Attend IN PERSON and Discover the Biggest Factors That Will Affect Your Money in the Months Ahead

Each new year in the markets features new profit opportunities...and new risks. If you want your portfolio to thrive in ’25, you won’t want to go it alone. You’ll want to tap into the expertise of dozens of the nation’s premier investing and trading authorities. And the best place to do so next year is the MoneyShow/TradersEXPO Las Vegas!

At this signature event, we’ll connect you with top experts on stocks, bonds, commodities, real estate, cryptocurrencies, alternative investments, and more. We’ll create an environment where you can learn from dozens of analysts, money managers, financial advisors, investment strategists, newsletter publishers, and acclaimed authors. We’ll provide ample opportunities for you to interact and share ideas and tips with like-minded investors, all at your own pace and in a pleasing environment. Don’t miss out!

- Find out How to Capitalize on Cutting-Edge Tech Sector Trends

- Learn to Navigate Shifts in the Economy for Maximum Profit

- How Political Shifts in Washington Could Impact Your Investments

- Boost the Income Your Portfolio Spins Off with New Recommendations

- Meet and Interact with Several Top Money Experts—LIVE & in Person

- Walk Away with Dozens of Money-Saving Ideas & Picks

"Fantastic informative event that exposed me to new and current education and also a wide variety of interesting products. I definitely felt helped and enlarged."

What You Will Experience When You Attend IN PERSON

Gain real-world financial education, identify profitable opportunities, and make valuable connections that will last a lifetime when you attend The MoneyShow.

Meet and Greets with Experts

Get to know your favorite speakers better, take selfies with them, engage them in conversation, and interact with them on a more-personal level.

Attend Networking Receptions

At the end of a productive day of absorbing profitable insights, relax and unwind over casual drinks with your fellow market enthusiasts.

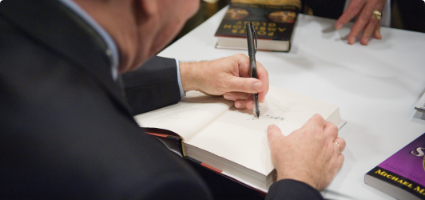

Book Signings with Popular Speakers

Pick up an autographed copy of the latest book by your favorite speaker/author and ask them specific questions to supercharge your investing or trading.

Visit the Interactive Exhibit Hall

Browse, comparison shop, and “test-drive” best-in-class financial tools, technological innovations, and investment opportunities—all under one roof.

Live Market Analysis & Demos

Watch the experts identify promising opportunities and show you step-by-step how they execute their entries and exits.

MoneyMasters Classes

Make the biggest strides in the shortest amount of time with these three-hour intensive sessions, which deliver the highest-caliber trading education.