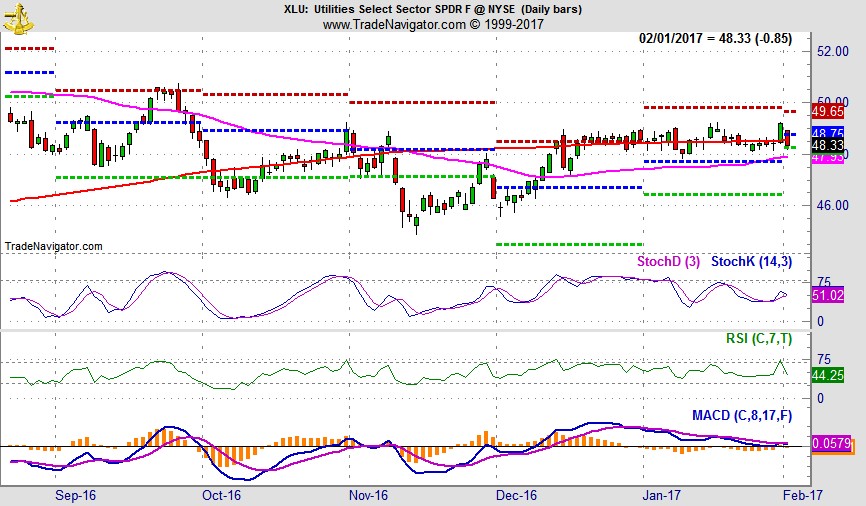

With a little more than $6 billion in assets and average daily trading volumes in excess of 12 million shares per day, SPDR Utilities (XLU) is the top choice to hold during Utilities seasonally favorable period. It has a gross expense ratio of just 0.14% and comes with the added kicker of a 3.37% dividend yield.

XLU could be bought on dips below $48.20. This is just above its projected monthly support (green-dashed line in daily bar chart below).

Based upon its 15-year average return of 6.1% during its favorable period mid-March to the beginning of October, an auto-sell price of $56.25 is set. If purchased an initial stop loss of $44.00 is suggested.